Answered step by step

Verified Expert Solution

Question

1 Approved Answer

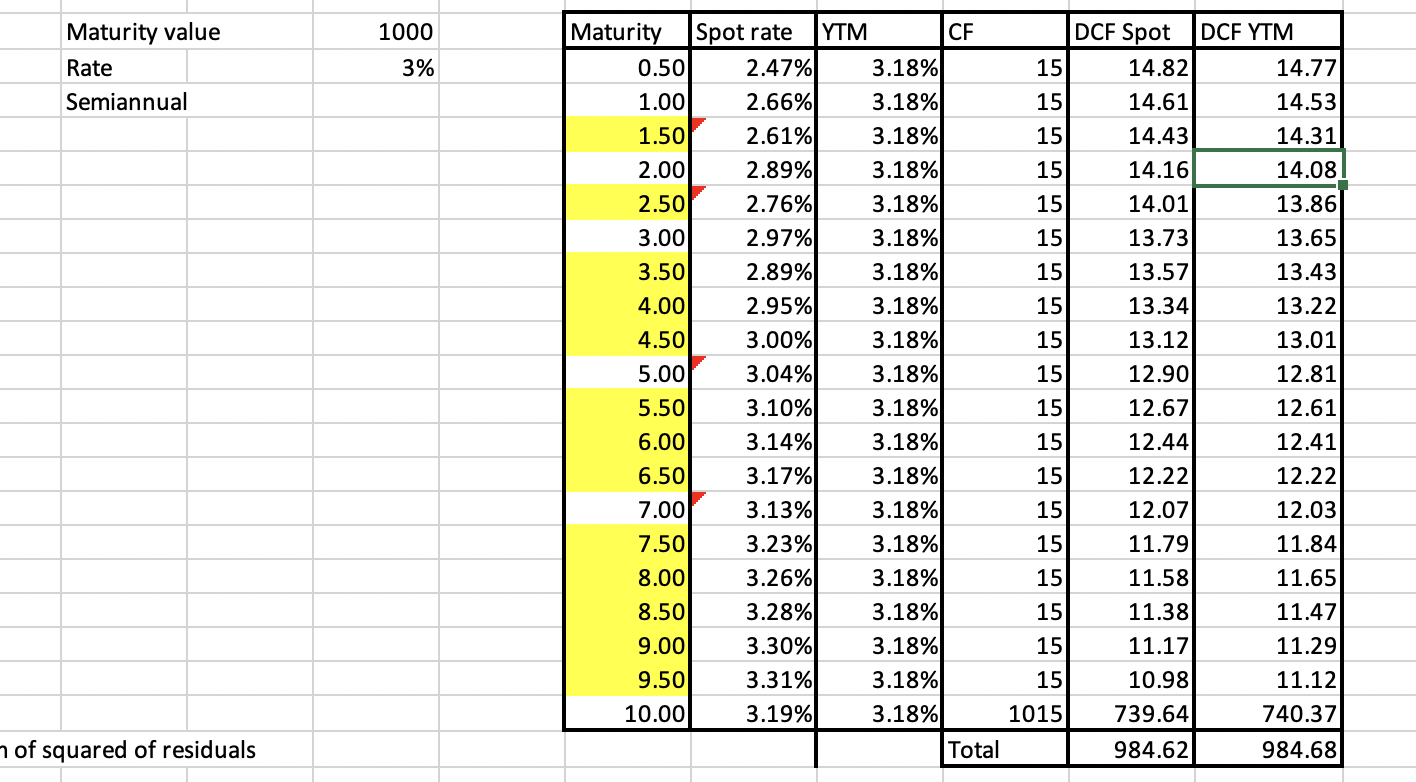

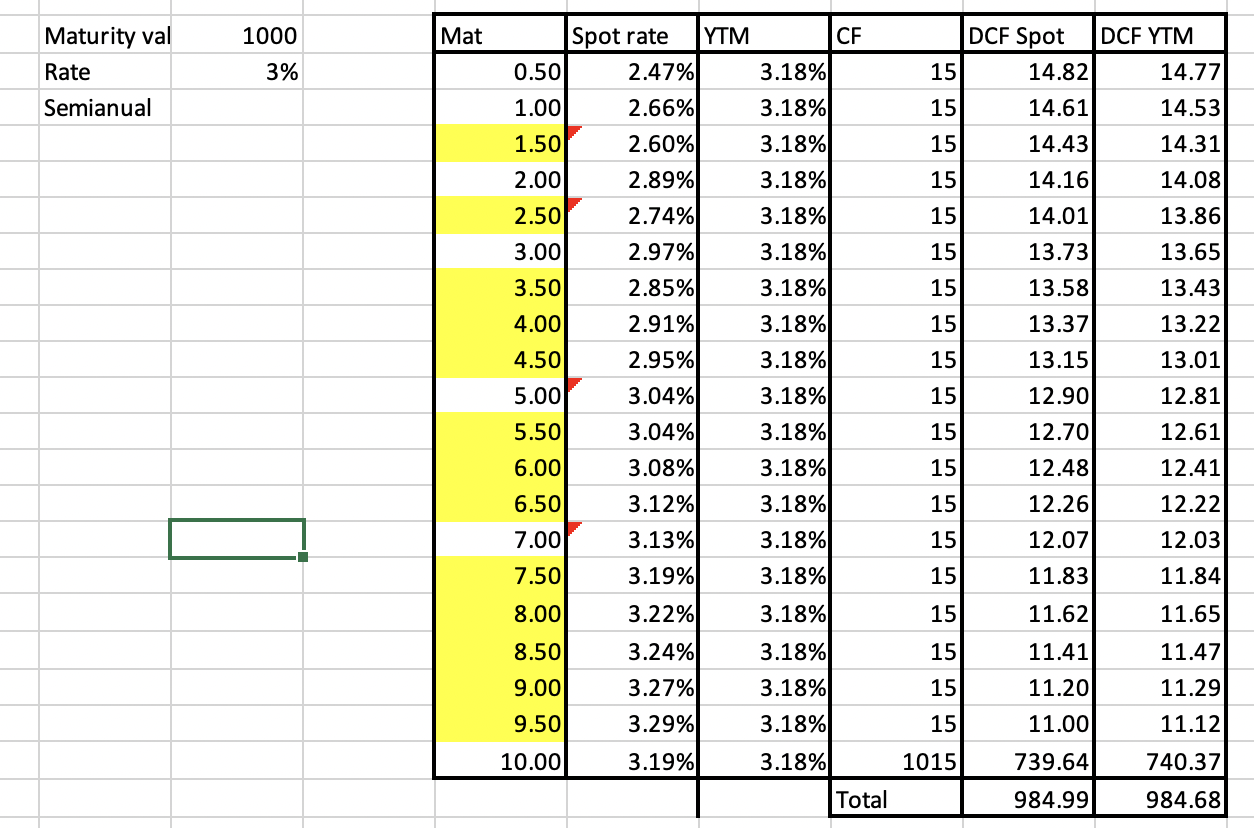

Cubic Spline Nelson Siegel Do you see any major difference between the two models? Which one seems to be better than the other and why?

Cubic Spline

Cubic Spline

Nelson Siegel

Nelson Siegel

Do you see any major difference between the two models? Which one seems to be better than the other and why?

Compare two bond prices and provide your findings.

