Question

Using the attached information for Melodic Musical Sales in. prepare full and complete tax return for 2020 using the forms in irs.gov. The return should

Using the attached information for Melodic Musical Sales in. prepare full and complete tax return for 2020 using the forms in irs.gov. The return should be as if sent to the IRS - No software is allowed. So in the following pages you should use only the information for the firm. TAX FORM/RETURN PREPARAYION PROBLEMS C:3-66 Melodic Musical Sales, Inc. is located at 5500 Fourth Avenue, City, ST 98765. The corporation uses the calendar year and accrual basis for both book and tax purposes. It is engaged in the sale of musical instruments with an employer identification number (EIN) of XX-2020018. The company incorporated on December 31, 2014, and began business on January 2, 2015. Table C:3-3 contains balance sheet information at January 1, 2018, and December 31, 2018. Table C:3-4 presents an unaudited GAAP income statement for 2018. These schedules are presented on a book basis. Other information follows the tables. See files attached. Required: Prepare the 2020 corporate tax return for Melodic Musical Sales, Inc. along with any necessary supporting schedules. Please help me showing the preparation of the IRS forms:1120 Form, Schedule D., Form 4562 and Schedule K.

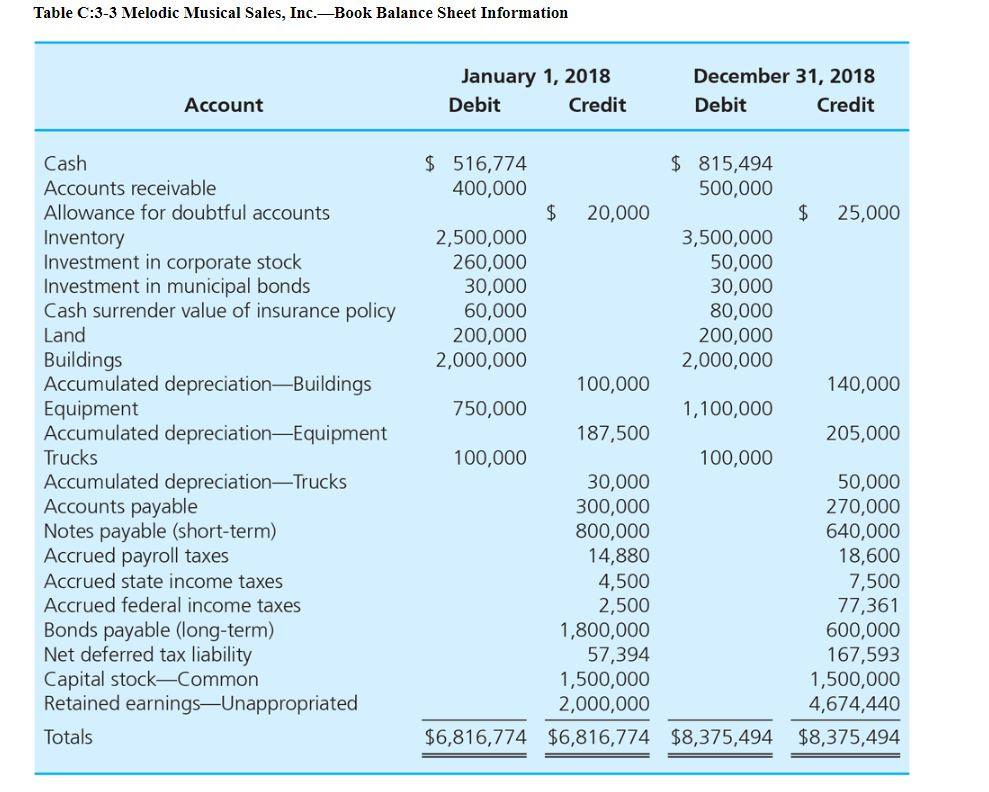

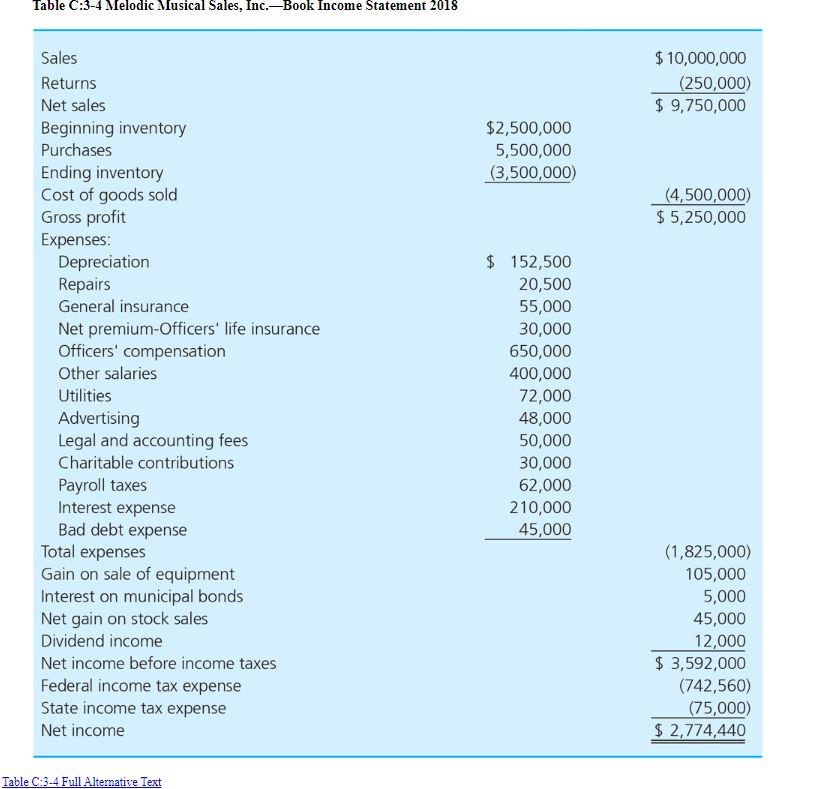

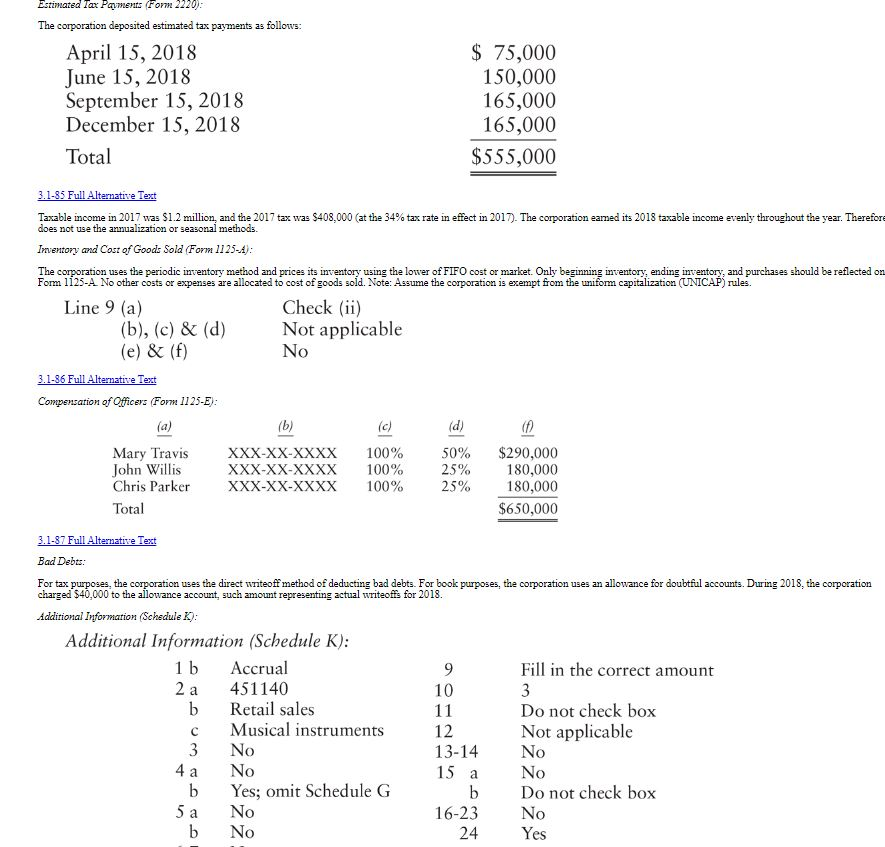

Table C:3-3 Melodic Musical Sales, Inc.-Book Balance Sheet Information January 1, 2018 Debit Credit December 31, 2018 Debit Credit Account Cash Accounts receivable Allowance for doubtful accounts Inventory Investment in corporate stock Investment in municipal bonds Cash surrender value of insurance policy Land Buildings Accumulated depreciationBuildings Equipment Accumulated depreciationEquipment Trucks Accumulated depreciationTrucks Accounts payable Notes payable (short-term) Accrued payroll taxes Accrued state income taxes Accrued federal income taxes Bonds payable (long-term) Net deferred tax liability Capital stock-Common Retained earningsUnappropriated Totals $ 516,774 $ 815,494 400,000 500,000 $ 20,000 $ 25,000 2,500,000 3,500,000 260,000 50,000 30,000 30,000 60,000 80,000 200,000 200,000 2,000,000 2,000,000 100,000 140,000 750,000 1,100,000 187,500 205,000 100,000 100,000 30,000 50,000 300,000 270,000 800,000 640,000 14,880 18,600 4,500 2,500 77,361 1,800,000 600,000 57,394 167,593 1,500,000 1,500,000 2,000,000 4,674,440 $6,816,774 $6,816,774 $8,375,494 $8,375,494 7,500 Table C:3-4 Melodic Musical Sales, Inc.