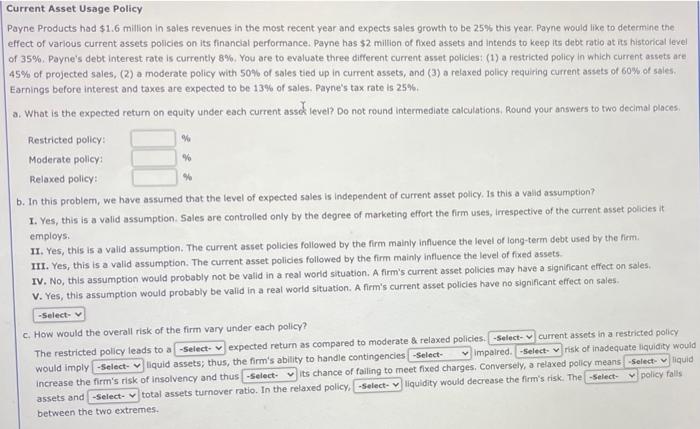

% Current Asset Usage Policy Payne Products had $1.6 million in sales revenues in the most recent year and expects sales growth to be 25% this year. Payne would like to determine the effect of various current assets policies on its financial performance. Payne has $2 million of fixed assets and intends to keep its debt ratio at its historical level of 35%. Payne's debt interest rate is currently 8%. You are to evaluate three different current asset policies (1) a restricted policy in which current assets are 45% of projected sales, (2) a moderate policy with 50% of sales tied up in current assets, and (3) a relaxed policy requiring current assets of 60% of sales, Earnings before interest and taxes are expected to be 13% of sales, Payne's tax rate is 25% a. What is the expected retum on equity under each current assek tevel? Do not round Intermediate calculations, Round your answers to two decimal places, Restricted policy: Moderate policy: Relaxed policy: b. In this problem, we have assumed that the level of expected sales is independent of current asset policy. Is this a valid assumption? 1. Yes, this is a valid assumption Sales are controlled only by the degree of marketing effort the firm uses, irrespective of the current asset policies it employs. 11. Yes, this is a valid assumption. The current asset policies followed by the firm mainly influence the level of long-term debt used by the fiem. III. Yes, this is a valid assumption. The current asset policies followed by the firm mainly influence the level of fixed assets IV. No, this assumption would probably not be valid in a real world situation. A firm's current asset policies may have a significant effect on sales, V. Yes, this assumption would probably be valid in a real world situation. A firm's current asset policies have no significant effect on sales -Select- C. How would the overall risk of the firm vary under each policy? The restricted policy leads to a -Select- expected return as compared to moderate & relaxed policies. -Select- current assets in a restricted policy would imply -Select-liquid assets; thus, the firm's ability to handle contingencies Select- impaired. -Select-risk of inadequate liquidity would increase the firm's risk of insolvency and thus -Select its chance of failing to meet fixed charges. Conversely, a relaxed policy means -Select-liquid policy falls assets and select- total assets turnover ratio. In the relaxed policy, -Select-liquidity would decrease the firm's risk. The -Select- between the two extremes