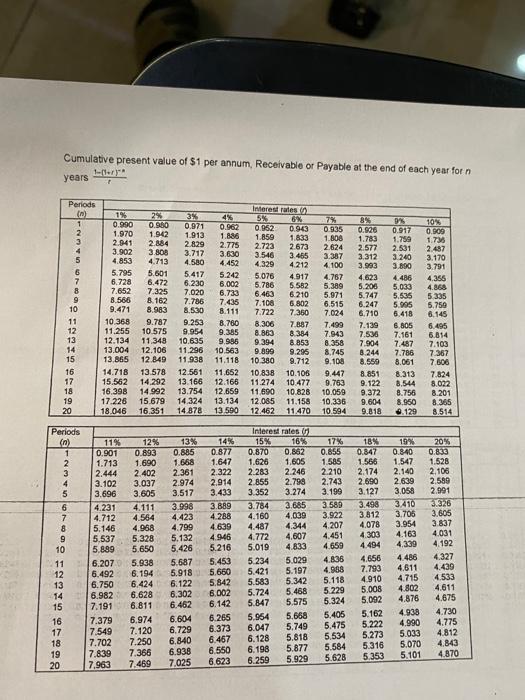

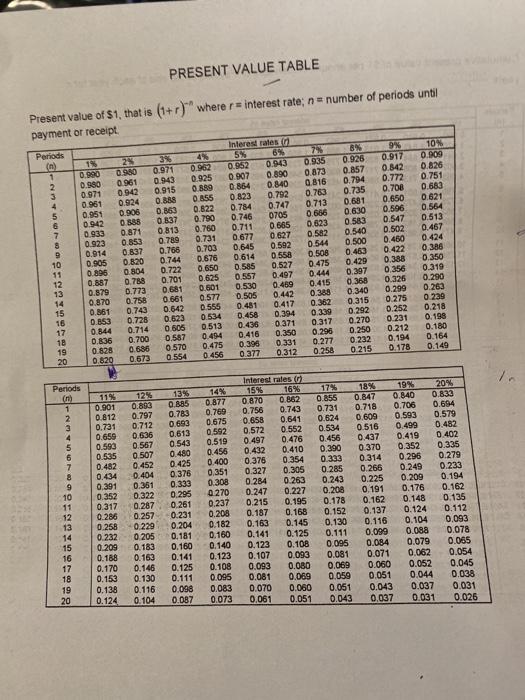

Cumulative present value of $1 per annum, Receivable or Payable at the end of each year for n years Periods (0) 1 2 3 5 7 9 10 11 12 13 14 15 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 13.865 14.718 15.562 16.398 17.226 18.046 29 0.900 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12 849 13.578 14.292 14.992 15 679 16.351 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14878 4% 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.996 10.563 11.118 11.652 12.166 12.659 13.134 13.590 Interest rates on 5% 0.962 0.943 1.859 1.833 2.723 2673 3.546 3.465 4.329 4212 5076 4.917 5.786 5.582 6.463 6.210 7.100 6802 7.722 7350 8.306 7.887 8.883 8384 9.394 8.853 9.899 9.296 10.380 9.712 10.838 10.106 11.274 10.477 11.690 10.828 12.085 11.158 12 462 11 470 7% 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8,745 9.108 9447 9.763 10.059 10.336 10.594 8% 0.926 1.783 2.577 3.312 3.983 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9955 0.917 1.759 2.531 3.240 3.890 4.486 5,033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 0.129 10% 0.509 1.735 2.487 3.170 3.791 4.356 4.868 5 335 5.750 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8,022 8.201 16 17 18 19 20 9.604 8.365 9.818 8.514 Periods (n) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 11% 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7,963 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 13% 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.452 6.604 6.729 6.840 6.938 7.025 14% 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4946 5.216 5.453 5.650 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 Interest rates 15% 16% 0.870 0.862 1.626 1.605 2.283 2.246 2.855 2.798 3.352 3.274 3.784 2.685 4.160 4.030 4.487 4.344 4.772 4,607 5.019 4.833 5.234 5.029 5.421 5.197 5.583 5.342 5.724 5.468 5.847 5.575 5.954 5.668 6.047 5.749 6.128 5.818 6.198 5.877 6.259 5.929 17% 0.855 1.585 2.210 2.743 3.199 3 589 3.922 4.207 4.451 4.659 4.836 4.988 5.118 5.229 5.324 5.405 5.475 5.534 5.584 5.628 18% 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 7.793 4.910 5,008 5,092 5.162 5.222 5.273 5.316 5.353 19% 0.840 1.547 2.140 2.639 3.058 3.410 3.706 3.954 4.163 4,339 4.486 4.611 4.715 4.802 4.876 4.938 4.990 5.033 5.070 5.101 20% 0.833 1.528 2,106 2.589 2.991 31326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.843 4870 19 20 PRESENT VALUE TABLE Present value of S1, that is (1+r) where r = interest rate; n = number of periods until payment or receipt Periods 0.962 1 2 3 4 5 6 7 19 0990 0.90 0.971 0.961 0.951 0.942 0939 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0853 0.844 0.836 0.828 0.820 0.850 0961 0.942 0924 0.906 0888 0.871 0.853 0.837 0820 0804 0.789 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0673 9 10 11 12 13 14 15 16 17 18 19 20 0.971 0.943 0.915 0.888 0.869 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0605 0.587 0 570 0554 Interest rates 53 0.952 0.943 0907 0.890 0.864 0.840 0.823 0.792 0.784 0.747 0.746 0705 0.711 0.665 0.677 0 627 0.645 0.592 0.614 0.550 0.585 0.527 0.557 0.497 0.530 0.459 0.505 0.442 0.481 0.417 0.458 0.394 0.436 0 371 0.416 0.350 