Question

Cubbies Corporation is a relatively young company that has enjoyed great financial success and a very strong growth pattern. However, Cubbies's management realizes that the

Cubbies Corporation is a relatively young company that has enjoyed great financial success and a very strong growth pattern. However, Cubbies's management realizes that the company has outgrown its "seat of the pants" management style, and must start to develop more sophisticated means of analyzing financial decisions. For example, the company is currently considering two projects, both of which have the same initial investment and, over a 6-year life, will return approximately the same amount of income to the company. To aid in choosing between these projects, the CFO has asked for an Excel model that can determine each project's net present value, profitability index, payback period, and internal rate of return, based on the project's cash flow projections.

| The Initial investment for Project B would also be $875,000, and the project is expected to last 6 years. | |||||||

| This would be a new venture for Cubbies, so no existing equipment would be sold. Because it is | |||||||

| a new business, revenues are expected to grow from $150,000 in year 1, to $250,000 in year 2, to | |||||||

| $450,000 annually in years 3 through 6. Likewise, costs are estimated at $125,000 in year 1, | |||||||

| $175,000 in year 2, and $210,000 annually in years 3 through 6. The equipment is expected to have a | |||||||

| salvage value of $90,000 at the end of 6 years. | |||||||

| Hurdle Rate: | |||||||

The company believes that a hurdle rate of 8% is appropriate for both these projects.

| |||||||

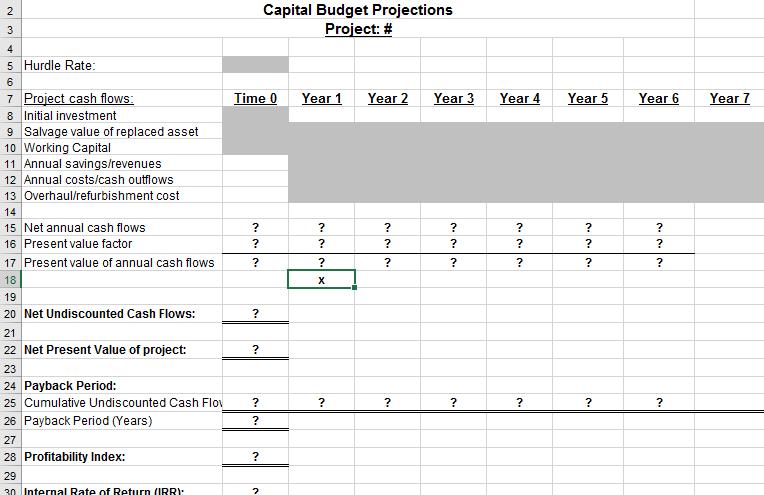

Capital Budget Projections Project: # 2 3 5 Hurdle Rate: 7 Project cash flows: 8 Initial investment 9 Salvage value of replaced asset 10 Working Capital 11 Annual savings/revenues 12 Annual costs/cash outflows 13 Overhaul/refurbishment cost Time 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 14 15 Net annual cash flows 16 Present value factor ? ? ? 17 Present value of annual cash flows 18 X 19 20 Net Undiscounted Cash Flows: 21 22 Net Present Value of project: 23 24 Payback Period: 25 Cumulative Undiscounted Cash Flov ? ? 26 Payback Period (Years) 27 28 Profitability Index: 29 30 Internal Rate of Return (IRRI: 456

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60915c5d9d362_207748.pdf

180 KBs PDF File

60915c5d9d362_207748.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started