Answered step by step

Verified Expert Solution

Question

1 Approved Answer

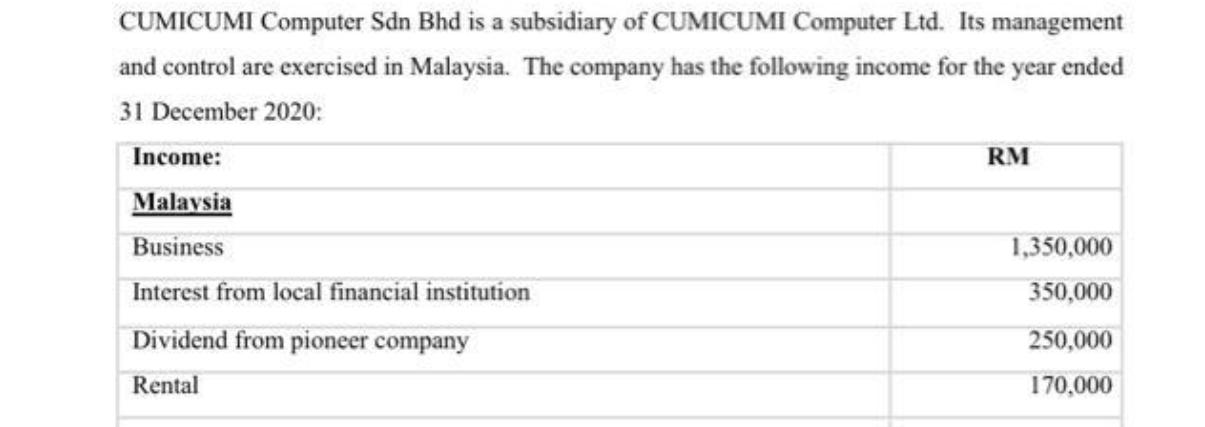

CUMICUMI Computer Sdn Bhd is a subsidiary of CUMICUMI Computer Ltd. Its management and control are exercised in Malaysia. The company has the following

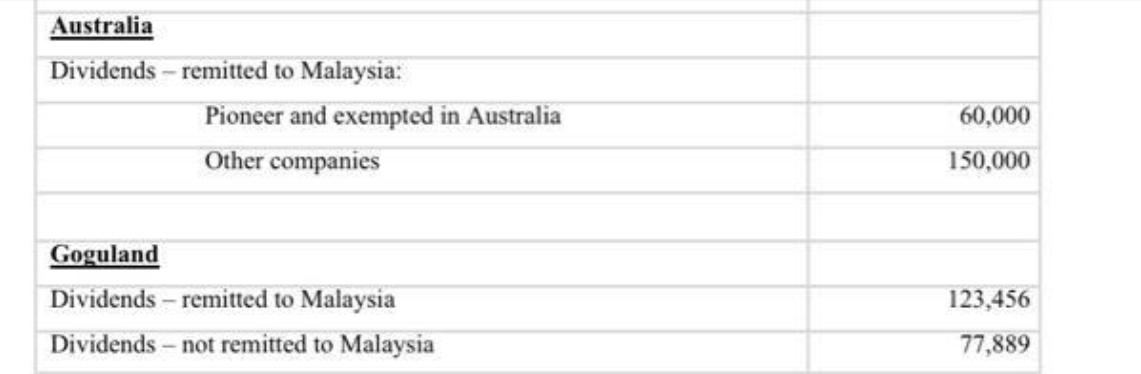

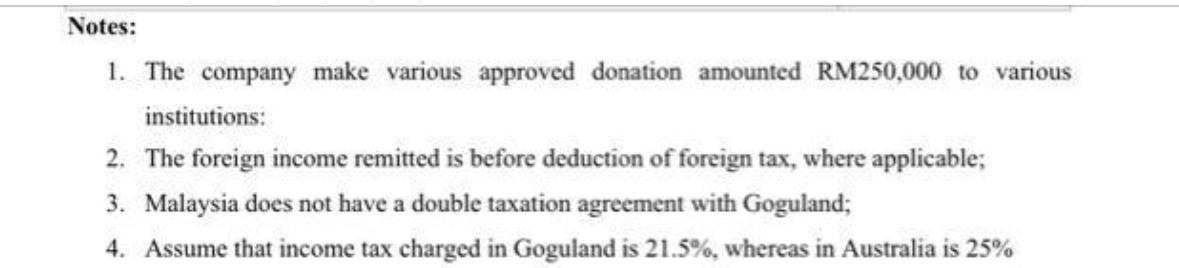

CUMICUMI Computer Sdn Bhd is a subsidiary of CUMICUMI Computer Ltd. Its management and control are exercised in Malaysia. The company has the following income for the year ended 31 December 2020: Income: Malaysia Business Interest from local financial institution Dividend from pioneer company Rental RM 1,350,000 350,000 250,000 170,000 Australia Dividends - remitted to Malaysia: Pioneer and exempted in Australia Other companies Goguland Dividends - remitted to Malaysia Dividends - not remitted to Malaysia 60,000 150,000 123,456 77,889 Notes: 1. The company make various approved donation amounted RM250,000 to various institutions: 2. The foreign income remitted is before deduction of foreign tax, where applicable; 3. Malaysia does not have a double taxation agreement with Goguland; 4. Assume that income tax charged in Goguland is 21.5%, whereas in Australia is 25% REQUIRED: Estimate income tax payable of CUMICUMI Computer Sdn Bhd for YA 2020. Notes: You are required to explain the available reliefs based on Section 132 and Section 133 of Income Tax Act 1967.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Income Tax Payable of CUMICUMI Computer Sdn Bhd for YA 2020 1 Assessable Income Source of Income Amo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started