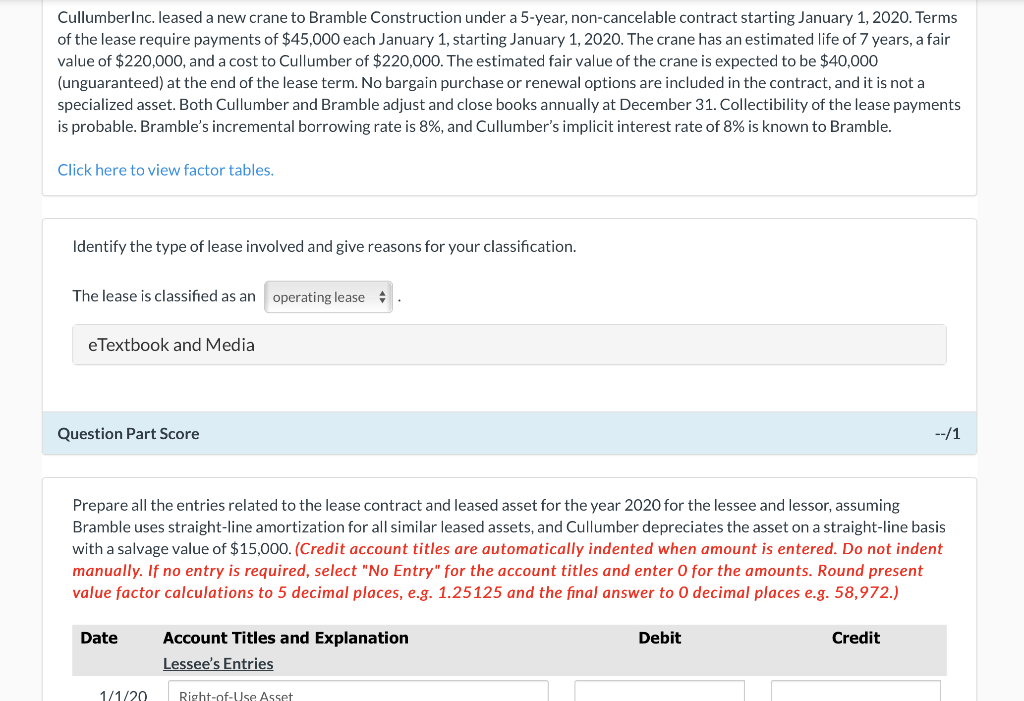

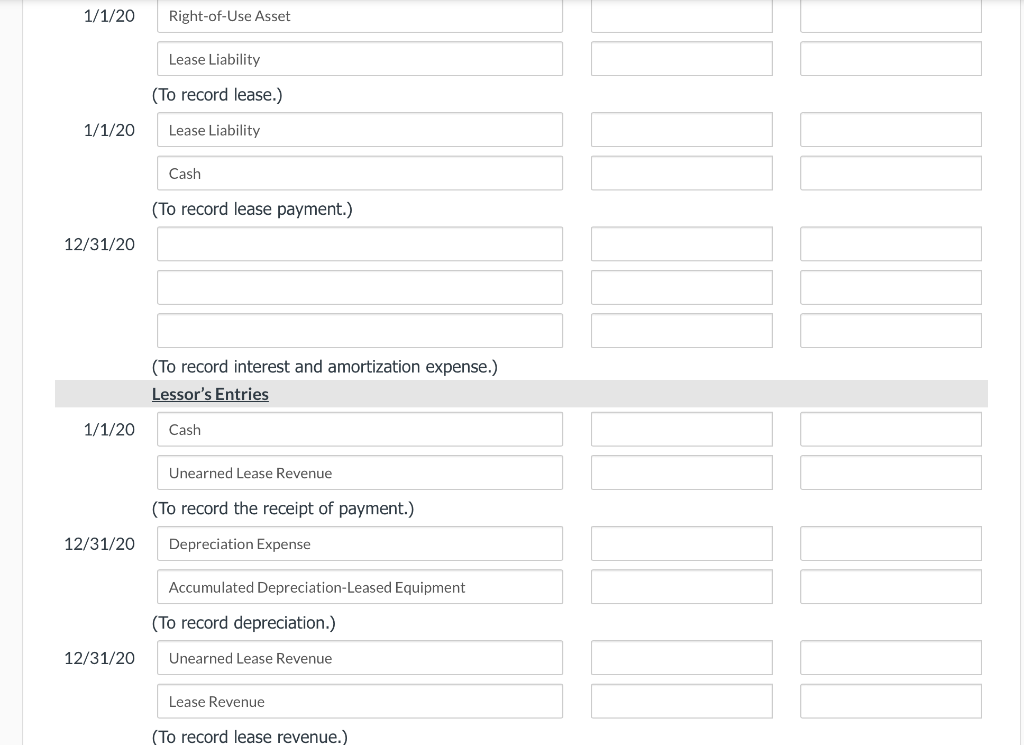

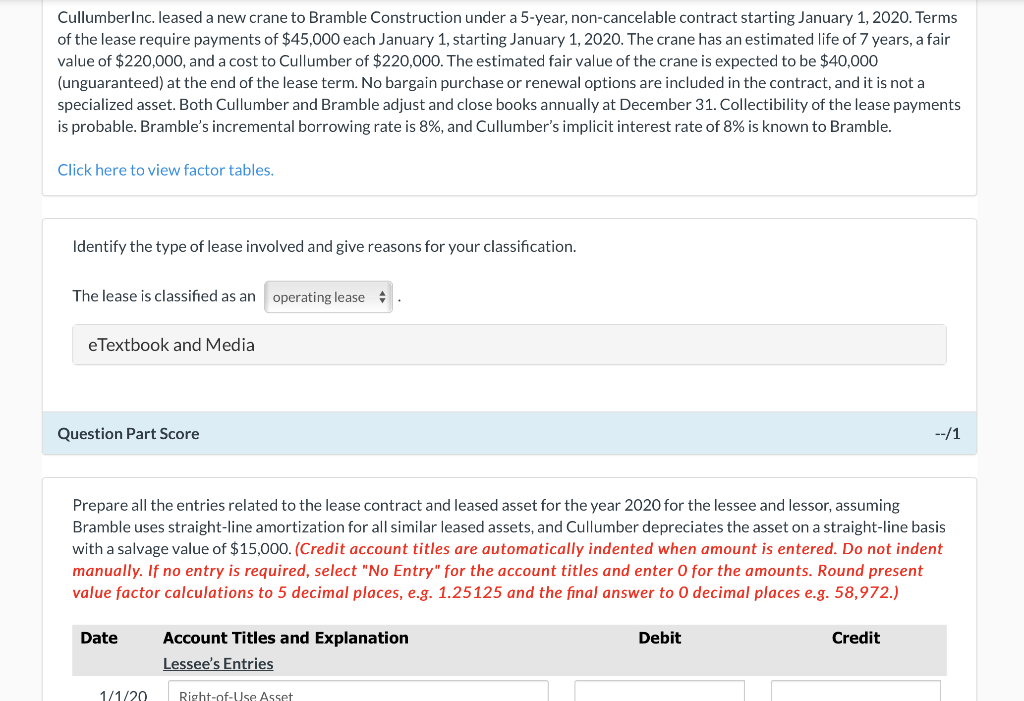

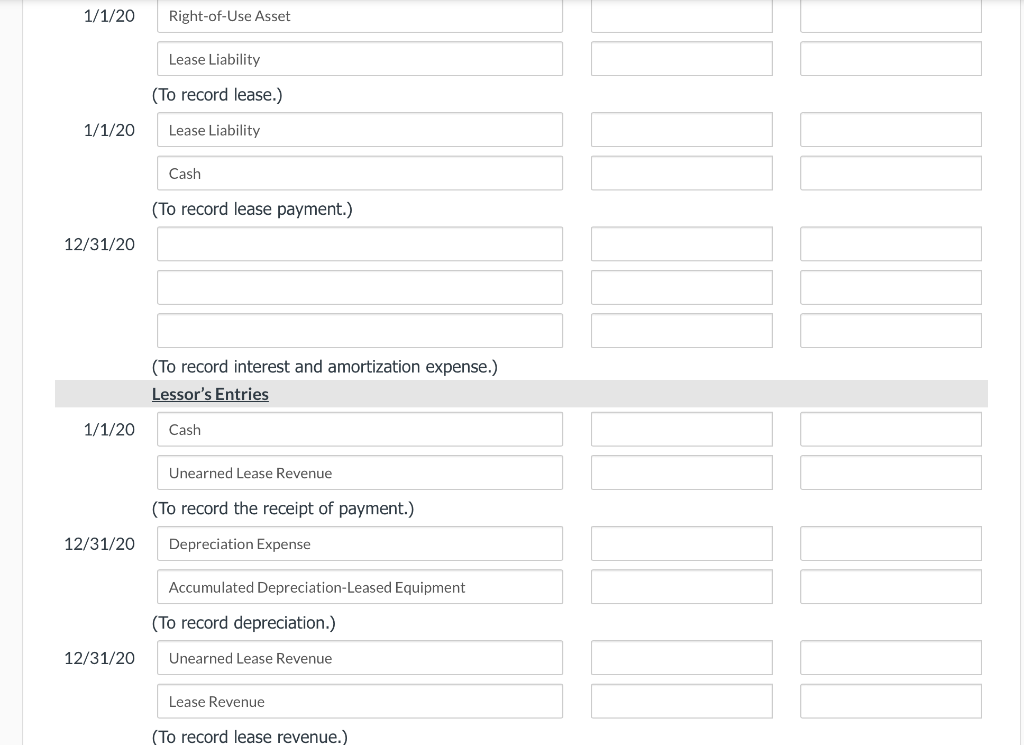

Cullumberinc. leased a new crane to Bramble Construction under a 5-year, non-cancelable contract starting January 1, 2020. Terms of the lease require payments of $45,000 each January 1, starting January 1, 2020. The crane has an estimated life of 7 years, a fair value of $220,000, and a cost to Cullumber of $220,000. The estimated fair value of the crane is expected to be $40,000 (unguaranteed) at the end of the lease term. No bargain purchase or renewal options are included in the contract, and it is not a specialized asset. Both Cullumber and Bramble adjust and close books annually at December 31. Collectibility of the lease payments is probable. Bramble's incremental borrowing rate is 8%, and Cullumber's implicit interest rate of 8% is known to Bramble. Click here to view factor tables. Identify the type of lease involved and give reasons for your classification. The lease is classified as an operating lease e Textbook and Media Question Part Score --/1 Prepare all the entries related to the lease contract and leased asset for the year 2020 for the lessee and lessor, assuming Bramble uses straight-line amortization for all similar