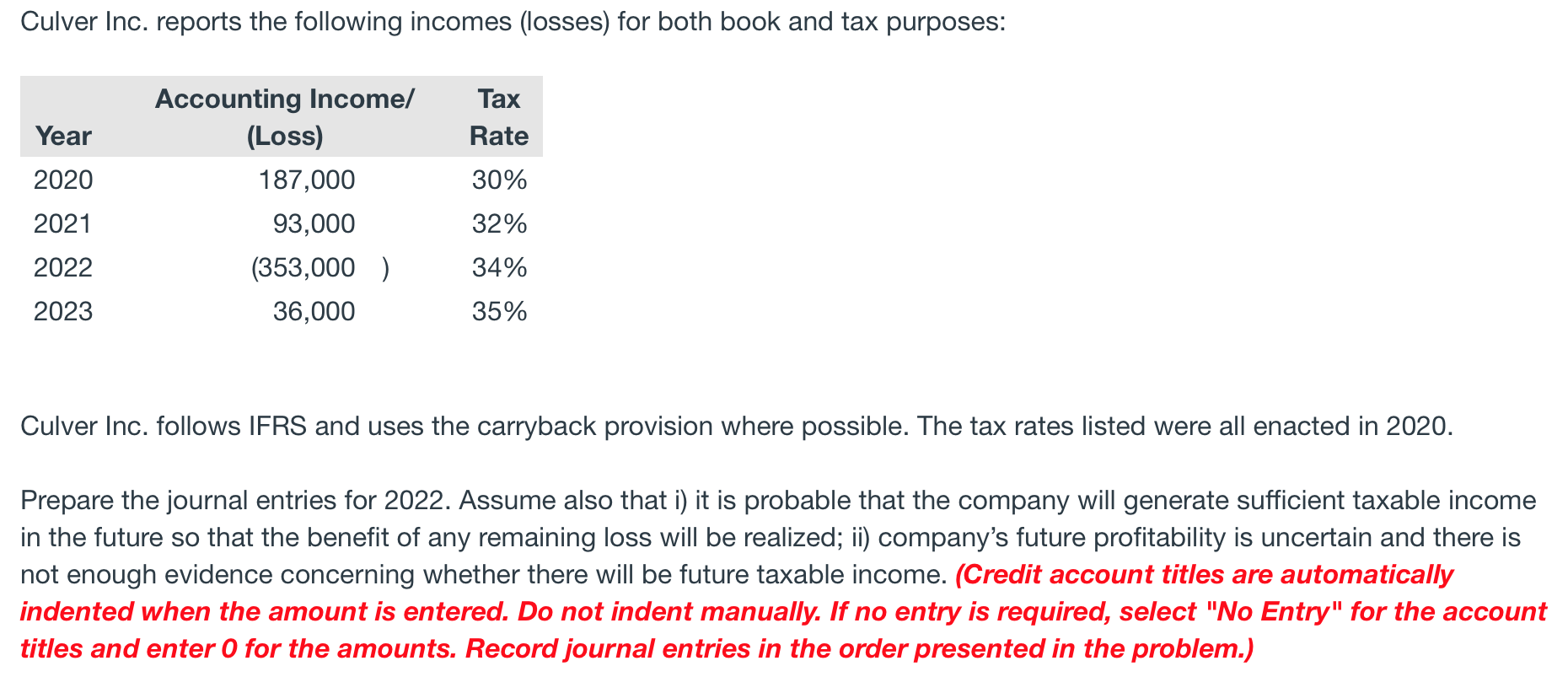

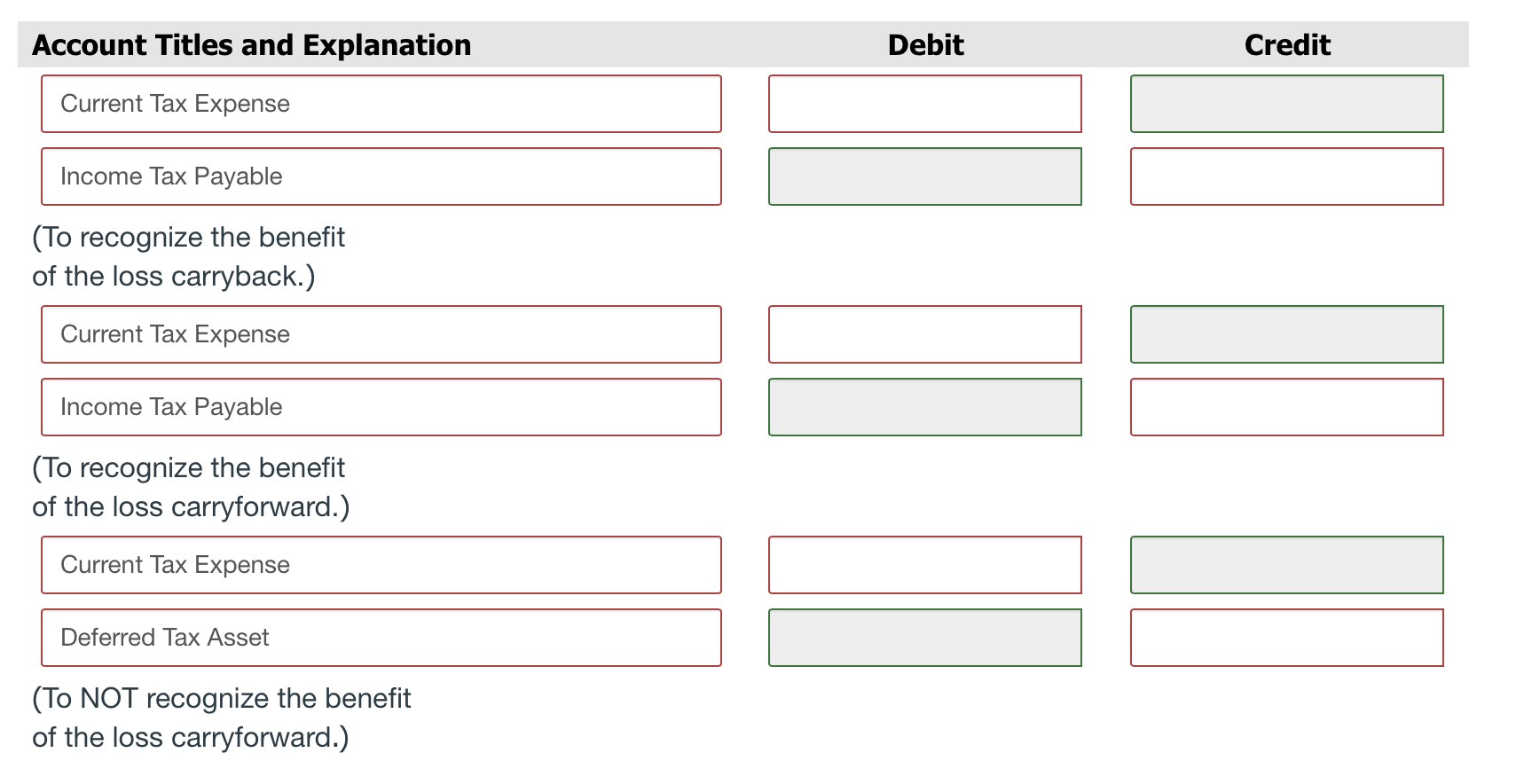

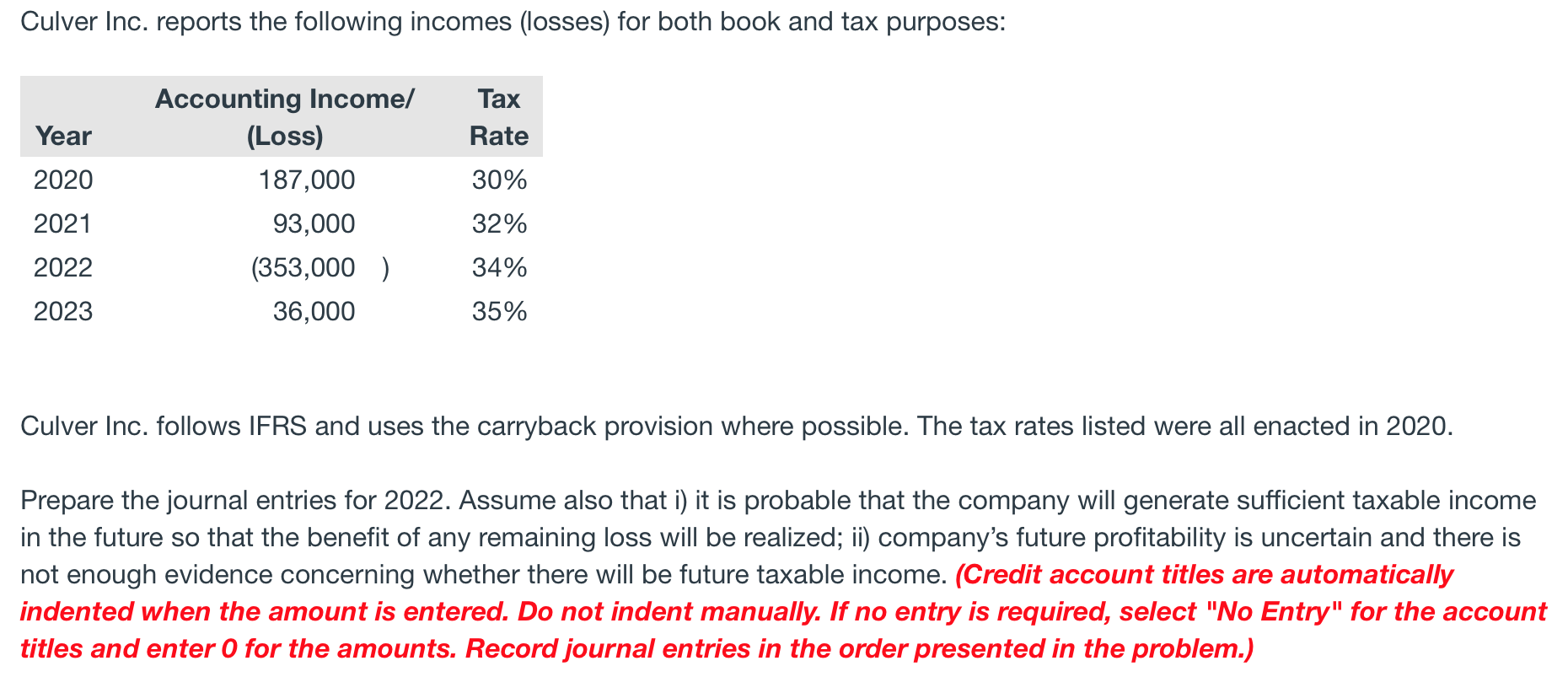

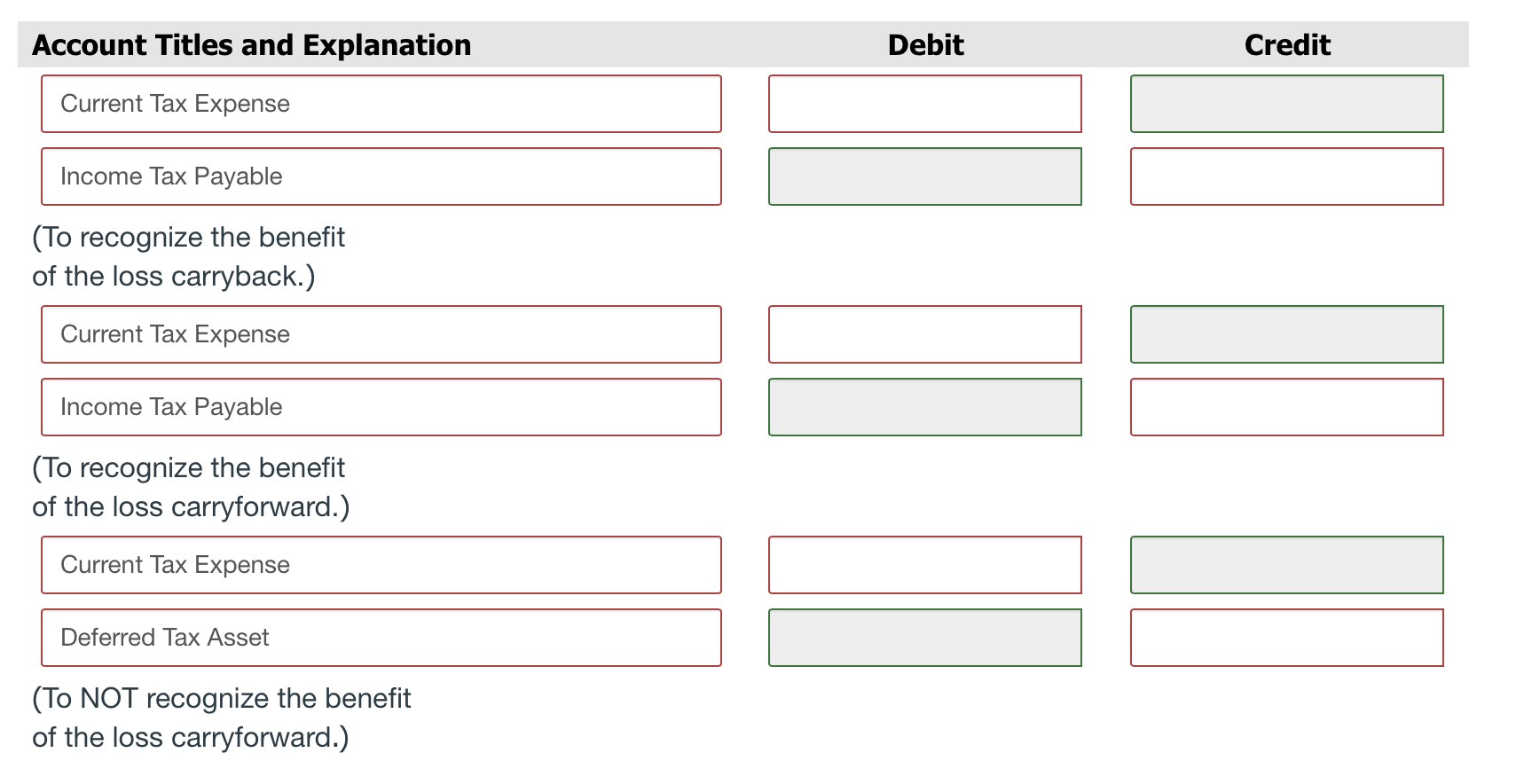

Culver Inc. reports the following incomes (losses) for both book and tax purposes: Tax Rate Year 2020 Accounting Income/ (Loss) 187,000 93,000 (353,000) 36,000 30% 32% 2021 2022 34% 2023 35% Culver Inc. follows IFRS and uses the carryback provision where possible. The tax rates listed were all enacted in 2020. Prepare the journal entries for 2022. Assume also that i) it is probable