Question

Crystal Exporting Co. is a U.S. wholesaler engaged in foreign trade. The following transactions are representative of its business dealings. The company uses a periodic

Crystal Exporting Co. is a U.S. wholesaler engaged in foreign trade.

The following transactions are representative of its business dealings. The company uses a periodic inventory system and is on a calendar-year basis. All exchange rates are direct quotations.

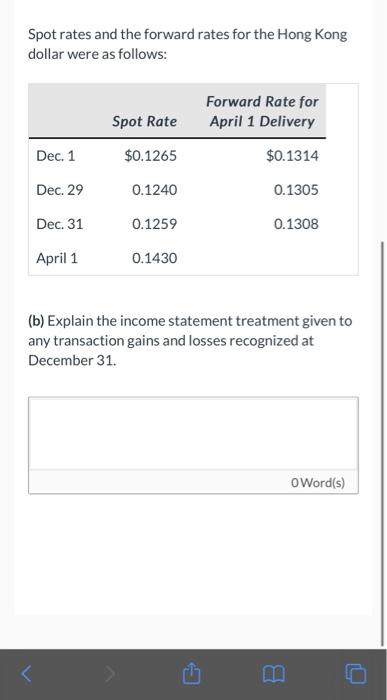

Dec. 1

Crystal Exporting purchased merchandise from Chang's Ltd., a Hong Kong manufacturer. The invoice was for 210,000 Hong Kong dollars, payable on April 1. On this same date, Crystal Exporting acquired a forward contract to buy 210,000 Hong Kong dollars on April 1 for $0.1314.

Dec. 29

Crystal Exporting sold merchandise to Zintel Retailers for 120,000 Hong Kong dollars, receivable in 90 days. No hedging was involved.

April 1

Crystal Exporting received 120,000 Hong Kong dollars from Zintel Retailers.

April 1

Crystal Exporting submitted full payment of 210,000

Hong Kong dollars to Chang's, Ltd., after obtaining the 210,000 Hong Kong dollars on its forward contract.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started