0.396 0 331 0377 0.312 0.925 0.889 0855 0.822 0.790 0.760 0.731 0.703 0.675 0.650 0.625 0.601 0 577 0 555 0534 0.513 0.494 0.475 0.456 0.935 0.873 0816 0.763 0.713 0.656 0.623 0.582 0.544 0508 0 475 0.444 0.415 0.388 0.362 0329 0317 0.296 0.277 0258 0.925 0.857 0.794 0.735 0.681 0.630 0 583 0.540 0 500 0.460 0.429 0.297 0.358 0.340 0 315 0.292 0270 0.250 0 232 0215 10% 0.809 0826 0.751 0.682 0.621 0.564 0.513 0.467 0.424 0.385 0.350 0.319 0.290 0.263 0 229 0.218 0.199 0.180 0.164 0.149 0.917 0.842 0.772 0.700 0.650 0.896 0.847 0.502 0.450 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 Periods im 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 119 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 12 0.893 0.797 0.712 0.636 0.567 0507 0.452 0.404 0.351 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0270 0.237 0.208 0.162 0.160 0.140 0.123 0.108 0.095 0.083 0.073 Interest rates 15% 16% 0.870 0.862 0.756 0.743 0.658 0.641 0.572 0.552 0.497 0.476 0.432 0.410 0.376 0.354 0.327 0.305 0.284 0.263 0.247 0.227 0.215 0.195 0.187 0.168 0.163 0.145 0.141 0.123 0.108 0.107 0.093 0.093 0.080 0.081 0.069 0.070 0.060 0.061 0.051 17% 0.855 0.731 0.624 0.534 0.456 0.390 0.333 0.285 0.243 0.208 0.178 0.152 0.130 0.111 0 095 0.081 0.069 0.059 0.051 0.043 18% 0.847 0.718 0 609 0.516 0.437 0.370 0.314 0.266 0.225 0.191 0.162 0.137 0.116 0.009 0.084 0.071 0.060 0.051 0.043 0.037 19% 20% 0.840 0.833 0.706 0.694 0.593 0.579 0.499 0.482 0.419 0.402 0.352 0.335 0.296 0.279 0.249 0.233 0.209 0.194 0.176 0.162 0.148 0.125 0.124 0.112 0.104 0.093 0.088 0.078 0.079 0.065 0.062 0.054 0.052 0.045 0.044 0.038 0.037 0.031 0.031 0.026 0.125 Cumulative present value of $1 per annum, Receivable or Payable at the end of each year for n years Periods (0) 1 2 3 5 7 9 10 11 12 13 14 15 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 13.865 14.718 15.562 16.398 17.226 18.046 29 0.900 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12 849 13.578 14.292 14.992 15 679 16.351 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14878 4% 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.996 10.563 11.118 11.652 12.166 12.659 13.134 13.590 Interest rates on 5% 0.962 0.943 1.859 1.833 2.723 2673 3.546 3.465 4.329 4212 5076 4.917 5.786 5.582 6.463 6.210 7.100 6802 7.722 7350 8.306 7.887 8.883 8384 9.394 8.853 9.899 9.296 10.380 9.712 10.838 10.106 11.274 10.477 11.690 10.828 12.085 11.158 12 462 11 470 7% 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8,745 9.108 9447 9.763 10.059 10.336 10.594 8% 0.926 1.783 2.577 3.312 3.983 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9955 0.917 1.759 2.531 3.240 3.890 4.486 5,033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 0.129 10% 0.509 1.735 2.487 3.170 3.791 4.356 4.868 5 335 5.750 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8,022 8.201 16 17 18 19 20 9.604 8.365 9.818 8.514 Periods (n) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 11% 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7,963 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 13% 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.452 6.604 6.729 6.840 6.938 7.025 14% 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4946 5.216 