Question

CSB Records is planning to release a new Michael Johnson album called Mad. The album can be released as a tape recording, or as a

CSB Records is planning to release a new Michael Johnson album called "Mad". The album can

be released as a tape recording, or as a compact disk (CD), or as both. Although later impressions

can be made, CSB is currently concerned with the first release, and wishes to use the coming

week's production capacity for running off this first release. Future weeks' capacity has already

been committed for other albums.

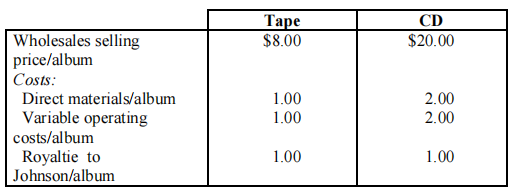

Some financial details follow:

Fixed labour and overhead costs per week are $50 000 regardless of whether Tapes or CDs or both

are produced.

Current copying capacity is either 80 000 Tapes or 10 000 CDs per week, or a linear combination

of the two.

It is believed that consumer demand for Tape or CD versions is not affected by the form in which

the album is released. Maximum demand for the first release is estimated to be 50 000 Tapes and

5000 CDs.

Required:

(a) What is the unit contribution margin for Tape and CD versions of the album? (10 marks)

(b) If there are no costs other than those already mentioned, and CSB wish to produce and sell

the album in the ratio Tape:CD = 9:1, how many of each type should CSB plan to produce

in the coming week to earn a net profit of $190 000 on the first release? (10 marks)

(c) CSB hire you as a consultant to help them maximise their profits on the first release. You

charge a fee of $5000 to determine the optimum mix. Earn your fee by writing an LP model,

solve it and state the optimum mix and resulting net profit on the first release. Would CSB

find it worthwhile hiring you as a consultant, compared with their original plan in (b)?

Why? (10 marks)

(d) You feel a little guilty earning your fee with so little effort. So you point out to CSB that

they could increase their profits even more if they could temporarily increase their copying

capacity for the week. Taking up your suggestion, CSB come up with two proposals and

ask you to advise them on the merits of each:

(i) CSB could increase overall capacity for the week by 20% if they employed additional

temporary staff and reorganised production methods. This would add 10 cents to the

cost of each Tape and CD produced during the week; or

(ii) CSB could pay a competitor $5000 for the lease of 10% additional CD capacity for

the week.

Advise CSB whether either, or both proposals are viable options. Make a recommendation,

and calculate the increase in profits from adopting your recommended action.

(10 marks)

You feel a little guilty earning your fee with so little effort. So you point out to CSB that

they could increase their profits even more if they could temporarily increase their copying

capacity for the week. Taking up your suggestion, CSB come up with two proposals and

ask you to advise them on the merits of each:

(i)

CSB could increase overall capacity for the week by 20% if they employed additional

temporary staff and reorganised production methods. This would add 10 cents to the

cost of each Tape and CD produced during the week; or

(ii)

CSB could pay a competitor $5000 for the lease of 10% additional CD capacity for

the week.

Advise CSB whether either, or both proposals are viable options. Make a recommendation,

and calculate the increase in profits from adopting your recommended action.

(10 marks)

Tape $8.00 CD $20.00 Wholesales selling price/album Costs: Direct materials/album Variable operating costs/album Royaltie to Johnson/album 1.00 1.00 2.00 2.00 1.00 1.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started