Answered step by step

Verified Expert Solution

Question

1 Approved Answer

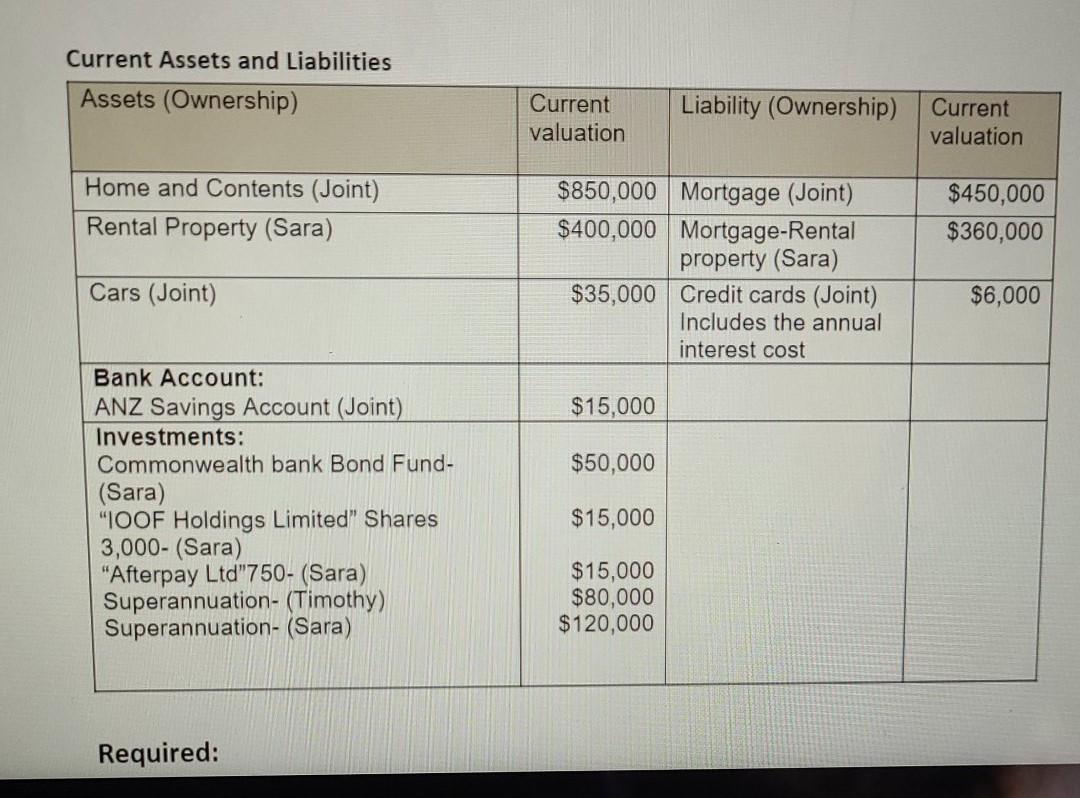

Current Assets and Liabilities Assets (Ownership) Current valuation Liability (Ownership) Current valuation Home and Contents (Joint) Rental Property (Sara) $450,000 $360,000 $850,000 Mortgage (Joint) $400,000

Current Assets and Liabilities Assets (Ownership) Current valuation Liability (Ownership) Current valuation Home and Contents (Joint) Rental Property (Sara) $450,000 $360,000 $850,000 Mortgage (Joint) $400,000 Mortgage-Rental property (Sara) $35,000 Credit cards (Joint) Includes the annual interest cost Cars (Joint) $6,000 $15,000 $50,000 Bank Account: ANZ Savings Account (Joint) Investments: Commonwealth bank Bond Fund- (Sara) "OOF Holdings Limited" Shares 3,000-(Sara) "Afterpay Ltd"750- (Sara) Superannuation- (Timothy) Superannuation- (Sara) $15,000 $15,000 $80,000 $120,000 Required: Sara's capital gains liability if she were to sell her Afterpay Ltd Shares. Assume sell her shares and advise her on a strategy she could use to minimise her pos ain. Also, show (calculation) the effect this strategy would have. Current Assets and Liabilities Assets (Ownership) Current valuation Liability (Ownership) Current valuation Home and Contents (Joint) Rental Property (Sara) $450,000 $360,000 $850,000 Mortgage (Joint) $400,000 Mortgage-Rental property (Sara) $35,000 Credit cards (Joint) Includes the annual interest cost Cars (Joint) $6,000 $15,000 $50,000 Bank Account: ANZ Savings Account (Joint) Investments: Commonwealth bank Bond Fund- (Sara) "OOF Holdings Limited" Shares 3,000-(Sara) "Afterpay Ltd"750- (Sara) Superannuation- (Timothy) Superannuation- (Sara) $15,000 $15,000 $80,000 $120,000 Required: Sara's capital gains liability if she were to sell her Afterpay Ltd Shares. Assume sell her shares and advise her on a strategy she could use to minimise her pos ain. Also, show (calculation) the effect this strategy would have

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started