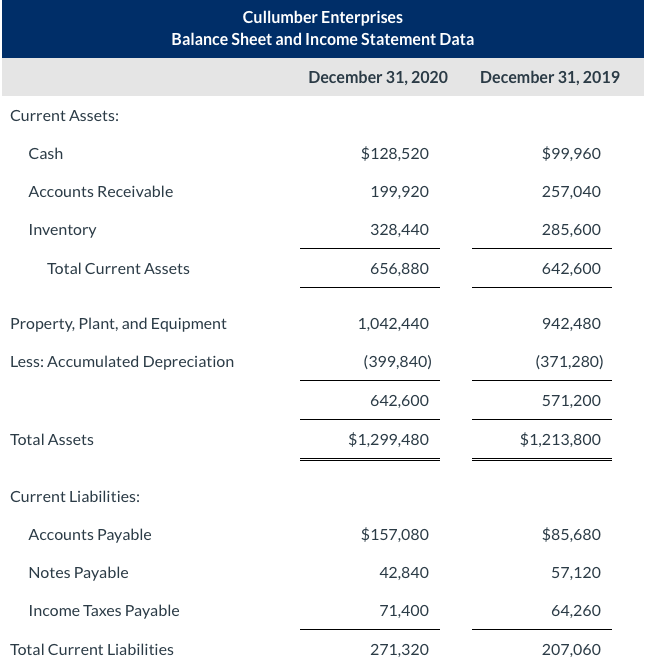

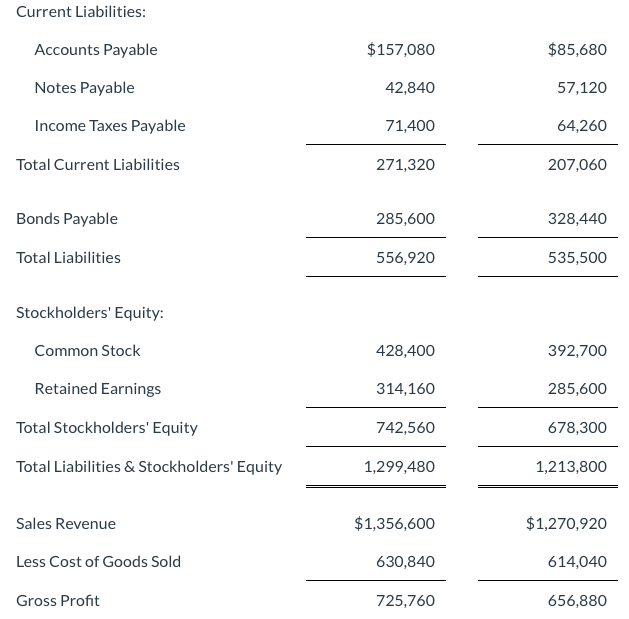

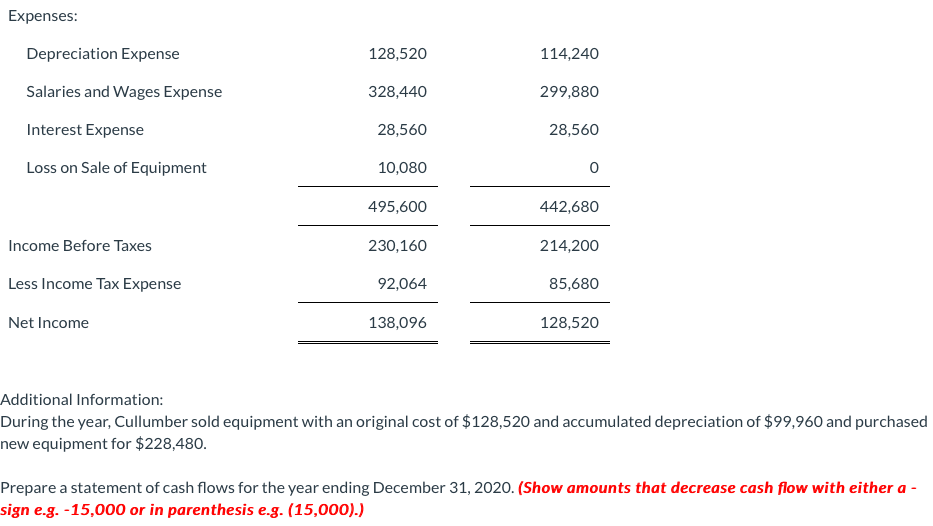

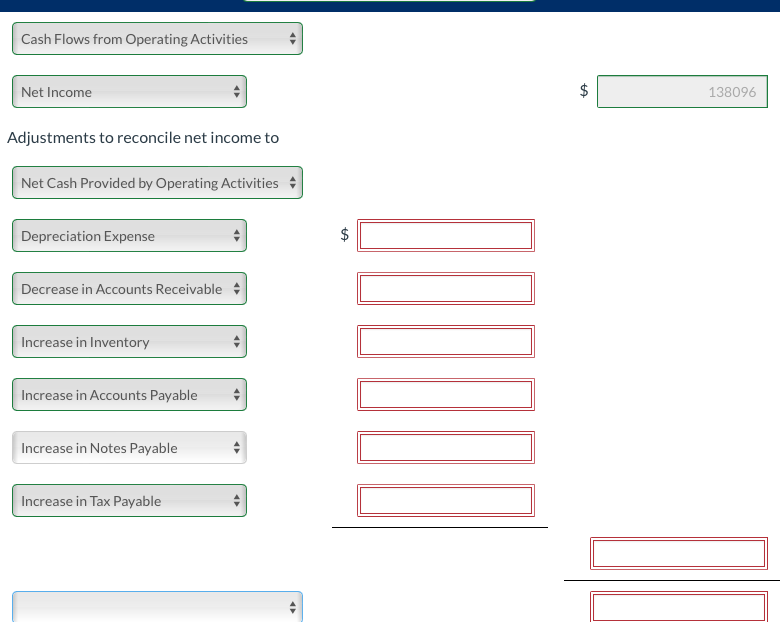

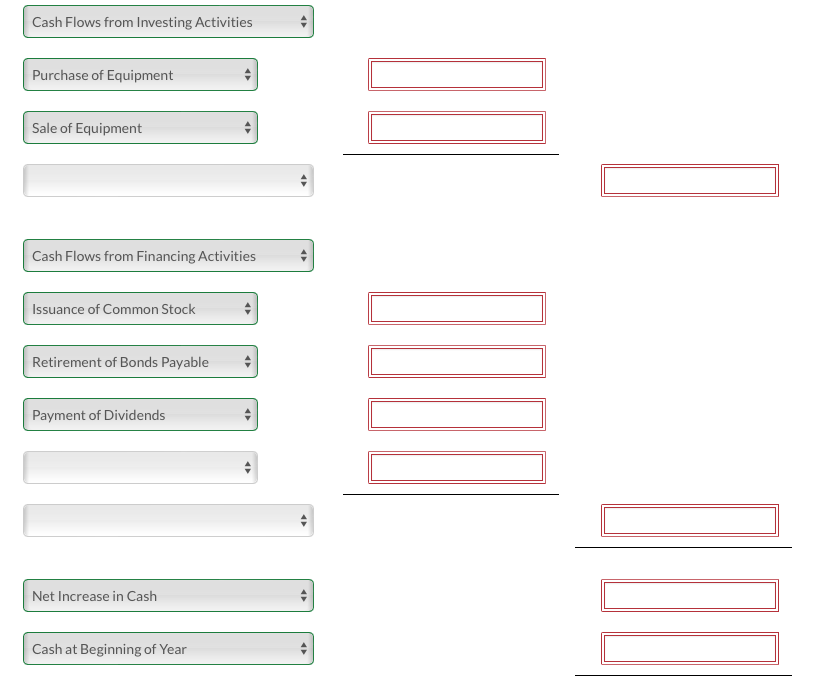

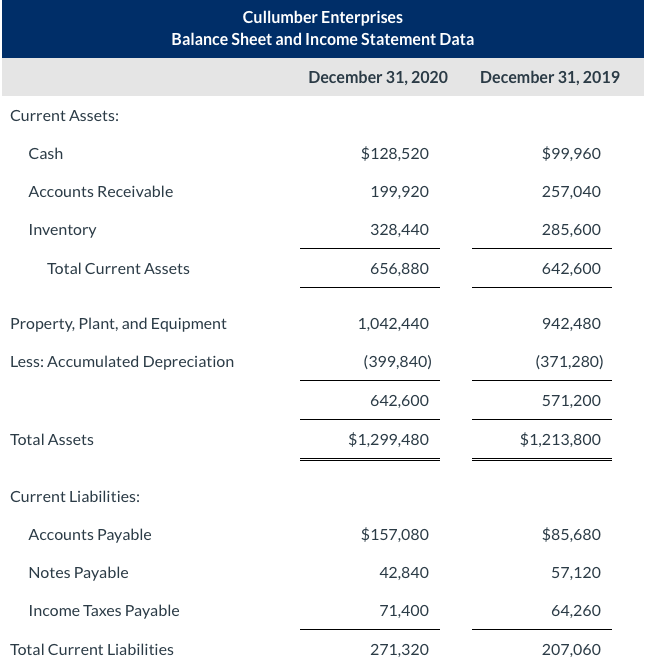

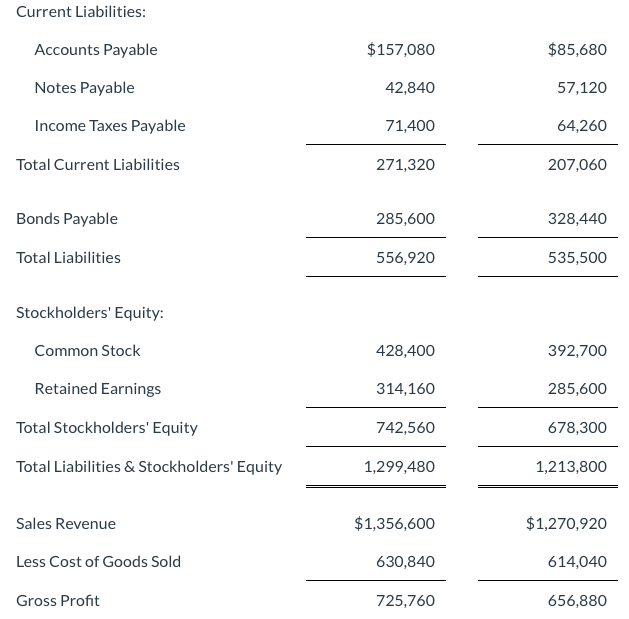

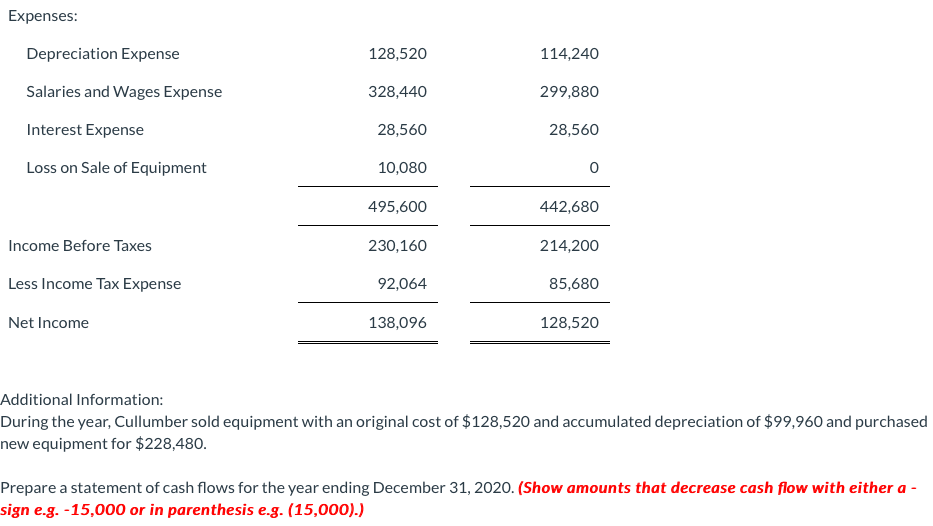

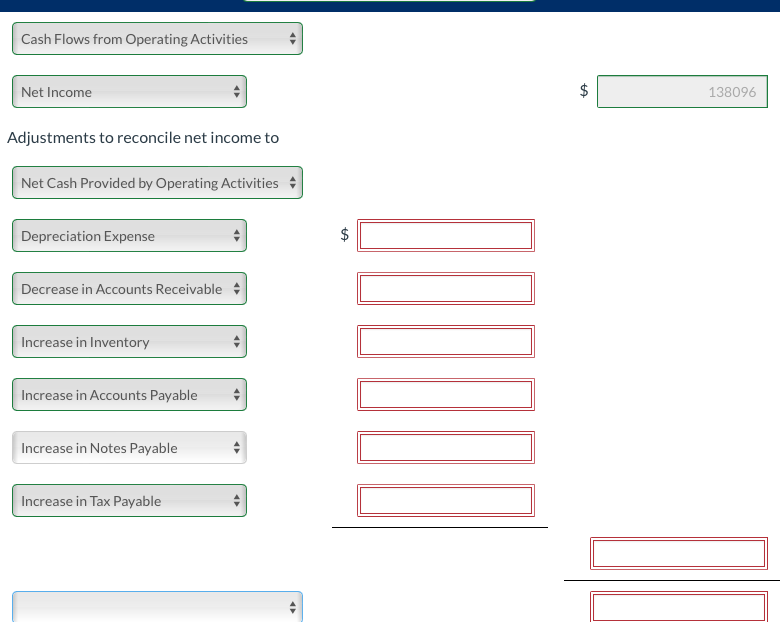

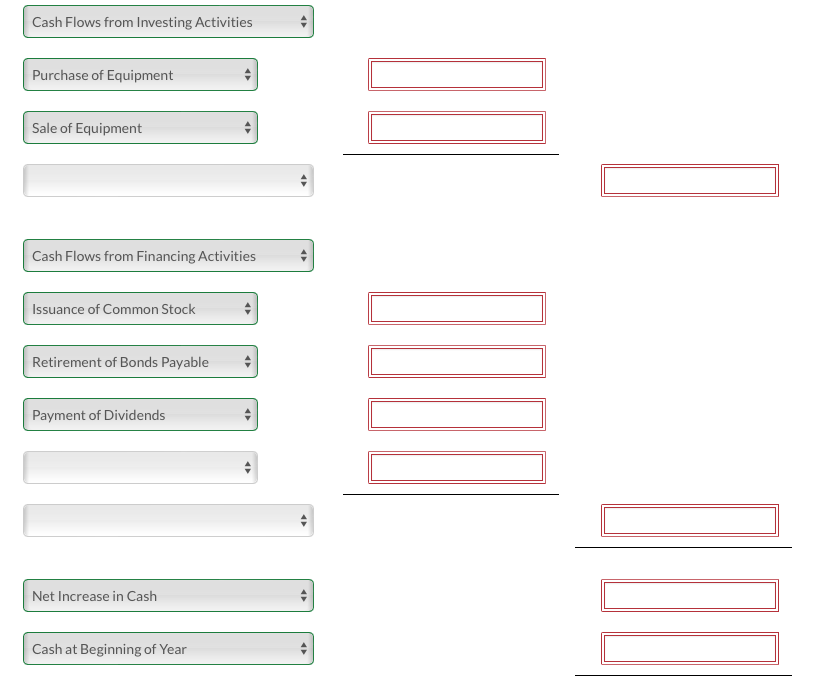

Cullumber Enterprises Balance Sheet and Income Statement Data December 31, 2020 December 31, 2019 Current Assets: Cash $128,520 $99,960 Accounts Receivable 199,920 257,040 Inventory 328,440 285,600 Total Current Assets 656,880 642,600 