Question

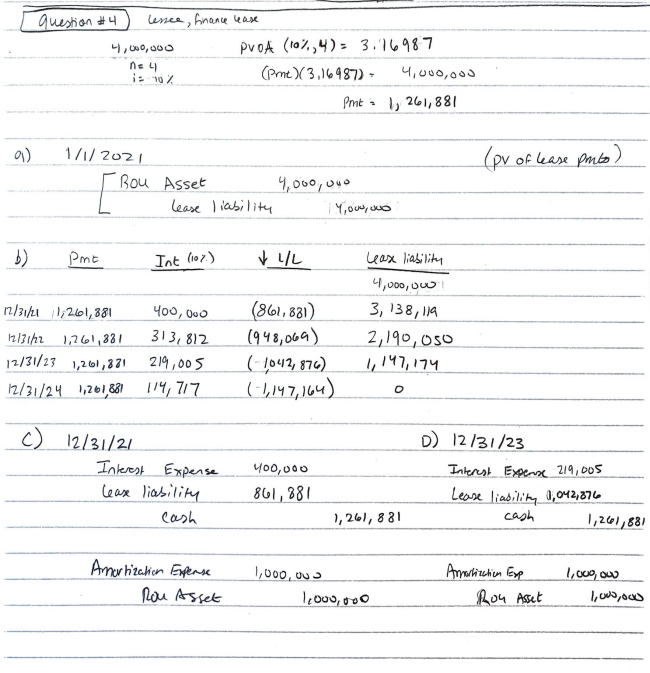

Culver Cutting Corp leased a CNC machine from Mooney Manufacturing. Mooney completed construction of the machine on January 1, 2021. The lease agreement for the

Culver Cutting Corp leased a CNC machine from Mooney Manufacturing. Mooney completed construction of the machine on January 1, 2021. The lease agreement for the $4 million (fair value and present value of lease payments) machine specified four equal payments at the end of each year. The useful life of the machine was expected to be four years with no residual value. Mooneys implicit interest rate was 10%.

a. Prepare the journal entry for Culver at the beginning of the lease on January 1, 2021.

b. Prepare an amortization schedule for the four-year term of the lease.

c. Prepare the appropriate entries related to the lease on December 31, 2021.

d. Prepare the appropriate entries related to the lease on December 31, 2023.

Here's what I was thinking but I would like to check:

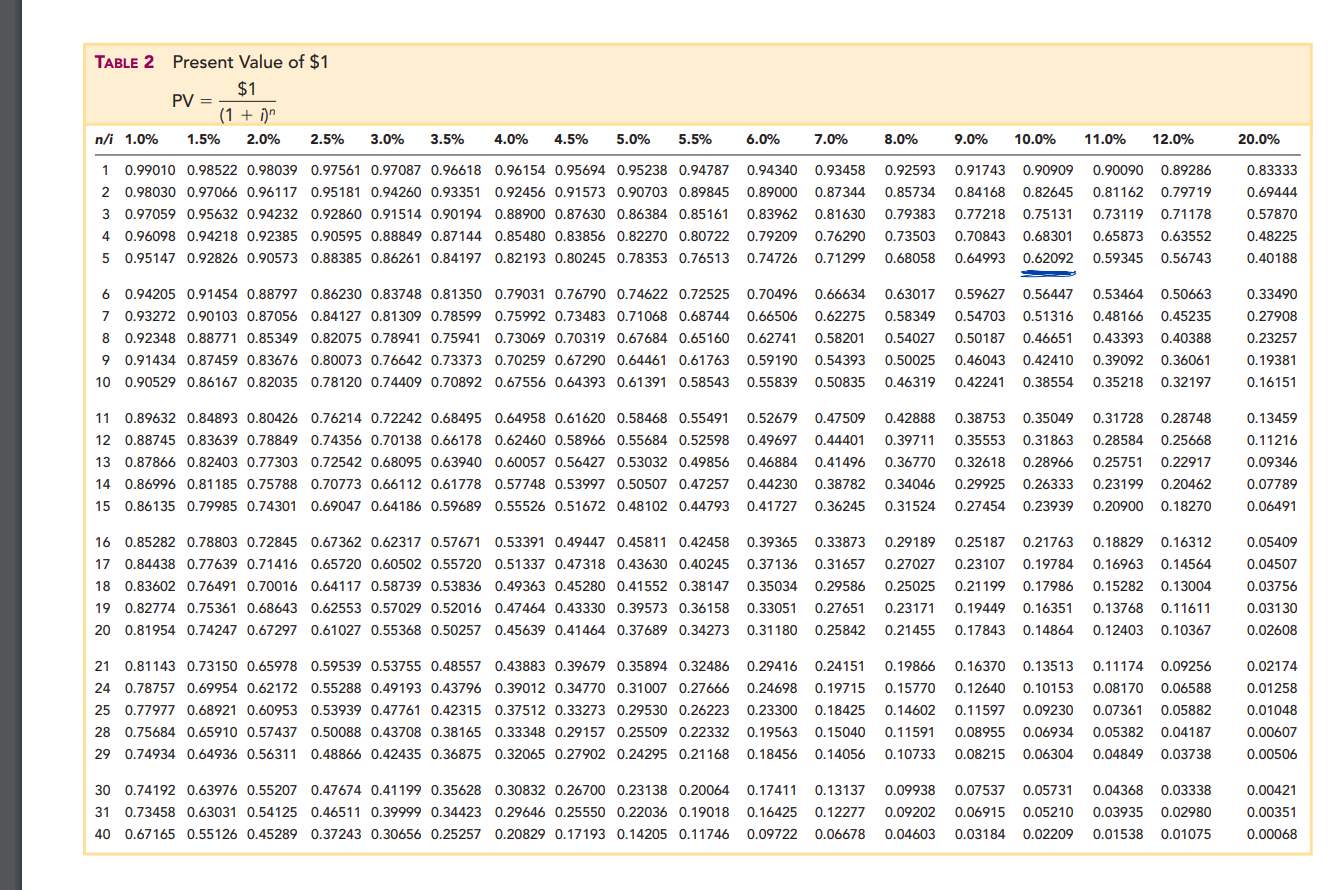

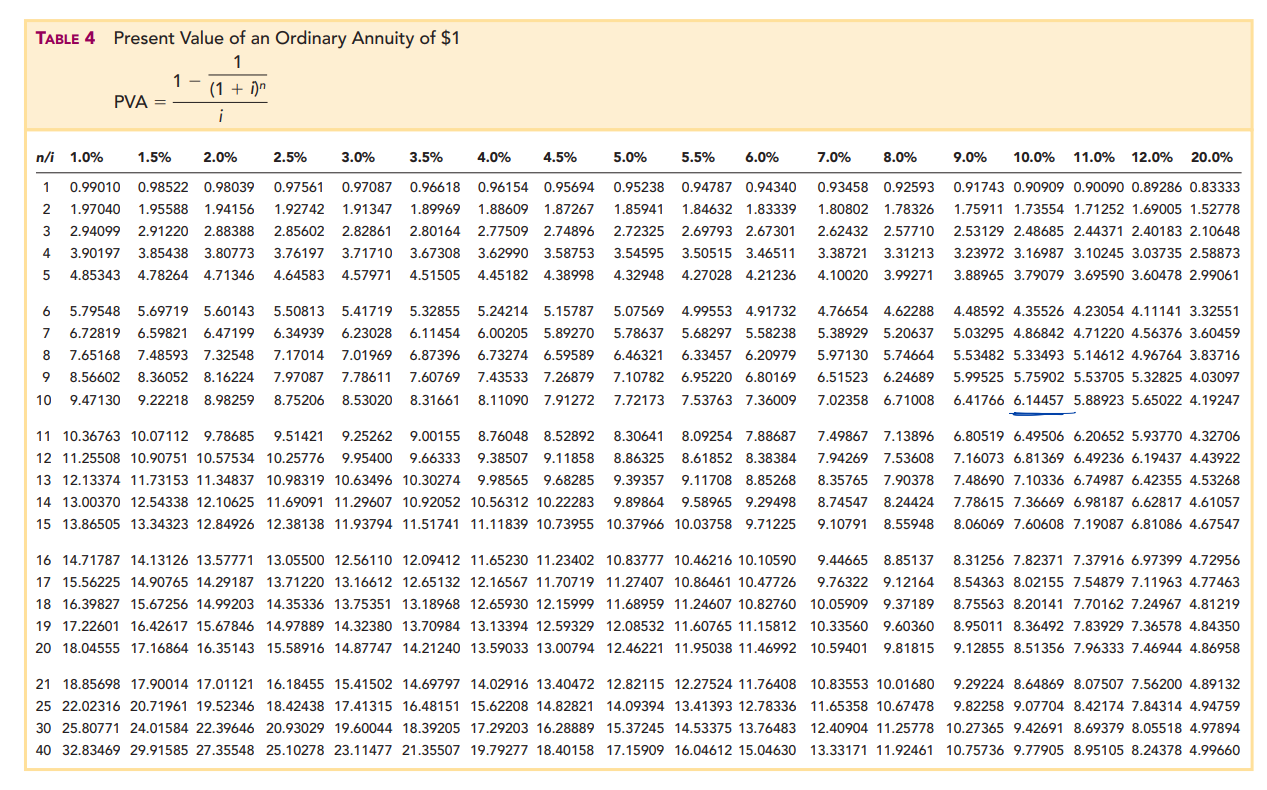

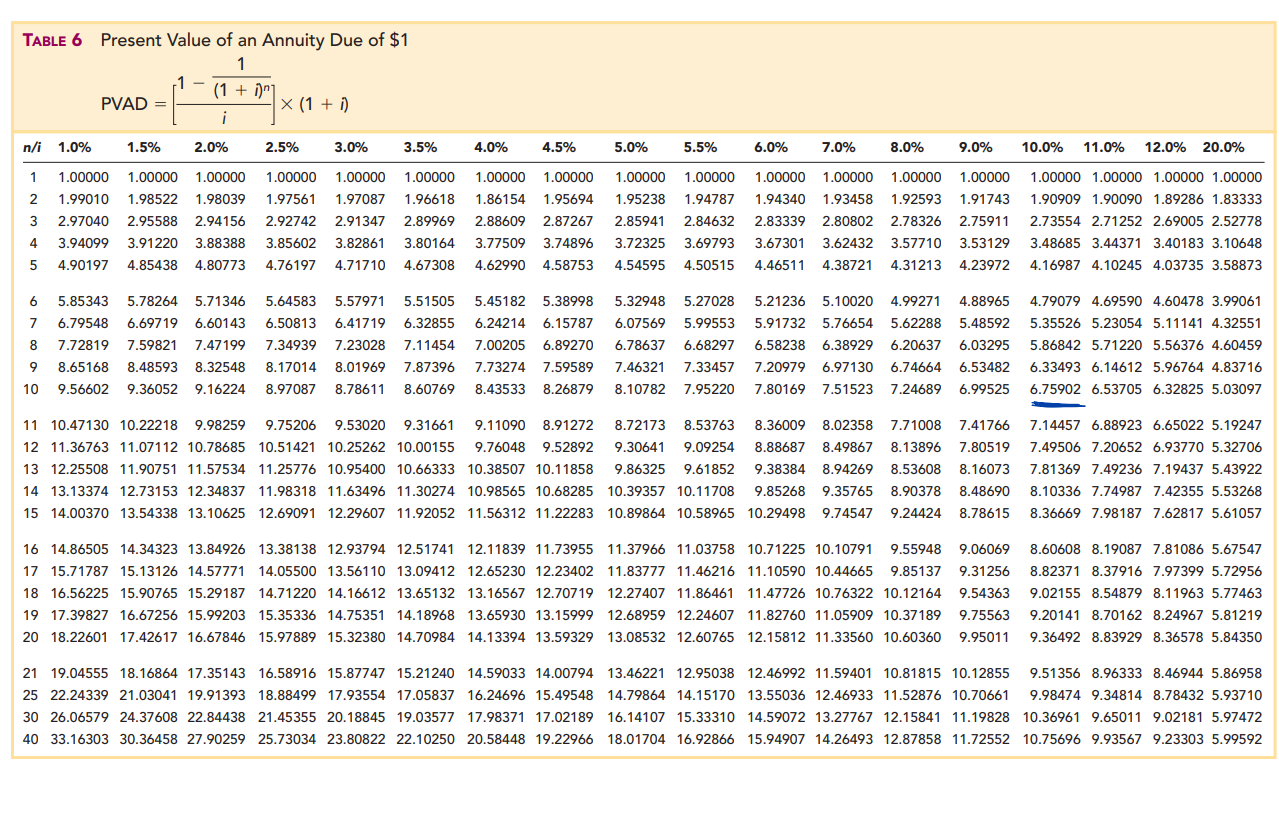

TABLE 2 Present Value of $1 ABLE 4 Present Value of an Ordinary Annuity of $1 PVA=i1(1+i)n1 ABLE 6 Present Value of an Annuity Due of $1 PVAD=:1(1+i)n1(1+i) question \#4 lesce, finance lease Pmt=1,261,881 9) 1/1/2021 (pr of lease pmto) [BouAssetleaseliability4,000,0404,000,00 c) 12/31/21 D) 12/31/23 Interest Expense 400,000 Interest Expenx 219,005 lease liasility 861,881 lease liasilith 0,042,876 cash 1,261,881 cash 1,261,881 Amartization Expense 1,000,000 Aprorticstion Exp 1,000,000 Rou Asset 1,000,000 Rou Asset 1,000,000

TABLE 2 Present Value of $1 ABLE 4 Present Value of an Ordinary Annuity of $1 PVA=i1(1+i)n1 ABLE 6 Present Value of an Annuity Due of $1 PVAD=:1(1+i)n1(1+i) question \#4 lesce, finance lease Pmt=1,261,881 9) 1/1/2021 (pr of lease pmto) [BouAssetleaseliability4,000,0404,000,00 c) 12/31/21 D) 12/31/23 Interest Expense 400,000 Interest Expenx 219,005 lease liasility 861,881 lease liasilith 0,042,876 cash 1,261,881 cash 1,261,881 Amartization Expense 1,000,000 Aprorticstion Exp 1,000,000 Rou Asset 1,000,000 Rou Asset 1,000,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started