1000 Maturity value Rate Semiannual 3% u u Maturity Spot rate YTM CF DCF Spot DCF YTM 0.50 2.47% 3.18% 15 14.82 14.77 1.00 2.66% 3.18% 15 14.61 14.53 1.50 2.61% 3.18% 15 14.43 14.31 2.00 2.89% 3.18% 15 14.16 14.08 2.50 2.76% 3.18% 15 14.01 13.86 3.00 2.97% 3.18% 15 13.73 13.65 3.50 2.89% 3.18% 15 13.57 13.43 4.00 2.95% 3.18% 15 13.34 13.22 4.50 3.00% 3.18% 15 13.12 13.01 5.00 3.04% 3.18% 15 12.90 12.81 5.50 3.10% 3.18% 15 12.67 12.61 6.00 3.14% 3.18% 15 12.44 12.41 6.50 3.17% 3.18% 15 12.22 12.22 7.00 3.13% 3.18% 15 12.07 12.03 7.50 3.23% 3.18% 15 11.79 11.84 8.00 3.26% 3.18% 15 11.58 11.65 8.50 3.28% 3.18% 15 11.38 11.47 9.00 3.30% 3.18% 15 11.17 11.29 9.50 3.31% 3.18% 15 10.98 11.12 10.00 3.19% 3.18% 1015 739.64 740.37 Total 984.62 984.68 7 of squared of residuals Mat Maturity val Rate Semianual 1000 3% . 1 Spot rate YTM CF 0.50 2.47% 3.18% 1.00 2.66% 3.18% 1.50 2.60% 3.18% 2.00 2.89% 3.18% 2.50 2.74% 3.18% 3.00 2.97% 3.18% 3.50 2.85% 3.18% 4.00 2.91% 3.18% 4.50 2.95% 3.18% 5.00 3.04% 3.18% 5.50 3.04% 3.18% 6.00 3.08% 3.18% 6.50 3.12% 3.18% 7.00 3.13% 3.18% 7.50 3.19% 3.18% 8.00 3.22% 3.18% DCF Spot DCF YTM 15 14.82 14.77 15 14.61 14.53 15 14.43 14.31 15 14.16 14.08 15 14.01 13.86 15 13.73 13.65 15 13.58 13.43 15 13.37 13.22 15 13.15 13.01 15 12.90 12.81 15 12.70 12.61 15 12.48 12.41 15 12.26 12.22 15 12.07 12.03 15 11.83 11.84 EE 1 1 PP 15 11.62 11.65 8.50 3.18% 15 11.41 3.24% 3.27% 3.29% 11.47 11.29 9.00 15 11.20 3.18% 3.18% 9.50 15 R 11.00 11.12 10.00 3.19% 3.18% 1015 739.64 740.37 Total 984.99 984.68 1000 Maturity value Rate Semiannual 3% u u Maturity Spot rate YTM CF DCF Spot DCF YTM 0.50 2.47% 3.18% 15 14.82 14.77 1.00 2.66% 3.18% 15 14.61 14.53 1.50 2.61% 3.18% 15 14.43 14.31 2.00 2.89% 3.18% 15 14.16 14.08 2.50 2.76% 3.18% 15 14.01 13.86 3.00 2.97% 3.18% 15 13.73 13.65 3.50 2.89% 3.18% 15 13.57 13.43 4.00 2.95% 3.18% 15 13.34 13.22 4.50 3.00% 3.18% 15 13.12 13.01 5.00 3.04% 3.18% 15 12.90 12.81 5.50 3.10% 3.18% 15 12.67 12.61 6.00 3.14% 3.18% 15 12.44 12.41 6.50 3.17% 3.18% 15 12.22 12.22 7.00 3.13% 3.18% 15 12.07 12.03 7.50 3.23% 3.18% 15 11.79 11.84 8.00 3.26% 3.18% 15 11.58 11.65 8.50 3.28% 3.18% 15 11.38 11.47 9.00 3.30% 3.18% 15 11.17 11.29 9.50 3.31% 3.18% 15 10.98 11.12 10.00 3.19% 3.18% 1015 739.64 740.37 Total 984.62 984.68 7 of squared of residuals Mat Maturity val Rate Semianual 1000 3% . 1 Spot rate YTM CF 0.50 2.47% 3.18% 1.00 2.66% 3.18% 1.50 2.60% 3.18% 2.00 2.89% 3.18% 2.50 2.74% 3.18% 3.00 2.97% 3.18% 3.50 2.85% 3.18% 4.00 2.91% 3.18% 4.50 2.95% 3.18% 5.00 3.04% 3.18% 5.50 3.04% 3.18% 6.00 3.08% 3.18% 6.50 3.12% 3.18% 7.00 3.13% 3.18% 7.50 3.19% 3.18% 8.00 3.22% 3.18% DCF Spot DCF YTM 15 14.82 14.77 15 14.61 14.53 15 14.43 14.31 15 14.16 14.08 15 14.01 13.86 15 13.73 13.65 15 13.58 13.43 15 13.37 13.22 15 13.15 13.01 15 12.90 12.81 15 12.70 12.61 15 12.48 12.41 15 12.26 12.22 15 12.07 12.03 15 11.83 11.84 EE 1 1 PP 15 11.62 11.65 8.50 3.18% 15 11.41 3.24% 3.27% 3.29% 11.47 11.29 9.00 15 11.20 3.18% 3.18% 9.50 15 R 11.00 11.12 10.00 3.19% 3.18% 1015 739.64 740.37 Total 984.99 984.68

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started