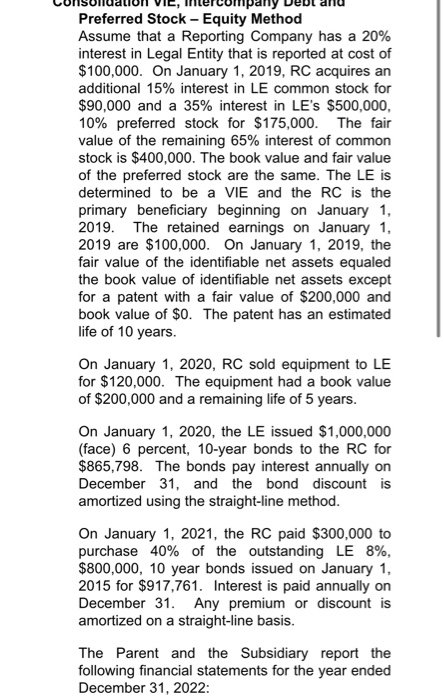

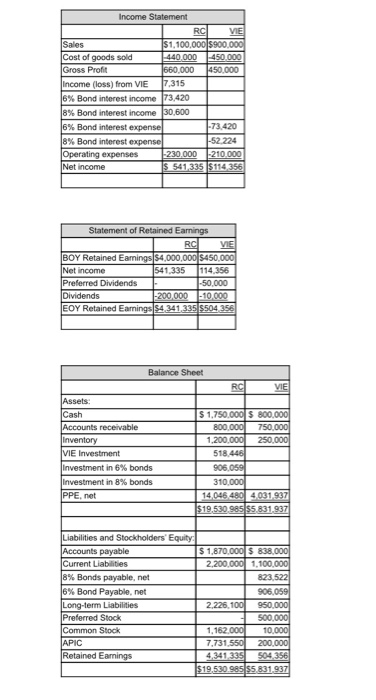

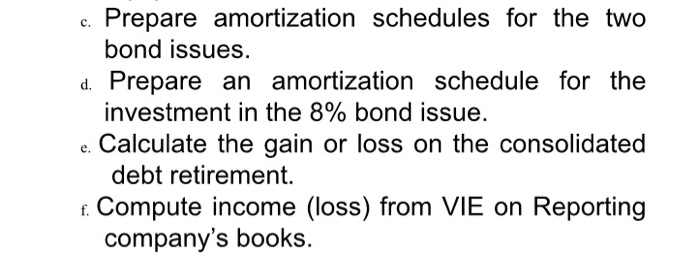

CUIISUlluaLIUII VIL, Ihlercompany Deol arlu Preferred Stock - Equity Method Assume that a Reporting Company has a 20% interest in Legal Entity that is reported at cost of $100,000. On January 1, 2019, RC acquires an additional 15% interest in LE common stock for $90,000 and a 35% interest in LE's $500,000, 10% preferred stock for $175,000. The fair value of the remaining 65% interest of common stock is $400,000. The book value and fair value of the preferred stock are the same. The LE is determined to be a VIE and the RC is the primary beneficiary beginning on January 1, 2019. The retained earnings on January 1, 2019 are $100,000. On January 1, 2019, the fair value of the identifiable net assets equaled the book value of identifiable net assets except for a patent with a fair value of $200,000 and book value of $0. The patent has an estimated life of 10 years. On January 1, 2020, RC sold equipment to LE for $120,000. The equipment had a book value of $200,000 and a remaining life of 5 years. On January 1, 2020, the LE issued $1,000,000 (face) 6 percent, 10-year bonds to the RC for $865,798. The bonds pay interest annually on December 31, and the bond discount is amortized using the straight-line method. On January 1, 2021, the RC paid $300,000 to purchase 40% of the outstanding LE 8%, $800,000, 10 year bonds issued on January 1, 2015 for $917,761. Interest is paid annually on December 31. Any premium or discount is amortized on a straight-line basis. The Parent and the Subsidiary report the following financial statements for the year ended December 31, 2022: Income Statement RC VIE Sales $1,100,000 $900.000 Cost of goods sold 440,000 450.000 Gross Profit 660.000 450.000 Income (loss) from VIE 7.315 6% Bond interest income 73 420 8% Bond interest income 30,600 6% Bond interest expense 8% Bond interest expense 52.224 Operating expenses 230 000 210.000 Net Income S 541 335 5114 356 Statement of Retained Earnings RC VE BOY Retained Earnings 54,000,000 $450,000 Net Income 541 335 114 356 Preferred Dividends 50,000 Dividends -200,000 -10.000 EOY Retained Earings $4 341 335 5504 356 Balance Sheet RCI VIE Assets Cash Accounts receivable Inventory VIE Investment Investment in 6% bonds Investment in 8% bonds PPE.net $1.750.000 $ 800.000 800.000 750.000 1.200.000 250.000 518.446 05050 310.000 14 046480 4031.937 $19.530 sesls5 831 937 Liabilities and Stockholders' Equity Accounts payable Current Liabilities 8% Bonds payable, nel 6% Bond Payable net Long-term Liabilities Preferred Stock Common Stock APIC Retained Earnings S 1.870.000 S 838.000 2.200.000 1.100.000 823 522 906,059 2.226.100 950.000 500,000 1.162 000 10.000 7.731,550 200.000 4.341 335 504356 $19.530.985 $5,831.937 c. Prepare amortization schedules for the two bond issues. d. Prepare an amortization schedule for the investment in the 8% bond issue. e. Calculate the gain or loss on the consolidated debt retirement. f. Compute