Question

Cullumber Company is considering these two alternatives for financing the purchase of a fleet of airplanes. 1. Issue 52,000 shares of common stock at $45

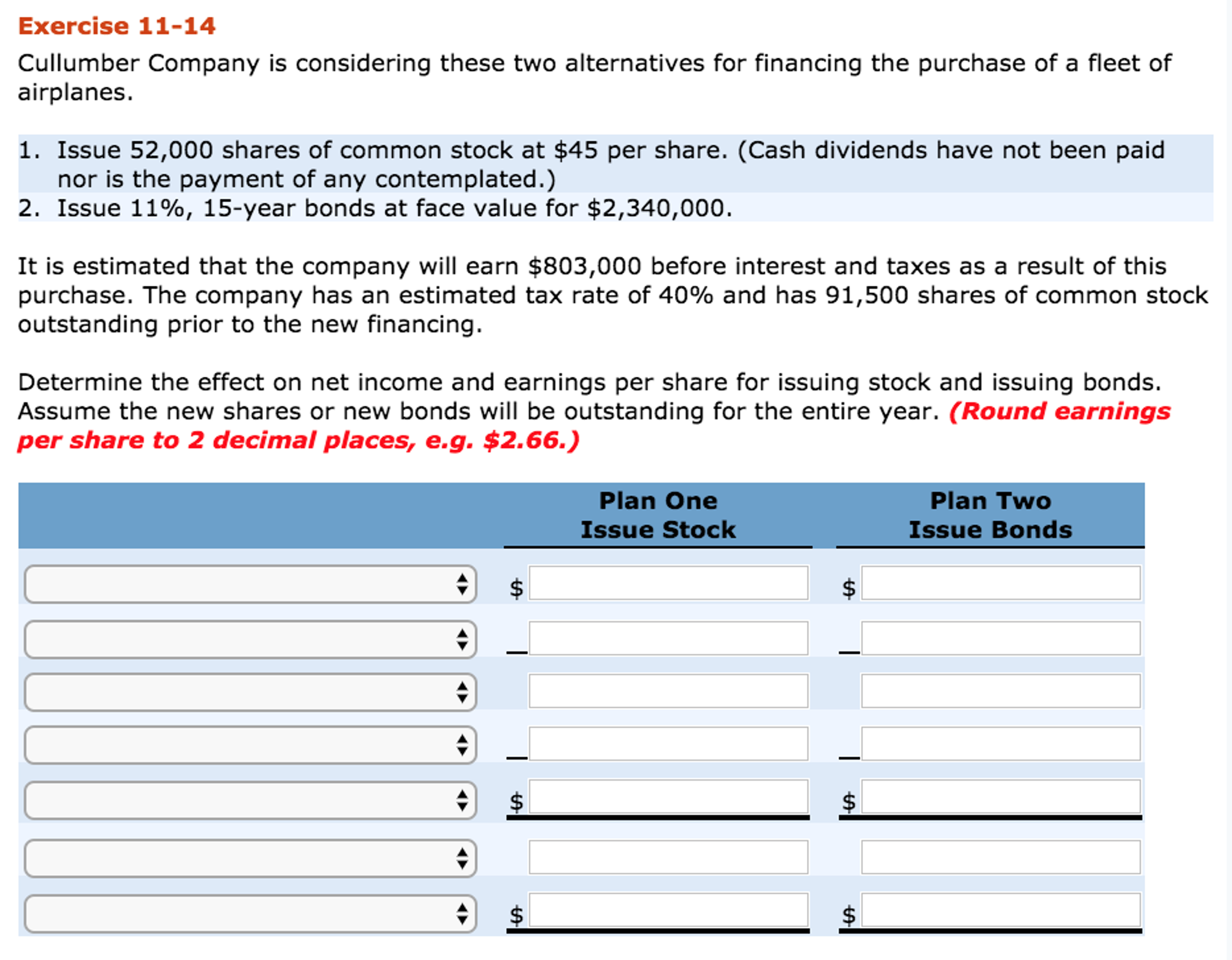

Cullumber Company is considering these two alternatives for financing the purchase of a fleet of airplanes.

| 1. | Issue 52,000 shares of common stock at $45 per share. (Cash dividends have not been paid nor is the payment of any contemplated.) | |

| 2. | Issue 11%, 15-year bonds at face value for $2,340,000. |

It is estimated that the company will earn $803,000 before interest and taxes as a result of this purchase. The company has an estimated tax rate of 40% and has 91,500 shares of common stock outstanding prior to the new financing. Determine the effect on net income and earnings per share for issuing stock and issuing bonds. Assume the new shares or new bonds will be outstanding for the entire year.

Please answer with calculations if possible! I'd like to understand.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started