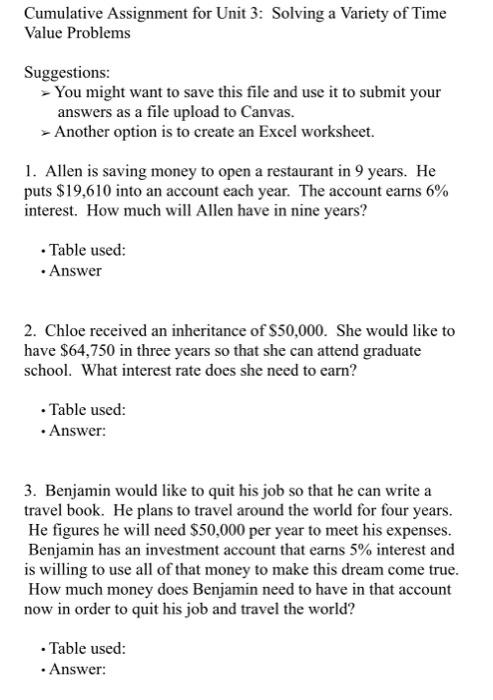

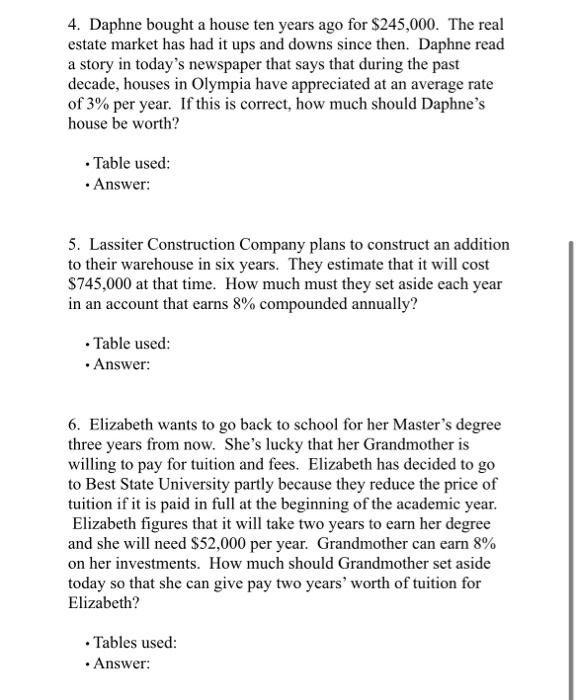

Cumulative Assignment for Unit 3: Solving a Variety of Time Value Problems Suggestions: You might want to save this file and use it to submit your answers as a file upload to Canvas. Another option is to create an Excel worksheet. 1. Allen is saving money to open a restaurant in 9 years. He puts $19,610 into an account each year. The account earns 6% interest. How much will Allen have in nine years? Table used: Answer 2. Chloe received an inheritance of $50,000. She would like to have $64,750 in three years so that she can attend graduate school. What interest rate does she need to earn? Table used: Answer: 3. Benjamin would like to quit his job so that he can write a travel book. He plans to travel around the world for four years. He figures he will need $50,000 per year to meet his expenses. Benjamin has an investment account that earns 5% interest and is willing to use all of that money to make this dream come true. How much money does Benjamin need to have in that account now in order to quit his job and travel the world? Table used: . Answer: 4. Daphne bought a house ten years ago for $245,000. The real estate market has had it ups and downs since then. Daphne read a story in today's newspaper that says that during the past decade, houses in Olympia have appreciated at an average rate of 3% per year. If this is correct, how much should Daphne's house be worth? Table used: Answer: 5. Lassiter Construction Company plans to construct an addition to their warehouse in six years. They estimate that it will cost $745,000 at that time. How much must they set aside each year in an account that earns 8% compounded annually? Table used: Answer: 6. Elizabeth wants to go back to school for her Master's degree three years from now. She's lucky that her Grandmother is willing to pay for tuition and fees. Elizabeth has decided to go to Best State University partly because they reduce the price of tuition if it is paid in full at the beginning of the academic year. Elizabeth figures that it will take two years to earn her degree and she will need $52,000 per year. Grandmother can earn 8% on her investments. How much should Grandmother set aside today so that she can give pay two years' worth of tuition for Elizabeth? Tables used: