Answered step by step

Verified Expert Solution

Question

1 Approved Answer

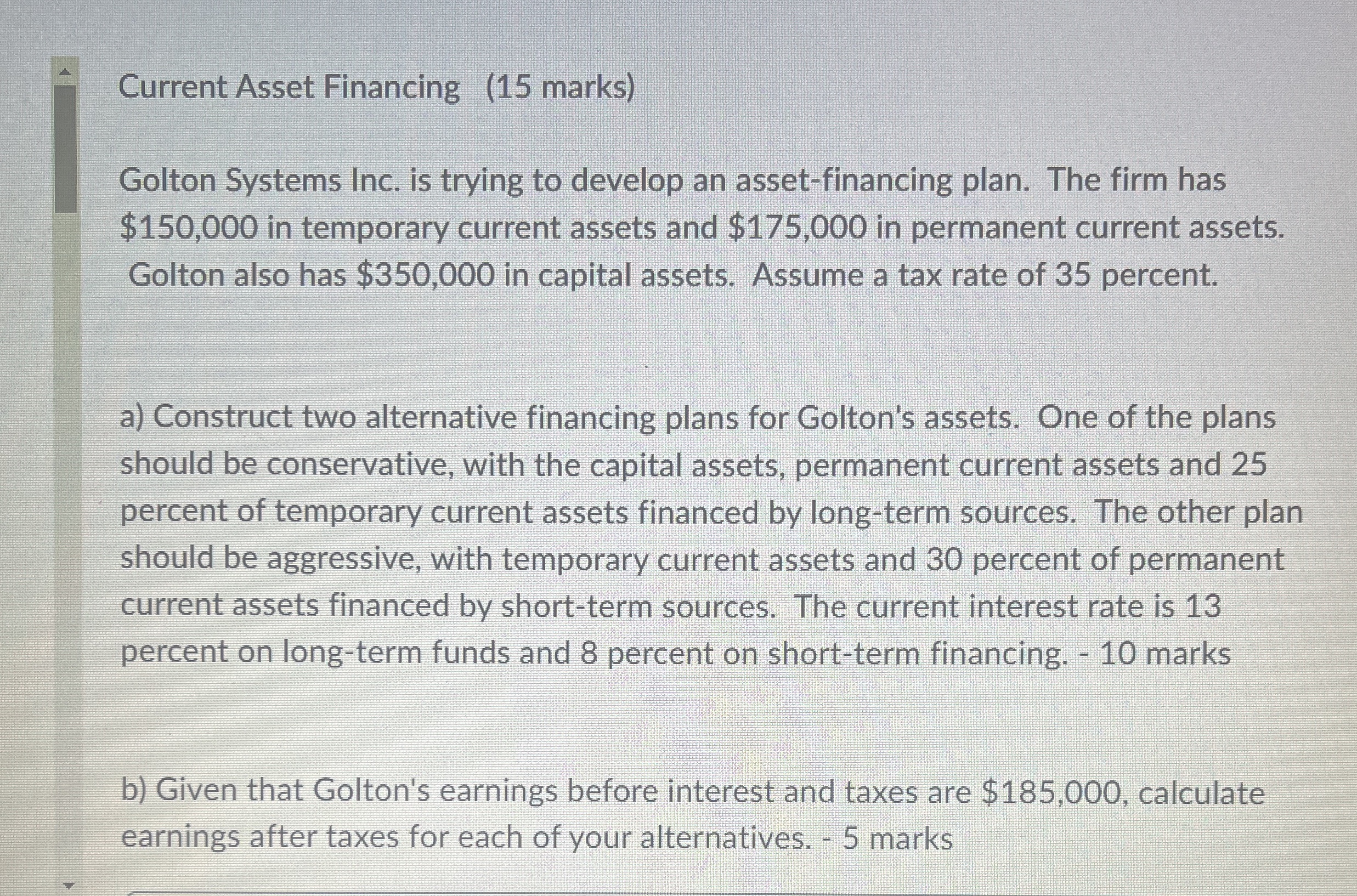

Current Asset Financing ( 1 5 marks ) Golton Systems Inc. is trying to develop an asset - financing plan. The firm has $ 1

Current Asset Financing marks

Golton Systems Inc. is trying to develop an assetfinancing plan. The firm has $ in temporary current assets and $ in permanent current assets. Golton also has $ in capital assets. Assume a tax rate of percent.

a Construct two alternative financing plans for Golton's assets. One of the plans should be conservative, with the capital assets, permanent current assets and percent of temporary current assets financed by longterm sources. The other plan should be aggressive, with temporary current assets and percent of permanent current assets financed by shortterm sources. The current interest rate is percent on longterm funds and percent on shortterm financing. marks

b Given that Golton's earnings before interest and taxes are $ calculate earnings after taxes for each of your alternatives. marksCurrent Asset Financing marks

Golton Systems Inc. is trying to develop an assetfinancing plan. The firm has $ in temporary current assets and $ in permanent current assets. Golton also has $ in capital assets. Assume a tax rate of percent.

a Construct two alternative financing plans for Golton's assets. One of the plans should be conservative, with the capital assets, permanent current assets and percent of temporary current assets financed by longterm sources. The other plan should be aggressive, with temporary current assets and percent of permanent current assets financed by shortterm sources. The current interest rate is percent on longterm funds and percent on shortterm financing. marks

b Given that Golton's earnings before interest and taxes are $ calculate earnings after taxes for each of your alternatives. marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started