Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Culver Inc. manufactures cycling equipment. Recently, the vice president of operations of the company has requested construction of a new plant to meet the

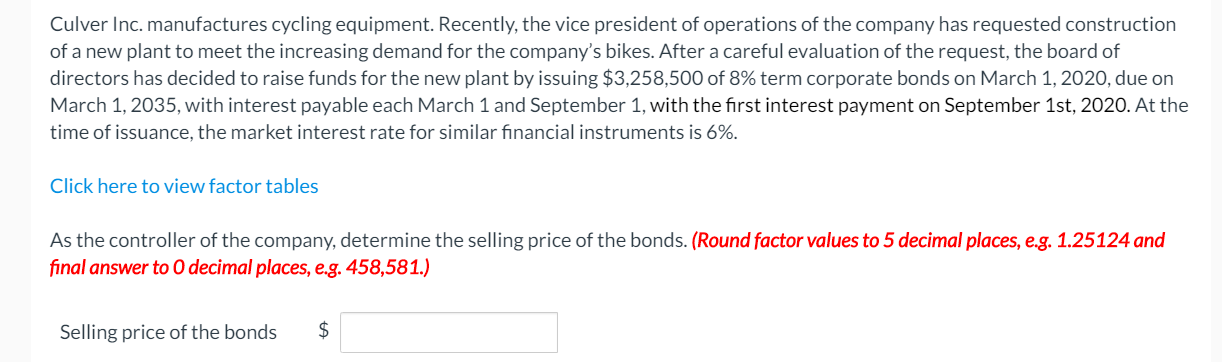

Culver Inc. manufactures cycling equipment. Recently, the vice president of operations of the company has requested construction of a new plant to meet the increasing demand for the company's bikes. After a careful evaluation of the request, the board of directors has decided to raise funds for the new plant by issuing $3,258,500 of 8% term corporate bonds on March 1, 2020, due on March 1, 2035, with interest payable each March 1 and September 1, with the first interest payment on September 1st, 2020. At the time of issuance, the market interest rate for similar financial instruments is 6%. Click here to view factor tables As the controller of the company, determine the selling price of the bonds. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,581.) Selling price of the bonds $

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Selling price of Bond 3897191 Working Bonds issue price is calculated by ADDING t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started