income (loss) from VIE on Reporting company's books. CUIISUlluaLIUII VIL, Ihlercompany Deol arlu Preferred Stock - Equity Method Assume that a Reporting Company has a 20% interest in Legal Entity that is reported at cost of $100,000. On January 1, 2019, RC acquires an additional 15% interest in LE common stock for $90,000 and a 35% interest in LE's $500,000, 10% preferred stock for $175,000. The fair value of the remaining 65% interest of common stock is $400,000. The book value and fair value of the preferred stock are the same. The LE is determined to be a VIE and the RC is the primary beneficiary beginning on January 1, 2019. The retained earnings on January 1, 2019 are $100,000. On January 1, 2019, the fair value of the identifiable net assets equaled the book value of identifiable net assets except for a patent with a fair value of $200,000 and book value of $0. The patent has an estimated life of 10 years. On January 1, 2020, RC sold equipment to LE for $120,000. The equipment had a book value of $200,000 and a remaining life of 5 years. On January 1, 2020, the LE issued $1,000,000 (face) 6 percent, 10-year bonds to the RC for $865,798. The bonds pay interest annually on December 31, and the bond discount is amortized using the straight-line method. On January 1, 2021, the RC paid $300,000 to purchase 40% of the outstanding LE 8%, $800,000, 10 year bonds issued on January 1, 2015 for $917,761. Interest is paid annually on December 31. Any premium or discount is amortized on a straight-line basis. The Parent and the Subsidiary report the following financial statements for the year ended December 31, 2022: Income Statement RC VIE Sales $1,100,000 $900.000 Cost of goods sold 440,000 450.000 Gross Profit 660.000 450.000 Income (loss) from VIE 7.315 6% Bond interest income 73 420 8% Bond interest income 30,600 6% Bond interest expense 8% Bond interest expense 52.224 Operating expenses 230 000 210.000 Net Income S 541 335 5114 356 Statement of Retained Earnings RC VE BOY Retained Earnings 54,000,000 $450,000 Net Income 541 335 114 356 Preferred Dividends 50,000 Dividends -200,000 -10.000 EOY Retained Earings $4 341 335 5504 356 Balance Sheet RCI VIE Assets Cash Accounts receivable Inventory VIE Investment Investment in 6% bonds Investment in 8% bonds PPE.net $1.750.000 $ 800.000 800.000 750.000 1.200.000 250.000 518.446 05050 310.000 14 046480 4031.937 $19.530 sesls5 831 937 Liabilities and Stockholders' Equity Accounts payable Current Liabilities 8% Bonds payable, nel 6% Bond Payable net Long-term Liabilities Preferred Stock Common Stock APIC Retained Earnings S 1.870.000 S 838.000 2.200.000 1.100.000 823 522 906,059 2.226.100 950.000 500,000 1.162 000 10.000 7.731,550 200.000 4.341 335 504356 $19.530.985 $5,831.937 c. Prepare amortization schedules for the two bond issues. d. Prepare an amortization schedule for the investment in the 8% bond issue. e. Calculate the gain or loss on the consolidated debt retirement. f. Compute income (loss) from VIE on Reporting company's books