Question

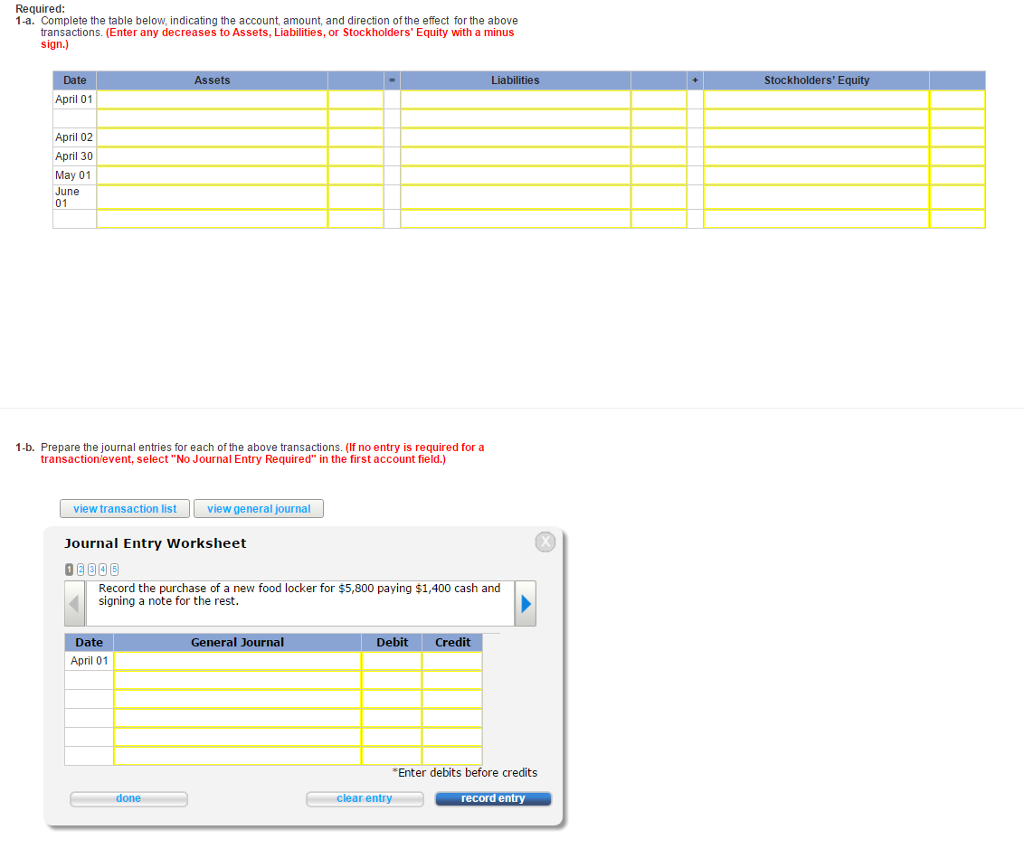

Randys Restaurant Company (RRC) entered into the following transactions during a recent year. April 1 Purchased a new food locker for $5,800 by paying $1,400

| Randys Restaurant Company (RRC) entered into the following transactions during a recent year. |

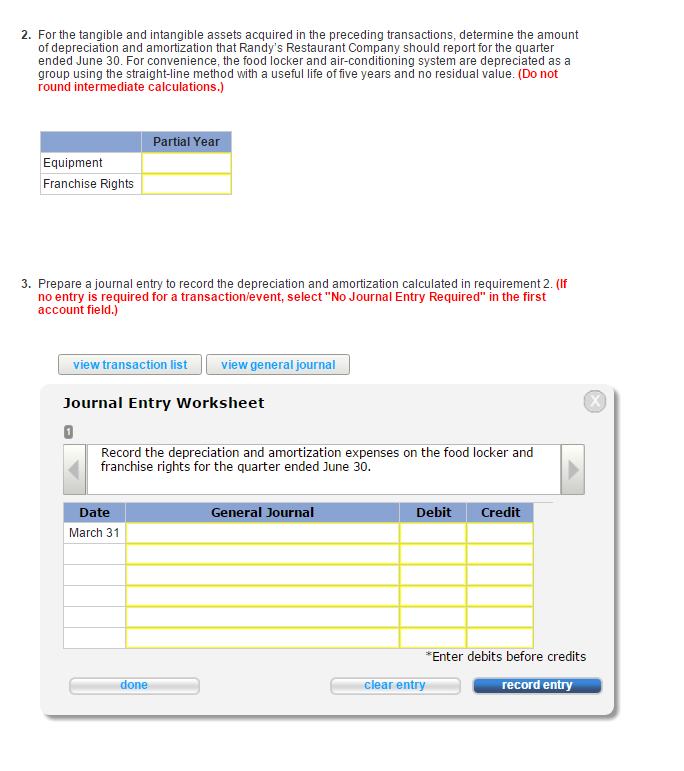

| April 1 | Purchased a new food locker for $5,800 by paying $1,400 cash and signing a $4,400 note due in six months. |

| April 2 | Installed an air-conditioning system in the food locker at a cost of $3,400, purchased on account. |

| April 30 | Wrote a check for the amount owed on account for the work completed on April 2. |

| May 1 | A local carpentry company repaired the restaurants front door, for which RRC wrote a check for the full $160 cost. |

| June 1 | Paid $10,080 cash for the rights to use the name and store concept created by a different restaurant that has been successful in the region. For the next four years, RRC will operate under the Mullet Restaurant name, with the slogan business customers in the front, and partiers in the back.

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started