Answered step by step

Verified Expert Solution

Question

1 Approved Answer

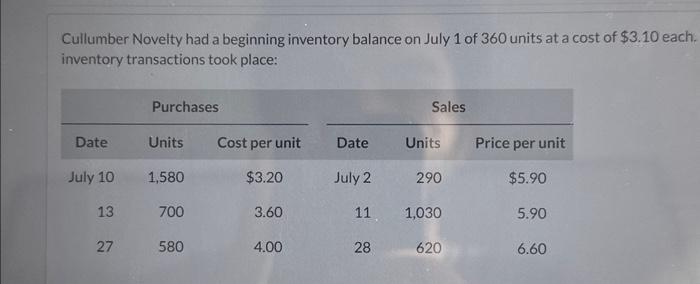

Cullumber Novelty had a beginning inventory balance on July 1 of 360 units at a cost of $3.10 each. inventory transactions took place: Purchases

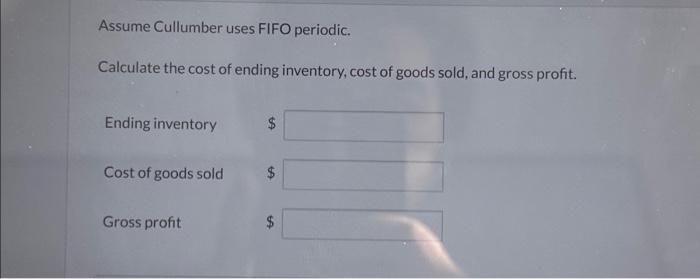

Cullumber Novelty had a beginning inventory balance on July 1 of 360 units at a cost of $3.10 each. inventory transactions took place: Purchases Sales Date Units Cost per unit Date Units Price per unit July 10 1,580 $3.20 July 2 290 $5.90 13 700 3.60 11 1,030 5.90 27 580 4.00 28 620 6.60 Assume Cullumber uses FIFO periodic. Calculate the cost of ending inventory, cost of goods sold, and gross profit. Ending inventory Cost of goods sold Gross profit $

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the cost of ending inventory cost of goods sold and gross profit using the FIFO ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e2a575c07d_960029.pdf

180 KBs PDF File

663e2a575c07d_960029.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started