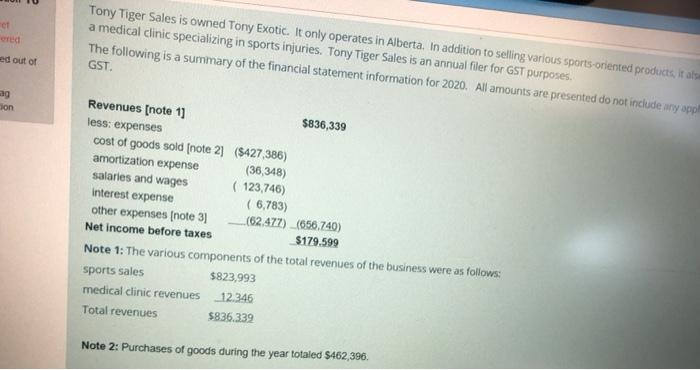

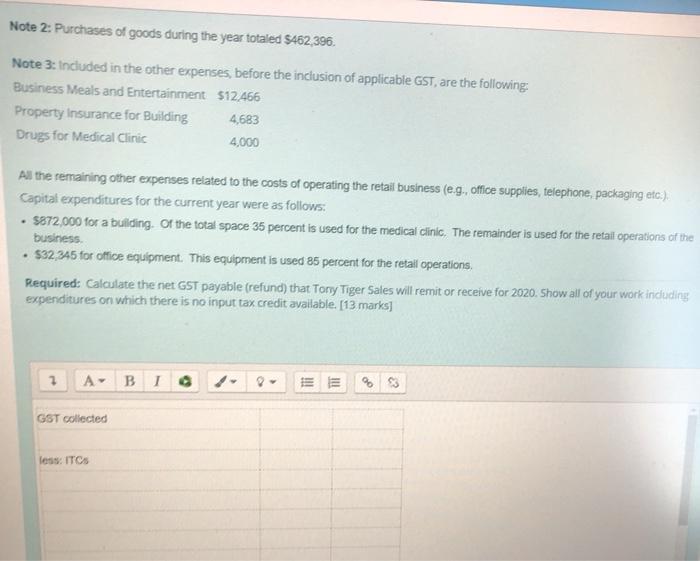

ct ered Tony Tiger Sales is owned Tony Exotic. It only operates in Alberta. In addition to selling various sports-oriented products, it als a medical clinic specializing in sports injuries. Tony Tiger Sales is an annual filer for GST purposes. The following is a summary of the financial statement information for 2020. All amounts are presented do not include any appl GST ed out of son Revenues [note 11 $836,339 less: expenses cost of goods sold (note 2 ($427,386) amortization expense (36,348) salaries and wages ( 123,746) Interest expense (6,783) other expenses (note 31 (62.477) (656,740) Net income before taxes $179.599 Note 1: The various components of the total revenues of the business were as follows: sports sales $823,993 medical clinic revenues 12.346 Total revenues $836.339 Note 2: Purchases of goods during the year totaled $462,396. Note 2: Purchases of goods during the year totaled $462,396. Note 3: Included in the other expenses, before the inclusion of applicable GST, are the following: Business Meals and Entertainment $12.466 Property Insurance for Building 4,683 Drugs for Medical Clinic 4,000 . All the remaining other expenses related to the costs of operating the retail business (e.g., office supplies, telephone, packaging etc.). Capital expenditures for the current year were as follows: 5872,000 for a building. Of the total space 35 percent is used for the medical clinic. The remainder is used for the retail operations of the business $32.345 for office equipment. This equipment is used 85 percent for the retail operations, Required: Calculate the net GST payable (refund) that Tory Tiger Sales will remit or receive for 2020. Show all of your work including expenditures on which there is no input tax credit available. [13 marks] 7 B I GST collected less: ITCS ct ered Tony Tiger Sales is owned Tony Exotic. It only operates in Alberta. In addition to selling various sports-oriented products, it als a medical clinic specializing in sports injuries. Tony Tiger Sales is an annual filer for GST purposes. The following is a summary of the financial statement information for 2020. All amounts are presented do not include any appl GST ed out of son Revenues [note 11 $836,339 less: expenses cost of goods sold (note 2 ($427,386) amortization expense (36,348) salaries and wages ( 123,746) Interest expense (6,783) other expenses (note 31 (62.477) (656,740) Net income before taxes $179.599 Note 1: The various components of the total revenues of the business were as follows: sports sales $823,993 medical clinic revenues 12.346 Total revenues $836.339 Note 2: Purchases of goods during the year totaled $462,396. Note 2: Purchases of goods during the year totaled $462,396. Note 3: Included in the other expenses, before the inclusion of applicable GST, are the following: Business Meals and Entertainment $12.466 Property Insurance for Building 4,683 Drugs for Medical Clinic 4,000 . All the remaining other expenses related to the costs of operating the retail business (e.g., office supplies, telephone, packaging etc.). Capital expenditures for the current year were as follows: 5872,000 for a building. Of the total space 35 percent is used for the medical clinic. The remainder is used for the retail operations of the business $32.345 for office equipment. This equipment is used 85 percent for the retail operations, Required: Calculate the net GST payable (refund) that Tory Tiger Sales will remit or receive for 2020. Show all of your work including expenditures on which there is no input tax credit available. [13 marks] 7 B I GST collected less: ITCS