Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cullumber Clark opened Cullumber's Cleaning Service on July 1, 2022. During July, the following transactions were completed. July 1 1 3 5 12 18 20

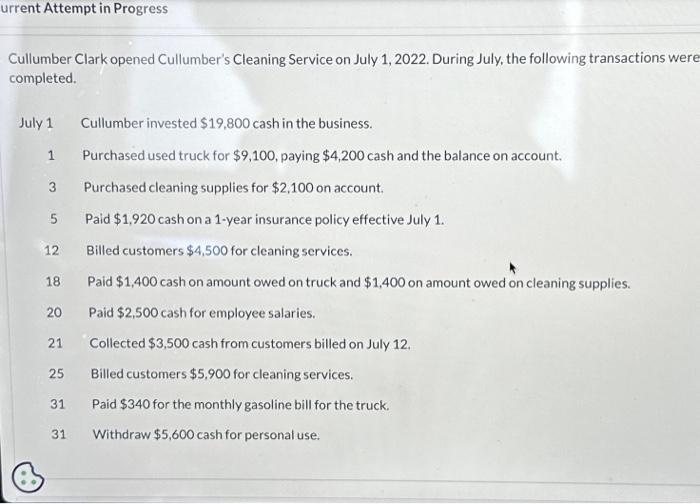

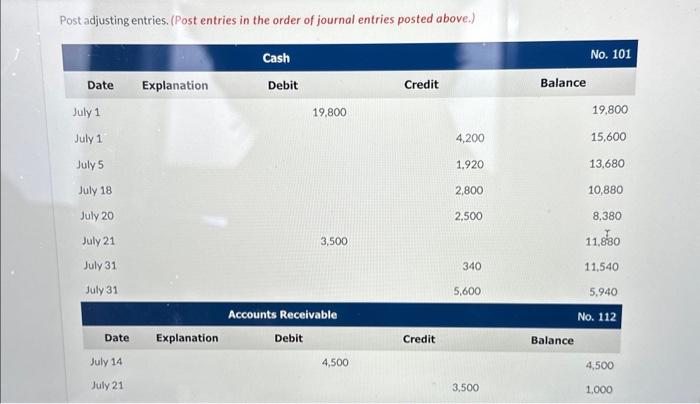

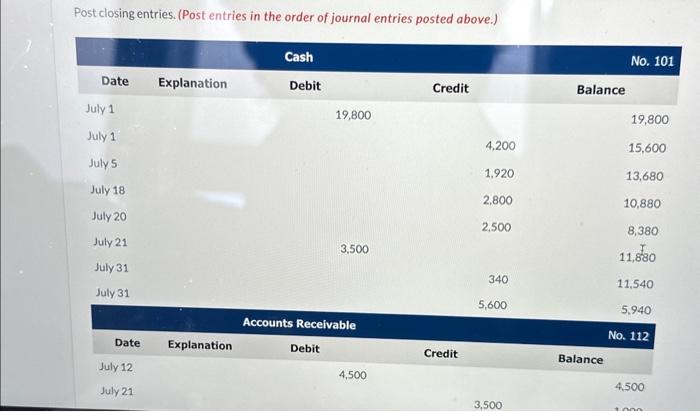

Cullumber Clark opened Cullumber's Cleaning Service on July 1, 2022. During July, the following transactions were completed. July 1 1 3 5 12 18 20 21 25 31 31 Cullumber invested $19,800 cash in the business. Purchased used truck for $9,100, paying $4,200 cash and the balance on account. Purchased cleaning supplies for $2,100 on account. Paid $1,920 cash on a 1-year insurance policy effective July 1. Billed customers $4,500 for cleaning services. Paid $1,400 cash on amount owed on truck and $1,400 on amount owed on cleaning supplies. Paid $2,500 cash for employee salaries. Collected $3,500 cash from customers billed on July 12. Billed customers $5,900 for cleaning services. Paid $340 for the monthly gasoline bill for the truck. Withdraw $5,600 cash for personal use.