5.453 5.650 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 Interest rates 15% 16% 0.870 0.862 1.626 1.605 2.283 2.246 2.855 2.798 3.352 3.274 3.784 2.685 4.160 4.030 4.487 4.344 4.772 4,607 5.019 4.833 5.234 5.029 5.421 5.197 5.583 5.342 5.724 5.468 5.847 5.575 5.954 5.668 6.047 5.749 6.128 5.818 6.198 5.877 6.259 5.929 17% 0.855 1.585 2.210 2.743 3.199 3 589 3.922 4.207 4.451 4.659 4.836 4.988 5.118 5.229 5.324 5.405 5.475 5.534 5.584 5.628 18% 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 7.793 4.910 5,008 5,092 5.162 5.222 5.273 5.316 5.353 19% 0.840 1.547 2.140 2.639 3.058 3.410 3.706 3.954 4.163 4,339 4.486 4.611 4.715 4.802 4.876 4.938 4.990 5.033 5.070 5.101 20% 0.833 1.528 2,106 2.589 2.991 31326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.843 4870 19 20 PRESENT VALUE TABLE Present value of S1, that is (1+r) where r = interest rate; n = number of periods until payment or receipt Periods 0.962 1 2 3 4 5 6 7 19 0990 0.90 0.971 0.961 0.951 0.942 0939 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0853 0.844 0.836 0.828 0.820 0.850 0961 0.942 0924 0.906 0888 0.871 0.853 0.837 0820 0804 0.789 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0673 9 10 11 12 13 14 15 16 17 18 19 20 0.971 0.943 0.915 0.888 0.869 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0605 0.587 0 570 0554 Interest rates 53 0.952 0.943 0907 0.890 0.864 0.840 0.823 0.792 0.784 0.747 0.746 0705 0.711 0.665 0.677 0 627 0.645 0.592 0.614 0.550 0.585 0.527 0.557 0.497 0.530 0.459 0.505 0.442 0.481 0.417 0.458 0.394 0.436 0 371 0.416 0.350 0.396 0 331 0377 0.312 0.925 0.889 0855 0.822 0.790 0.760 0.731 0.703 0.675 0.650 0.625 0.601 0 577 0 555 0534 0.513 0.494 0.475 0.456 0.935 0.873 0816 0.763 0.713 0.656 0.623 0.582 0.544 0508 0 475 0.444 0.415 0.388 0.362 0329 0317 0.296 0.277 0258 0.925 0.857 0.794 0.735 0.681 0.630 0 583 0.540 0 500 0.460 0.429 0.297 0.358 0.340 0 315 0.292 0270 0.250 0 232 0215 10% 0.809 0826 0.751 0.682 0.621 0.564 0.513 0.467 0.424 0.385 0.350 0.319 0.290 0.263 0 229 0.218 0.199 0.180 0.164 0.149 0.917 0.842 0.772 0.700 0.650 0.896 0.847 0.502 0.450 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 Periods im 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 119 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 12 0.893 0.797 0.712 0.636 0.567 0507 0.452 0.404 0.351 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0270 0.237 0.208 0.162 0.160 0.140 0.123 0.108 0.095 0.083 0.073 Interest rates 15% 16% 0.870 0.862 0.756 0.743 0.658 0.641 0.572 0.552 0.497 0.476 0.432 0.410 0.376 0.354 0.327 0.305 0.284 0.263 0.247 0.227 0.215 0.195 0.187 0.168 0.163 0.145 0.141 0.123 0.108 0.107 0.093 0.093 0.080 0.081 0.069 0.070 0.060 0.061 0.051 17% 0.855 0.731 0.624 0.534 0.456 0.390 0.333 0.285 0.243 0.208 0.178 0.152 0.130 0.111 0 095 0.081 0.069 0.059 0.051 0.043 18% 0.847 0.718 0 609 0.516 0.437 0.370 0.314 0.266 0.225 0.191 0.162 0.137 0.116 0.009 0.084 0.071 0.060 0.051 0.043 0.037 19% 20% 0.840 0.833 0.706 0.694 0.593 0.579 0.499 0.482 0.419 0.402 0.352 0.335 0.296 0.279 0.249 0.233 0.209 0.194 0.176 0.162 0.148 0.125 0.124 0.112 0.104 0.093 0.088 0.078 0.079 0.065 0.062 0.054 0.052 0.045 0.044 0.038 0.037 0.031 0.031 0.026 0.125