Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cumulative Review Problem: Chapter 7 cumulative review help. B of ltbbiint important for Surn nation for questions 20-24: lel supplemental footnote information on accounts receivable

Cumulative Review Problem: Chapter 7

cumulative review help.

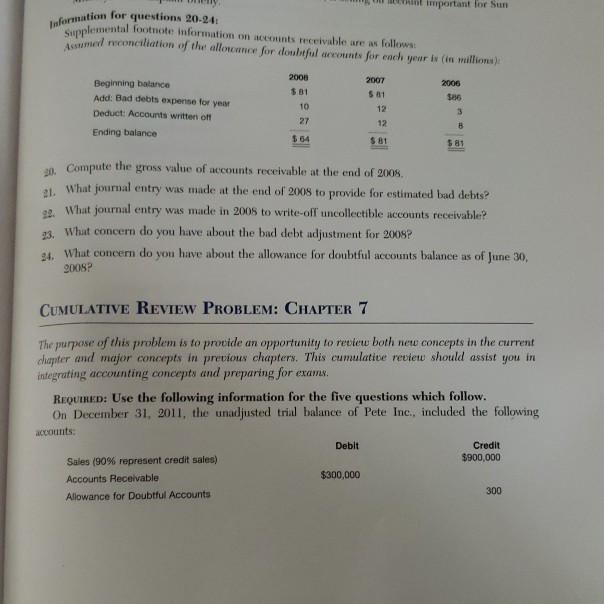

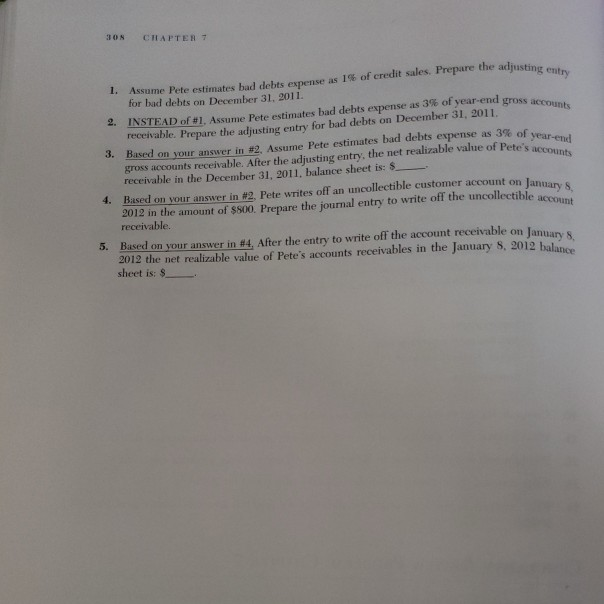

B of ltbbiint important for Surn nation for questions 20-24: lel supplemental footnote information on accounts receivable are as follows Assimed reconciliaton of the alloncance for doubtful accounts for each year is (in millions) Beginning balance Add: Bad debts expense for year Deduct: Accounts written off Ending balance 2008 $ 81 10 27 $ 64 2007 s 81 12 12 S 81 2006 386 $81 Compute the gross value of acounts receivable at the end of 2008. 21. What journal entry was made at the end of 2008 to provide for estimated bad debts? 2. What journal entry was made in 200s to write-off uncollectible accounts receivable? 23. What concern do you have about the bad debt adjustment for 2008? P4. What concern do you have about the allowance for doubtful accounts balance as of June 30, 2008? CUMULATIVE REVIEW PROBLEM: CHAPTER 7 The purpose of this problem is to provide an opportunity to revienc both nee concepts in the current dhapter and major concepts in previous chapters. This cumulative review should assist you in integrating accounting concepts and preparing for exams REQUIRED: Use the following information for the five questions which follow. On December 31, 2011, the unadjusted trial balance of Pete Inc., included the following accounts Debit Credit $900,000 Sales (90% represent credit sales) Accounts Receivable Allowance for Doubtful Accounts $300,000 300 308 CHAPTER7 Ar hund Phte estimates hd debs epense as 1% af eredt sles. Prepare the adusting entny I. Assume Pete for bad debts on December 31, 2011 INSTEAD of#1. Assume Pete estimates bad debts expense as 3% ofyear-end gross . receivable. Prepare the adjusting entry for bad debts on December 31, 2011.ts 2. nates bad debts expense as 3% of year-end s accounts 3, Based on your answer in #2, Assume Pete estim gross accounts receivable. After the adjusting entry, the net realizable value of Pete's receivable in the December 31, 2011, balance sheet is: Based on vour answer in #2. Pete writes off an uncollectible customer account on Ianuar 2012 in the amount of $$00. Prepare the journal entry to write off the uncollectible ac y S account 4. receivable. 5. Based onyour answer in #4: After the entry to write off the account receivable on Januar s 2012 the net realizable value of Pete's accounts receivables in the January S, 2012 bu sheet is: SStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started