-Book Income Statement 2018 $10,000,000 (250,000) $ 9,750,000 $2,500,000 5,500,000 (3,500,000) (4,500,000) $5,250,000 Sales Returns Net sales Beginning inventory Purchases Ending inventory Cost of goods sold Gross profit Expenses: Depreciation Repairs General insurance Net premium-Officers' life insurance Officers' compensation Other salaries Utilities Advertising Legal and accounting fees Charitable contributions Payroll taxes Interest expense Bad debt expense Total expenses Gain on sale of equipment Interest on municipal bonds Net gain on stock sales Dividend income Net income before income taxes Federal income tax expense State income tax expense Net income $ 152,500 20,500 55,000 30,000 650,000 400,000 72,000 48,000 50,000 30,000 62,000 210,000 45,000 (1,825,000) 105,000 5,000 45,000 12,000 $ 3,592,000 (742,560) (75,000) $ 2,774,440 Table C:3-4 Full Alternative Text Estimated Tax Payments (Form 2220): The corporation deposited estimated tax payments as follows: April 15, 2018 June 15, 2018 September 15, 2018 December 15, 2018 Total $ 75,000 150,000 165,000 165,000 $555,000 3.1-35 Full Alternative Text Taxable income in 2017 was $1.2 million and the 2017 tax was $408,000 (at the 34% tax rate in effect in 2017). The corporation eamed its 2018 taxable income evenly throughout the year. Therefore does not use the annualization or seasonal methods. Inventory and Cost of Goods Sold (Form 1125-4): The corporation uses the periodic inventory method and prices its inventory using the lower of FIFO cost or market. Only beginning inventory, ending inventory, and purchases should be reflected on Form 1125-4 No other costs or expenses are allocated to cost of goods sold. Note: Assume the corporation is exempt from the uniform capitalization (UNICA) rules. Line 9 (a) Check (ii) (b), (c) & (d) Not applicable (e) & (f) No 3.1-36 Full Alternative Text Compensation of Officers (Form 1125-E): (b) (c) (d) f Mary Travis XXX-XX-XXXX 100% 50% $290,000 John Willis XXX-XX-XXXX 