Answered step by step

Verified Expert Solution

Question

1 Approved Answer

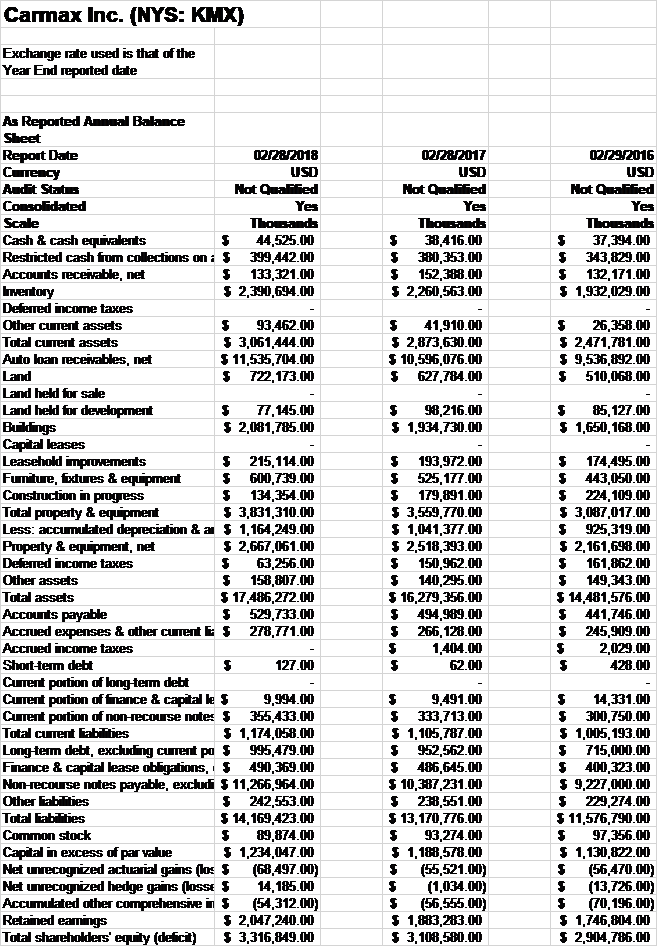

Current and historical Financial Statements (Income Statement (I/S), Balance Sheet (B/S) and Statement of Cash Flows) from the 3 most current years for the firm.

Current and historical Financial Statements (Income Statement (I/S), Balance Sheet (B/S) and Statement of Cash Flows) from the 3 most current years for the firm. The financial statements must include changes (deltas) between years, ratios from the most current and available 3 years with deltas and analysis

Canmax Inc. (NYS: KMX) Exchange rate used is that of the Restricted cash iom colecions oni5 3N442.00 $ 133,321.00 S 2,340,694.00 s 132,171.0 S 2,260,563.00 41,910.00 S 10,596,076.0O S 2471,781.00 S 3,061,444.00 $11,535,10M.00 $ 722.173.00 S510,06B.CO S2.081,785.00 S 1,650,16B.CO S 215,114.00 $193,972.00 $ 179,891.00 S1,041,3I7 CO $ 174,495.00 Fun re, xmes &eq pment S 3,831,310.00 Less: accumuated depreciaion& a 1,164.249.00 S 2,667061.00 $ 3.087,017.00 $ 925,319.00 S 2,161,68.0O $ 161,862.00 S 2,518,393.00 $15B,BOT.OO S 17486,2T2.00 S 14,481,576.00 S 441,746.00 $ 16,279,356.00 Accrued expenses & other curet E 27B,771.00 2 Cument pootion of tnance & capital le $9,994.00 Cument potion of nonHecouse notes 5 355433.00 S 1,174,05B.CO Longtem debt, exckin cuent pa 995479.00 Fnance & capital lease obigations. $ 490,369.00 NonHecourse notes payable, excki 5 11,266,964.00 $ 333,713.00 S 1,105,7B7.CO S 1,005,193.C0 $ 715,IO.OO $ 10,387,231.00 $ 9,227,00O.CO S 14,169,423.00 $89,874.00 S 1,234,47.0O Net umecogized actuarial gans [oe 5 (EB497.I0) Net umecogized hdge gans ([osst S 14,185.00 Accumuated other comprehensve i (54,312.00) $ 2,047,240.00 Total shareholders' epily (deici) ! 3,316,849.00 13,170,7T6.00 $93,274.00 S 1,188,5rB.CO S (55,521.00) $ 11,576,TSO.IO S 1,130,822.CO s (56A70.00) $(13,726.00) s (70.19600) S 1,746,8IM.CO S 3,108.58O 0O Canmax Inc. (NYS: KMX) Exchange rate used is that of the Restricted cash iom colecions oni5 3N442.00 $ 133,321.00 S 2,340,694.00 s 132,171.0 S 2,260,563.00 41,910.00 S 10,596,076.0O S 2471,781.00 S 3,061,444.00 $11,535,10M.00 $ 722.173.00 S510,06B.CO S2.081,785.00 S 1,650,16B.CO S 215,114.00 $193,972.00 $ 179,891.00 S1,041,3I7 CO $ 174,495.00 Fun re, xmes &eq pment S 3,831,310.00 Less: accumuated depreciaion& a 1,164.249.00 S 2,667061.00 $ 3.087,017.00 $ 925,319.00 S 2,161,68.0O $ 161,862.00 S 2,518,393.00 $15B,BOT.OO S 17486,2T2.00 S 14,481,576.00 S 441,746.00 $ 16,279,356.00 Accrued expenses & other curet E 27B,771.00 2 Cument pootion of tnance & capital le $9,994.00 Cument potion of nonHecouse notes 5 355433.00 S 1,174,05B.CO Longtem debt, exckin cuent pa 995479.00 Fnance & capital lease obigations. $ 490,369.00 NonHecourse notes payable, excki 5 11,266,964.00 $ 333,713.00 S 1,105,7B7.CO S 1,005,193.C0 $ 715,IO.OO $ 10,387,231.00 $ 9,227,00O.CO S 14,169,423.00 $89,874.00 S 1,234,47.0O Net umecogized actuarial gans [oe 5 (EB497.I0) Net umecogized hdge gans ([osst S 14,185.00 Accumuated other comprehensve i (54,312.00) $ 2,047,240.00 Total shareholders' epily (deici) ! 3,316,849.00 13,170,7T6.00 $93,274.00 S 1,188,5rB.CO S (55,521.00) $ 11,576,TSO.IO S 1,130,822.CO s (56A70.00) $(13,726.00) s (70.19600) S 1,746,8IM.CO S 3,108.58O 0O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started