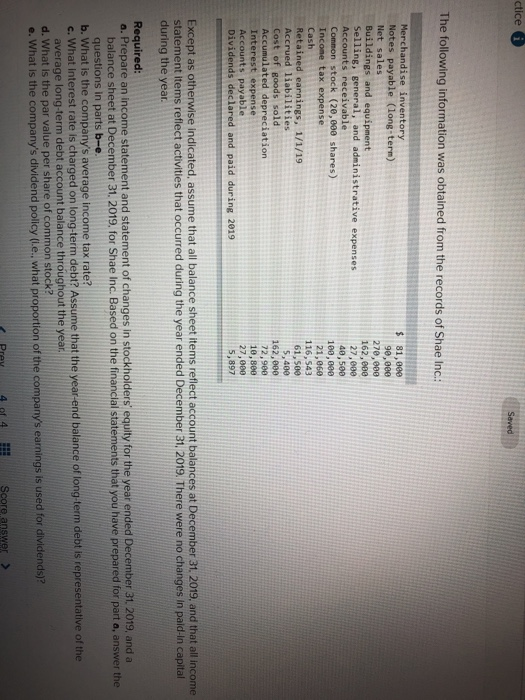

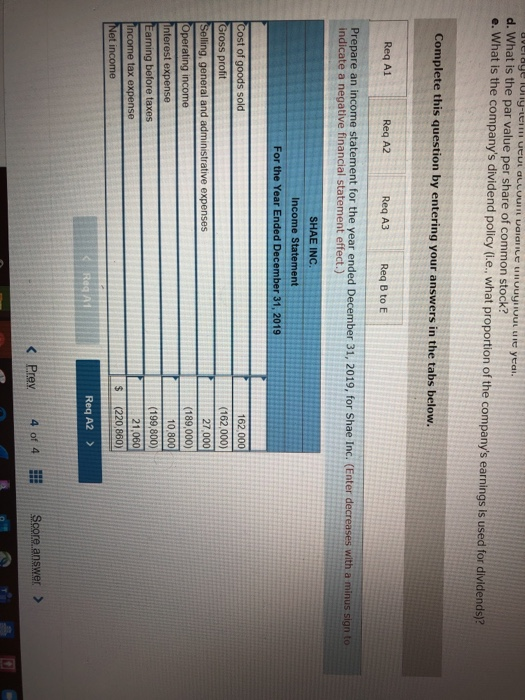

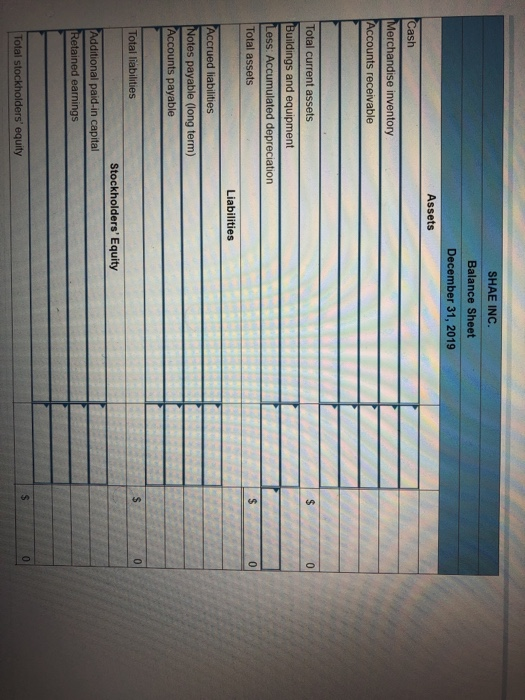

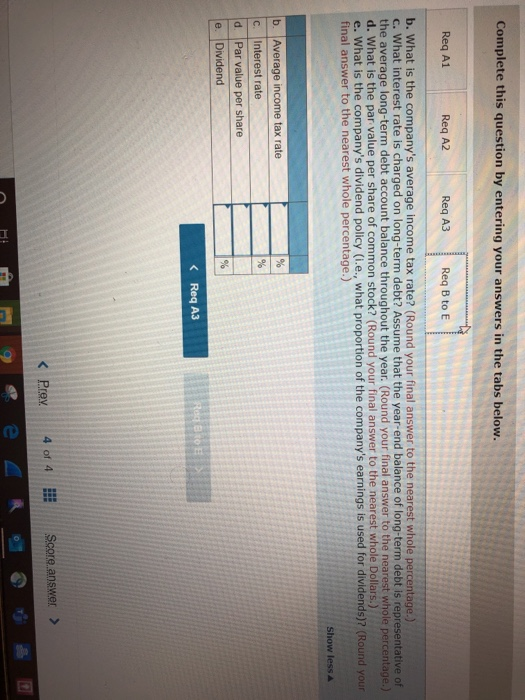

ctice Saved The following information was obtained from the records of Shae Inc.: Merchandise inventory Notes payable (long-term) Net sales Buildings and equipment Selling, general, and administrative expenses Accounts receivable Common stock (20,000 shares) Income tax expense Cash Retained earnings, 1/1/19 Accrued liabilities Cost of goods sold Accumulated depreciation Interest expense Accounts payable Dividends declared and paid during 2019 $ 81,000 90,000 270,000 162,000 27,000 40,500 100,000 21, 060 116,543 61, 500 5,400 162,000 72,900 10,800 27,000 5,897 Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2019, and that all income statement items reflect activities that occurred during the year ended December 31, 2019. There were no changes in pald-in capital during the year. Required: a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2019, and a balance sheet at December 31, 2019, for Shae Inc. Based on the financial statements that you have prepared for part a, answer the questions in parts b-e. b. What is the company's average income tax rate? c. What interest rate is charged on long-term debt? Assume that the year-end balance of long-term debt is representative of the average long-term debt account balance throughout the year. d. What is the par value per share of common stock? e. What is the company's dividend policy (e. what proportion of the company's earnings is used for dividends)? Score answer> uvelaye Uily-tein UEUL OLLUVIL UDICILE Llll uy VULLIE ytai. d. What is the par value per share of common stock? e. What is the company's dividend policy (i.e., what proportion of the company's earnings is used for dividends)? Complete this question by entering your answers in the tabs below. Req A1 Reg A2 Req A3 Req B to E Prepare an income statement for the year ended December 31, 2019, for Shae Inc. (Enter decreases with a minus sign to indicate a negative financial statement effect.) SHAE INC Income Statement For the Year Ended December 31, 2019 Cost of goods sold Gross profit Seling, general and administrative expenses Operating income interest expense Earning before taxes Income tax expense Net income 162 000 (162,000) 27,000 (189,000) 10 800 (199,800) 21,060 (220,860) $ Reg A1 Req A2 > 4 of 4 !