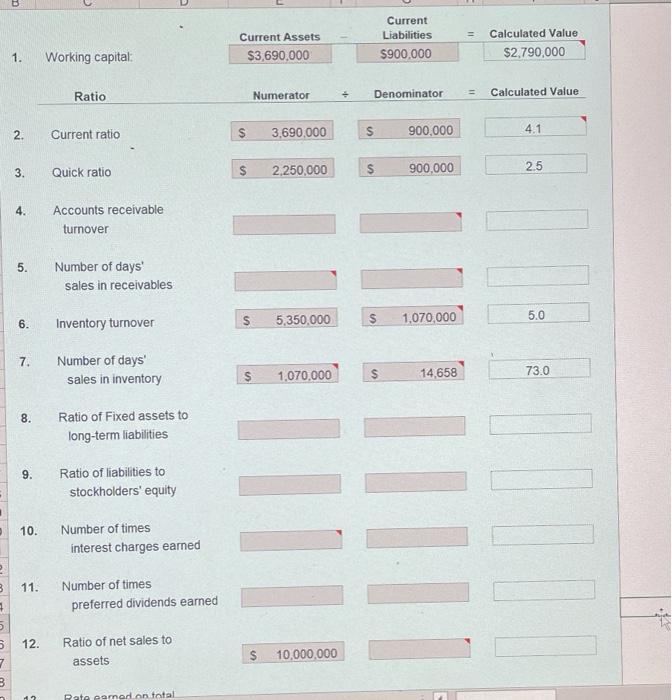

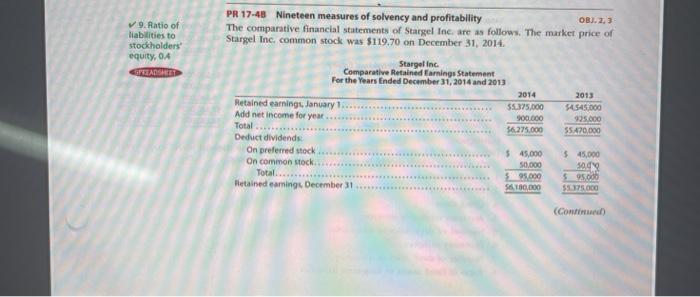

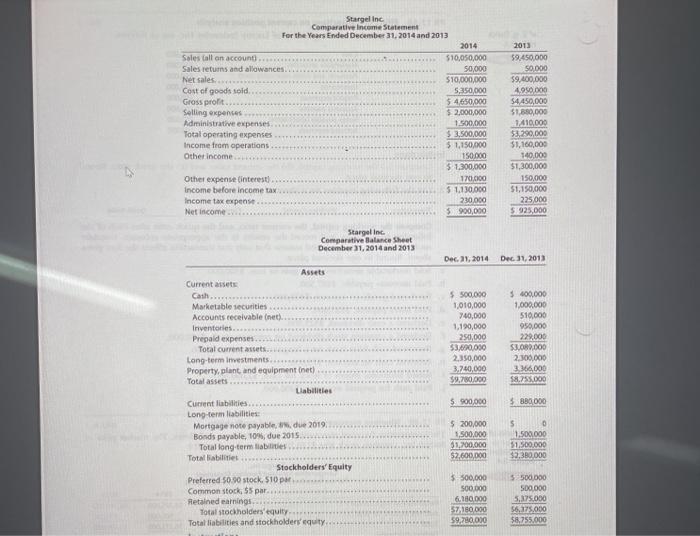

Current Assets $3,690.000 Current Liabilities $900,000 Calculated Value $2,790,000 1. Working capital Ratio Numerator Denominator Calculated Value 2. s Current ratio 3,690,000 S 4.1 900,000 3. $ Quick ratio 2,250,000 2.5 900,000 4. Accounts receivable turnover 5. Number of days sales in receivables 6. S Inventory turnover 5,350,000 5.0 1,070,000 7. Number of days' sales in inventory S 1.070,000 $ 14,658 73.0 8. Ratio of Fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity 10. Number of times interest charges eamed III 11. Number of times preferred dividends earned 12. Ratio of net sales to assets $ 10,000,000 7 3 12 Rate comedon total 9. Ratio of liabilities to stockholders equity, OA RELAGE PR 17-43 Nineteen measures of solvency and profitability OBJ. 2,3 The comparative financial statements of Stargel Inc. are as follows. The market price of Stargel Inc. common stock was $119.70 on December 31, 2014 Stargelinc Comparative Retained Earnings Statement For the Years Ended December 31, 2014 and 2013 2014 2013 Retained earnings, January 1 55.375,000 54545,000 Add net income for year 900.000 925.000 Total $6.275.000 55.420,000 Deduct dividends On preferred stock $ 45,000 $ 45,000 On common stock 50.000 5002 595.000 $95.00 Hetained earning: December 31 S180,000 Total... Conti Stargelinc Comparative Income Statement For the Year Ended December 31, 2014 and 2013 2014 Sales Call on account.. 510,050,000 Sales returns and allowances 50,000 Net sales $10,000,000 Cost of goods sold 5350,000 Gross profit. $ 4,650,000 Selling expenses $ 2,000,000 Administrative expenses 1.500.000 Total operating expenses $ 3,500,000 Income from operations $ 1,150,000 Other income 150.000 $ 1.300.000 Other expense interest 170,000 Income before income tax 5 1.130.000 Income tax expense. 230.000 Net Income $900,000 2013 59.450.000 50.000 59,400,000 4.950.000 $4,450,000 $1.550,000 7,410,000 $3,290,000 $1,100,000 140,000 $1,300,000 150,000 $1,150,000 225,000 5.925,000 Stargal Inc. Comparative Balance Sheet December 31, 2014 and 2013 Dec. 2, 2014 Dec 31, 2013 $ 500.000 1,010,000 740,000 1.190,000 250,000 33.000.000 2.350,000 3,700,000 59,780,000 $ 600.000 1.000.000 510,000 950,000 229.000 $3.000.000 2.300.000 3.366,000 $8.755.000 Assets Current assets Cash Marketable securities Accounts receivable net). Inventaries.. Prepaid expenses... Total current assets Long-term investments Property, plant and equipment inet) Total assets. Liabilities Current abilities Long term liabilities: Mortgage note payable, due 2019, Bonds payable, 10%, due 2015 Total long-term abilities Total liabilities Stockholders' Equity Preferred 50.90 stock. $10 pm Common stock, 55 par. Retained earnings Total stockholders'equity Total liabilities and stockholders' equity $ 900.000 $ 880,000 $ 200,000 1,500,000 91,700,000 $2,600,000 5 1.500.000 $1.500.000 $2,380.000 $ 500.000 500.000 6.180.000 57.150.000 59.780.000 5.500.000 500.000 5.375.000 56,375.000 $8.755.000