Answered step by step

Verified Expert Solution

Question

1 Approved Answer

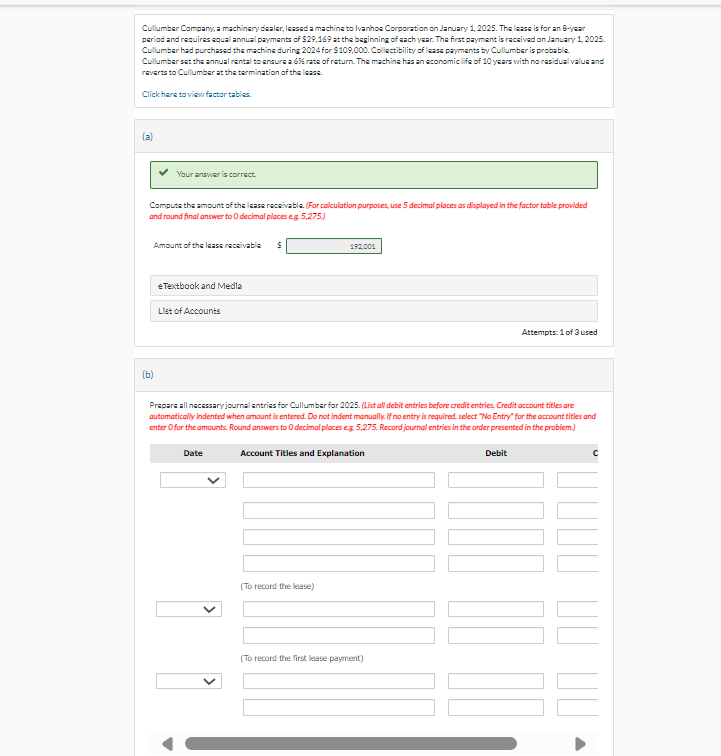

Cullumber Company, a machinery dealar, leased a machine to lvanhoe Corporation on January 1 , 2 0 2 5 . The lease is for an

Cullumber Company, a machinery dealar, leased a machine to lvanhoe Corporation on January The lease is for an Byear

period and requirss equal annual payments of $ at the beginning of each yaar. The first payment is racaived on January

Cullumber had purchased the machine during for $ Collectibility of lease payments by Cullumber is probable

Cullumber sat the annual rental to encure a rate of return. The machine has an economic life of years with no residual value and

revarts to Cullumber at the termination of the lease.

Click here toview factar tables.

a

Your answer is corract.

Campute the amount of the lease receivable For calculation purposes, use decimal places as displayed in the factor table provided

and round final answer to decimal places e

Amount of the lase receivable $

eTextbook and Medis

Llst of Accounts

Attempts of used

b

Prspars all nacessary journal antries for Cullumber for List all debit entries before credit entries. Credit account titles are

automatically indented when amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and

enter for the amounts. Round answers to decimal places e Record journal entries in the ander presented in the problem.

Date

Account Titles and Explanation

Debit

To record the lease

To record the first lease payment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started