100% 25% 180,000 Chris Parker XXX-XX-XXXX 100% 25% 180,000 Total $650,000 3.1-87 Full Alternative Text Bad Debts: For tax purposes, the corporation uses the direct writeoff method of deducting bad debts. For book purposes, the corporation uses an allowance for doubtful accounts. During 2018, the corporation charged $40,000 to the allowance account, such amount representing actual writeoffs for 2018. Additional Information Schedule K): Additional Information (Schedule K): 1 b Accrual 9 Fill in the correct amount 2 a 451140 10 3 b Retail sales Do not check box Musical instruments 12 Not applicable 3 No 13-14 No 4a No No b Yes; omit Schedule G b Do not check box 5 No 16-23 No b No 24 Yes 11 C 15 a 5 Table C:3-3 Melodic Musical Sales, Inc.-Book Balance Sheet Information January 1, 2018 Debit Credit December 31, 2018 Debit Credit Account Cash Accounts receivable Allowance for doubtful accounts Inventory Investment in corporate stock Investment in municipal bonds Cash surrender value of insurance policy Land Buildings Accumulated depreciationBuildings Equipment Accumulated depreciationEquipment Trucks Accumulated depreciationTrucks Accounts payable Notes payable (short-term) Accrued payroll taxes Accrued state income taxes Accrued federal income taxes Bonds payable (long-term) Net deferred tax liability Capital stock-Common Retained earningsUnappropriated Totals $ 516,774 $ 815,494 400,000 500,000 $ 20,000 $ 25,000 2,500,000 3,500,000 260,000 50,000 30,000 30,000 60,000 80,000 200,000 200,000 2,000,000 2,000,000 100,000 140,000 750,000 1,100,000 187,500 205,000 100,000 100,000 30,000 50,000 300,000 270,000 800,000 640,000 14,880 18,600 4,500 2,500 77,361 1,800,000 600,000 57,394 167,593 1,500,000 1,500,000 2,000,000 4,674,440 $6,816,774 $6,816,774 $8,375,494 $8,375,494 7,500 Table C:3-4 Melodic Musical Sales, Inc.-Book Income Statement 2018 $10,000,000 (250,000) $ 9,750,000 $2,500,000 5,500,000 (3,500,000) (4,500,000) $5,250,000 Sales Returns Net sales Beginning inventory Purchases Ending inventory Cost of goods sold Gross profit Expenses: Depreciation Repairs General insurance Net premium-Officers' life insurance Officers' compensation Other salaries Utilities Advertising Legal and accounting fees Charitable contributions Payroll taxes Interest expense Bad debt