that the company will generate sufficient taxable income in the future so that the benefit of any remaining loss will be realized; ii) company's future profitability is uncertain and there is not enough evidence concerning whether there will be future taxable income. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Account Titles and Explanation Debit Credit Current Tax Expense Income Tax Payable (To recognize the benefit of the loss carryback.) Current Tax Expense Income Tax Payable (To recognize the benefit of the loss carryforward.) Current Tax Expense Deferred Tax Asset (To NOT recognize the benefit of the loss carryforward.) Culver Inc. reports the following incomes (losses) for both book and tax purposes: Tax Rate Year 2020 Accounting Income/ (Loss) 187,000 93,000 (353,000) 36,000 30% 32% 2021 2022 34% 2023 35% Culver Inc. follows IFRS and uses the carryback provision where possible. The tax rates listed were all enacted in 2020. Prepare the journal entries for 2022. Assume also that i) it is probable that the company will generate sufficient taxable income in the future so that the benefit of any remaining loss will be realized; ii) company's future profitability is uncertain and there is not enough evidence concerning whether there will be future taxable income. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Account Titles and Explanation Debit Credit Current Tax Expense Income Tax Payable (To recognize the benefit of the loss carryback.) Current Tax Expense Income Tax Payable (To recognize the benefit of the loss carryforward.) Current Tax Expense Deferred Tax Asset (To NOT recognize the benefit of the loss carryforward.)