Answered step by step

Verified Expert Solution

Question

1 Approved Answer

currencies. The investors expect annual returns in excess of ( 2 5 % ) . Although officed in London, all accounts and

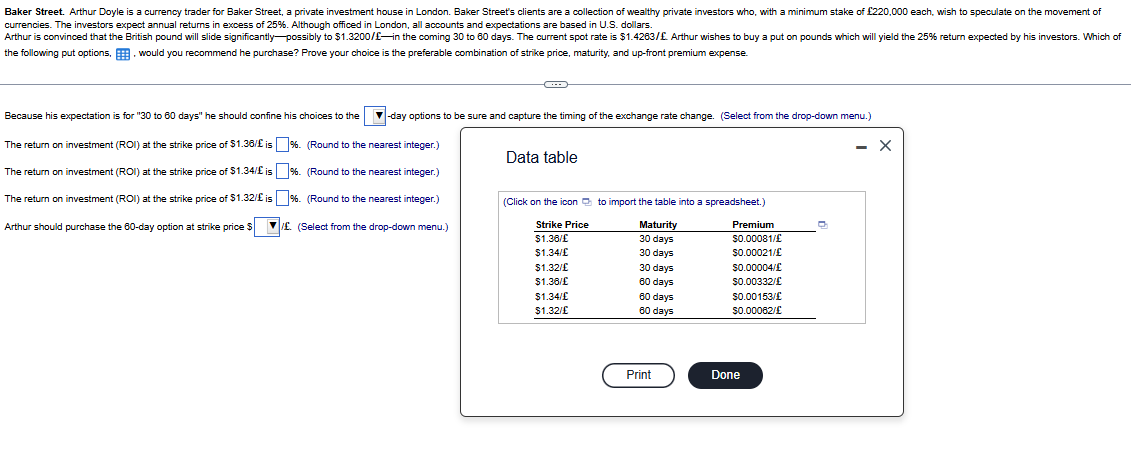

currencies. The investors expect annual returns in excess of Although officed in London, all accounts and expectations are based in US dollars. the following put options, would you recommend he purchase? Prove your choice is the preferable combination of strike price, maturity, and upfront premium expense.

Because his expectation is for to days" he should confine his choices to the day options to be sure and capture the timing of the exchange rate change. Select from the dropdown menu.

The return on investment ROI at the strike price of $ is

Round to the nearest integer.

The return on investment ROI at the strike price of $ is

Round to the nearest integer.

The return on investment ROI at the strike price of $ is

Round to the nearest integer.

Arthur should purchase the day option at strike price $ quad mid I. Select from the dropdown menu.

Data table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started