expense Total expenses Gain on sale of equipment Interest on municipal bonds Net gain on stock sales Dividend income Net income before income taxes Federal income tax expense State income tax expense Net income $ 152,500 20,500 55,000 30,000 650,000 400,000 72,000 48,000 50,000 30,000 62,000 210,000 45,000 (1,825,000) 105,000 5,000 45,000 12,000 $ 3,592,000 (742,560) (75,000) $ 2,774,440 Table C:3-4 Full Alternative Text Estimated Tax Payments (Form 2220): The corporation deposited estimated tax payments as follows: April 15, 2018 June 15, 2018 September 15, 2018 December 15, 2018 Total $ 75,000 150,000 165,000 165,000 $555,000 3.1-35 Full Alternative Text Taxable income in 2017 was $1.2 million and the 2017 tax was $408,000 (at the 34% tax rate in effect in 2017). The corporation eamed its 2018 taxable income evenly throughout the year. Therefore does not use the annualization or seasonal methods. Inventory and Cost of Goods Sold (Form 1125-4): The corporation uses the periodic inventory method and prices its inventory using the lower of FIFO cost or market. Only beginning inventory, ending inventory, and purchases should be reflected on Form 1125-4 No other costs or expenses are allocated to cost of goods sold. Note: Assume the corporation is exempt from the uniform capitalization (UNICA) rules. Line 9 (a) Check (ii) (b), (c) & (d) Not applicable (e) & (f) No 3.1-36 Full Alternative Text Compensation of Officers (Form 1125-E): (b) (c) (d) f Mary Travis XXX-XX-XXXX 100% 50% $290,000 John Willis XXX-XX-XXXX 100% 25% 180,000 Chris Parker XXX-XX-XXXX 100% 25% 180,000 Total $650,000 3.1-87 Full Alternative Text Bad Debts: For tax purposes, the corporation uses the direct writeoff method of deducting bad debts. For book purposes, the corporation uses an allowance for doubtful accounts. During 2018, the corporation charged $40,000 to the allowance account, such amount representing actual writeoffs for 2018. Additional Information Schedule K): Additional Information (Schedule K): 1 b Accrual 9 Fill in the correct amount 2 a 451140 10 3 b Retail sales Do not check box Musical instruments 12 Not applicable 3 No 13-14 No 4a No No b Yes; omit Schedule G b Do not check box 5 No 16-23 No b No 24 Yes 11 C 15 a 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started