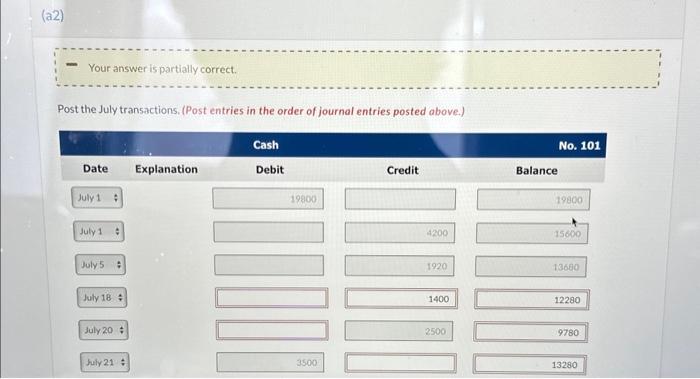

1. post the july transactions

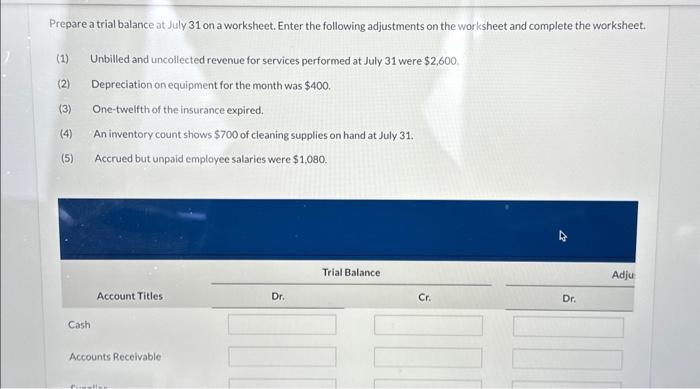

2. prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet and complete the worksheet.

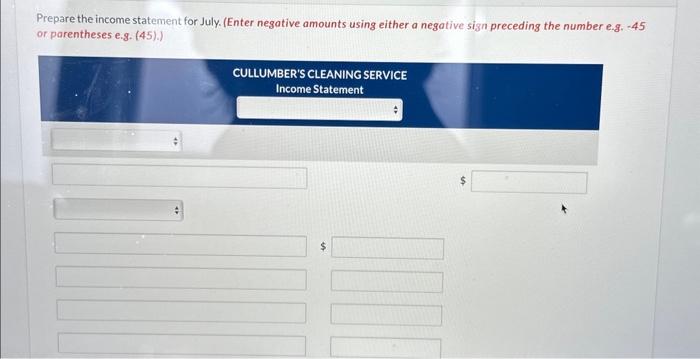

3. prepare the income statement for july.

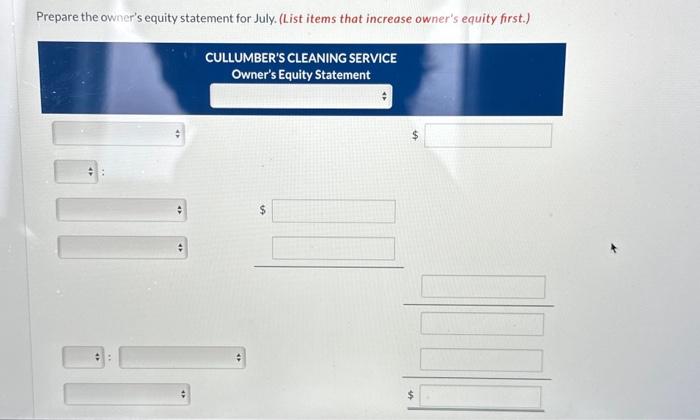

4. prepare the owners equity statement for july.