Property, Plant, and Equipment 1,042,440 942,480 Less: Accumulated Depreciation (399,840) (371,280) 642,600 571,200 Total Assets $1,299,480 $1,213,800 Current Liabilities: Accounts Payable $157,080 $85,680 Notes Payable 42,840 57,120 Income Taxes Payable 71,400 64,260 Total Current Liabilities 271,320 207,060 Current Liabilities: Accounts Payable $157,080 $85,680 42,840 57,120 Notes Payable Income Taxes Payable 71,400 64,260 Total Current Liabilities 271,320 207,060 Bonds Payable 285,600 328,440 Total Liabilities 556,920 535,500 Stockholders' Equity: Common Stock 428,400 392,700 Retained Earnings 314,160 285,600 Total Stockholders' Equity 742,560 678,300 Total Liabilities & Stockholders' Equity 1,299,480 1,213,800 Sales Revenue $1,356,600 $1,270,920 Less Cost of Goods Sold 630,840 614,040 Gross Profit 725,760 656,880 Expenses: Depreciation Expense 128,520 114,240 328,440 299,880 Salaries and Wages Expense Interest Expense 28,560 28,560 Loss on Sale of Equipment 10,080 0 495,600 442,680 Income Before Taxes 230,160 214,200 Less Income Tax Expense 92,064 85,680 Net Income 138,096 128,520 Additional Information: During the year, Cullumber sold equipment with an original cost of $128,520 and accumulated depreciation of $99,960 and purchased new equipment for $228,480. Prepare a statement of cash flows for the year ending December 31, 2020. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Cash Flows from Operating Activities Net Income $ 138096 Adjustments to reconcile net income to Net Cash Provided by Operating Activities - Depreciation Expense $ Decrease in Accounts Receivable Increase in Inventory LLLLL Increase in Accounts Payable Increase in Notes Payable Increase in Tax Payable + Cash Flows from Investing Activities Purchase of Equipment Sale of Equipment Cash Flows from Financing Activities Issuance of Common Stock Retirement of Bonds Payable Payment of Dividends Net Increase in Cash Cash at Beginning of Year Cash at Beginning of Year Cash at End of the Year $