Question

Crystal is appraising a flour mill investment which will require an investment of 10,000,000 in land, plants and equipment. The mill expects to make $6,000,000.00

Crystal is appraising a flour mill investment which will require an investment of 10,000,000 in land, plants and equipment. The mill expects to make $6,000,000.00 revenue in the first year and this is expected to grow at the rate of 3% per annum till the end of the tenth year. All costs were estimated to be $2,000.000.00 in the first but will grow at the rate of 4% until the end of the investment horizon which is in the tenth year. Working capital is $1,200,000 which will be returned at the end of the investment horizon. The companys weighted average cost of capital is 5%. Depreciation is $1,000,000 per year. Tax rate is 30%.

- Write a report based on the above results to the management of Crystal Investments using graphs of the sensitivity analysis in 2 and other relevant information to convince them about your position on the project.

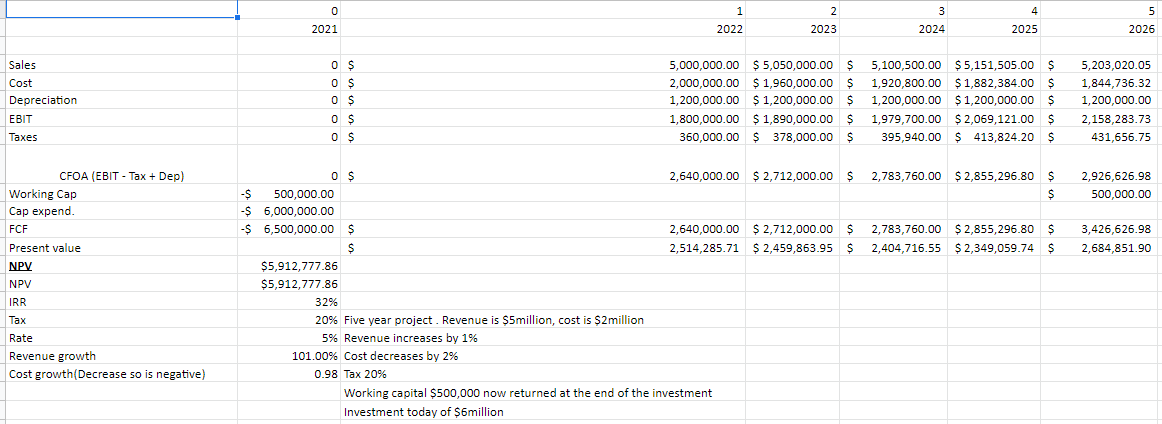

4 0 2021 1 2022 2 2023 3 2024 5 2026 2025 Sales Cost Depreciation EBIT Taxes 0 $ 0 $ 0 $ 0 $ 5,000,000.00 $ 5,050,000.00 $ 2,000,000.00 $ 1,960,000.00 $ $ 1,200,000.00 $ 1,200,000.00 $ $ 1,800,000.00 $ 1,890,000.00 $ 360,000.00 $ 378,000.00 $ 5,100,500.00 $5,151,505.00 $ 1,920,800.00 $ 1,882,384.00 $ 1,200,000.00 $ 1,200,000.00 $ 1,979,700.00 $ 2,069,121.00 $ 395,940.00 $ 413,824.20 $ 5,203,020.05 1,844,736.32 1,200,000.00 2,158,283.73 431,656.75 0 $ CFOA (EBIT - Tax + Dep) Working Cap Cap expend. FCF 2,783,760.00 $ 2,855,296.80 $ $ $ 2,926,626.98 500,000.00 2,783,760.00 $ 2,855,296.80 $ 2,404,716.55 $2,349,059.74 $ 3,426,626.98 2,684,851.90 Present value NPV NPV 0 $ 2,640,000.00 $ 2,712,000.00 $ -$ 500,000.00 -$ 6,000,000.00 -$ 6,500,000.00 $ 2,640,000.00 $ 2,712,000.00 $ $ S 2,514,285.71 $ 2,459,863.95 $ $5,912,777.86 $5,912,777.86 32% 20% Five year project. Revenue is $5million, cost is $2million 5% Revenue increases by 1% 101.00% Cost decreases by 2% 0.98 Tax 20% Working capital $500,000 now returned at the end of the investment Investment today of $6million IRR Tax Rate Revenue growth Cost growth(Decrease so is negative)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started