Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cullumber Anti-Pollution Company is suffering declining sales of its principal product, non-biodegradable plastic cartons. The president, Mark Harris, instructs his controller. Betty Martin, to lengthen

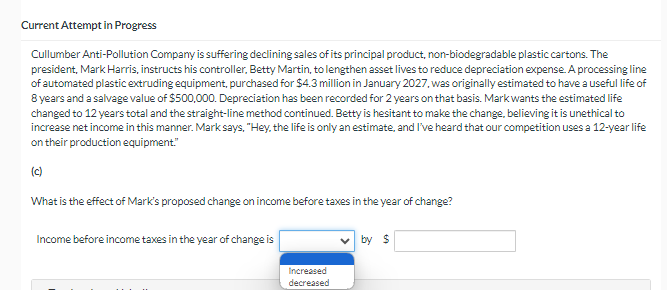

Cullumber Anti-Pollution Company is suffering declining sales of its principal product, non-biodegradable plastic cartons. The president, Mark Harris, instructs his controller. Betty Martin, to lengthen asset lives to reduce depreciation expense. A processing line of automated plastic extruding equipment, purchased for $4.3 million in January 2027, was originally estimated to have a useful life of 8 years and a salvage value of $500,000. Depreciation has been recorded for 2 years on that basis. Mark wants the estimated life changed to 12 years total and the straight-line method continued. Betty is hesitant to make the change, believing it is unethical to increase net income in this manner. Mark says, "Hey, the life is only an estimate, and l've heard that our competition uses a 12 -year life on their production equipment." (c) What is the effect of Mark's proposed change on income before taxes in the year of change? Income before income taxes in the year of change is by $

Cullumber Anti-Pollution Company is suffering declining sales of its principal product, non-biodegradable plastic cartons. The president, Mark Harris, instructs his controller. Betty Martin, to lengthen asset lives to reduce depreciation expense. A processing line of automated plastic extruding equipment, purchased for $4.3 million in January 2027, was originally estimated to have a useful life of 8 years and a salvage value of $500,000. Depreciation has been recorded for 2 years on that basis. Mark wants the estimated life changed to 12 years total and the straight-line method continued. Betty is hesitant to make the change, believing it is unethical to increase net income in this manner. Mark says, "Hey, the life is only an estimate, and l've heard that our competition uses a 12 -year life on their production equipment." (c) What is the effect of Mark's proposed change on income before taxes in the year of change? Income before income taxes in the year of change is by $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started