leased assets, and Cullumber depreciates the asset on a straight-line basis with a salvage value of $15,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25125 and the final answer to 0 decimal places e.g. 58,972.) Date Debit Credit Account Titles and Explanation Lessee's Entries 1/1/20 Right-of-Use Asset 1/1/20 Right-of-Use Asset Lease Liability (To record lease.) 1/1/20 Lease Liability Cash (To record lease payment.) 12/31/20 (To record interest and amortization expense.) Lessor's Entries 1/1/20 Cash Unearned Lease Revenue (To record the receipt of payment.) 12/31/20 Depreciation Expense Accumulated Depreciation-Leased Equipment (To record depreciation.) 12/31/20 Unearned Lease Revenue Lease Revenue (To record lease revenue.) Cullumberinc. leased a new crane to Bramble Construction under a 5-year, non-cancelable contract starting January 1, 2020. Terms of the lease require payments of $45,000 each January 1, starting January 1, 2020. The crane has an estimated life of 7 years, a fair value of $220,000, and a cost to Cullumber of $220,000. The estimated fair value of the crane is expected to be $40,000 (unguaranteed) at the end of the lease term. No bargain purchase or renewal options are included in the contract, and it is not a specialized asset. Both Cullumber and Bramble adjust and close books annually at December 31. Collectibility of the lease payments is probable. Bramble's incremental borrowing rate is 8%, and Cullumber's implicit interest rate of 8% is known to Bramble. Click here to view factor tables. Identify the type of lease involved and give reasons for your classification. The lease is classified as an operating lease e Textbook and Media Question Part Score --/1 Prepare all the entries related to the lease contract and leased asset for the year 2020 for the lessee and lessor, assuming Bramble uses straight-line amortization for all similar leased assets, and Cullumber depreciates the asset on a straight-line basis with a salvage value of $15,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25125 and the final answer to 0 decimal places e.g. 58,972.) Date Debit Credit Account Titles and Explanation Lessee's Entries 1/1/20 Right-of-Use Asset 1/1/20 Right-of-Use Asset Lease Liability (To record lease.) 1/1/20 Lease Liability Cash (To record lease payment.) 12/31/20 (To record interest and amortization expense.) Lessor's Entries 1/1/20 Cash Unearned Lease Revenue (To record the receipt of payment.) 12/31/20 Depreciation Expense Accumulated Depreciation-Leased Equipment (To record depreciation.) 12/31/20 Unearned Lease Revenue Lease Revenue (To record lease revenue.)