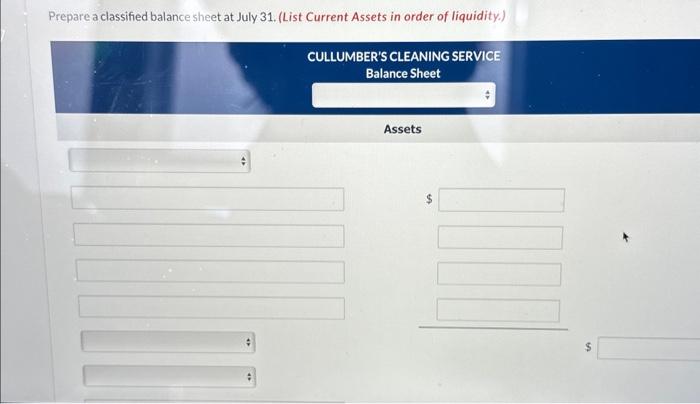

5. prepare a classified balance sheet at july 31.

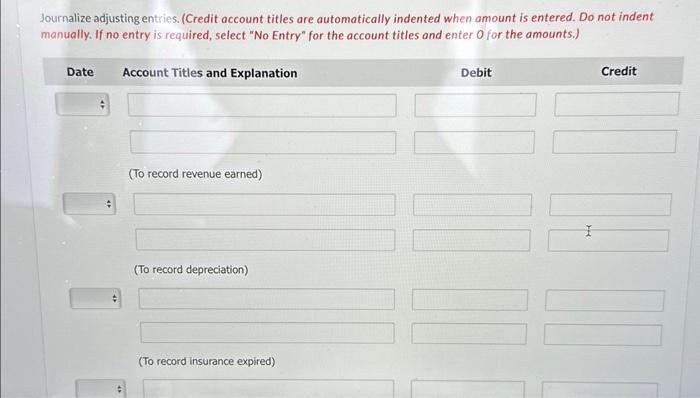

6. journalize adjusting entries.

7. post adjusting entries

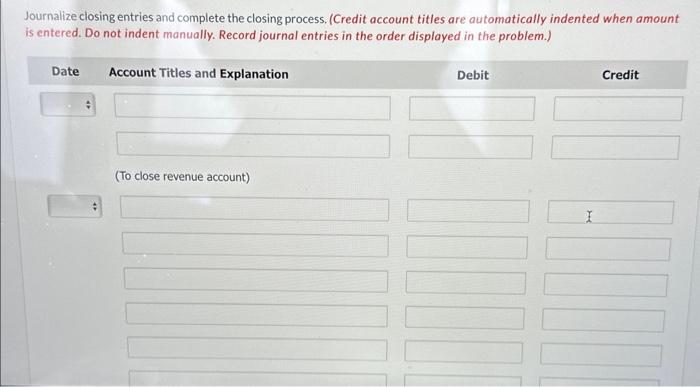

8. journalize closing entries and complete the closing process.

9. post closing entries.

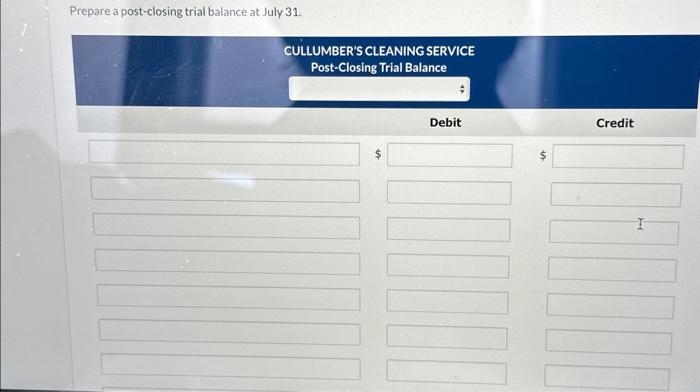

10. prepare a post-closing trial balance at july 31.

thank you so much more than you know.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started