Question

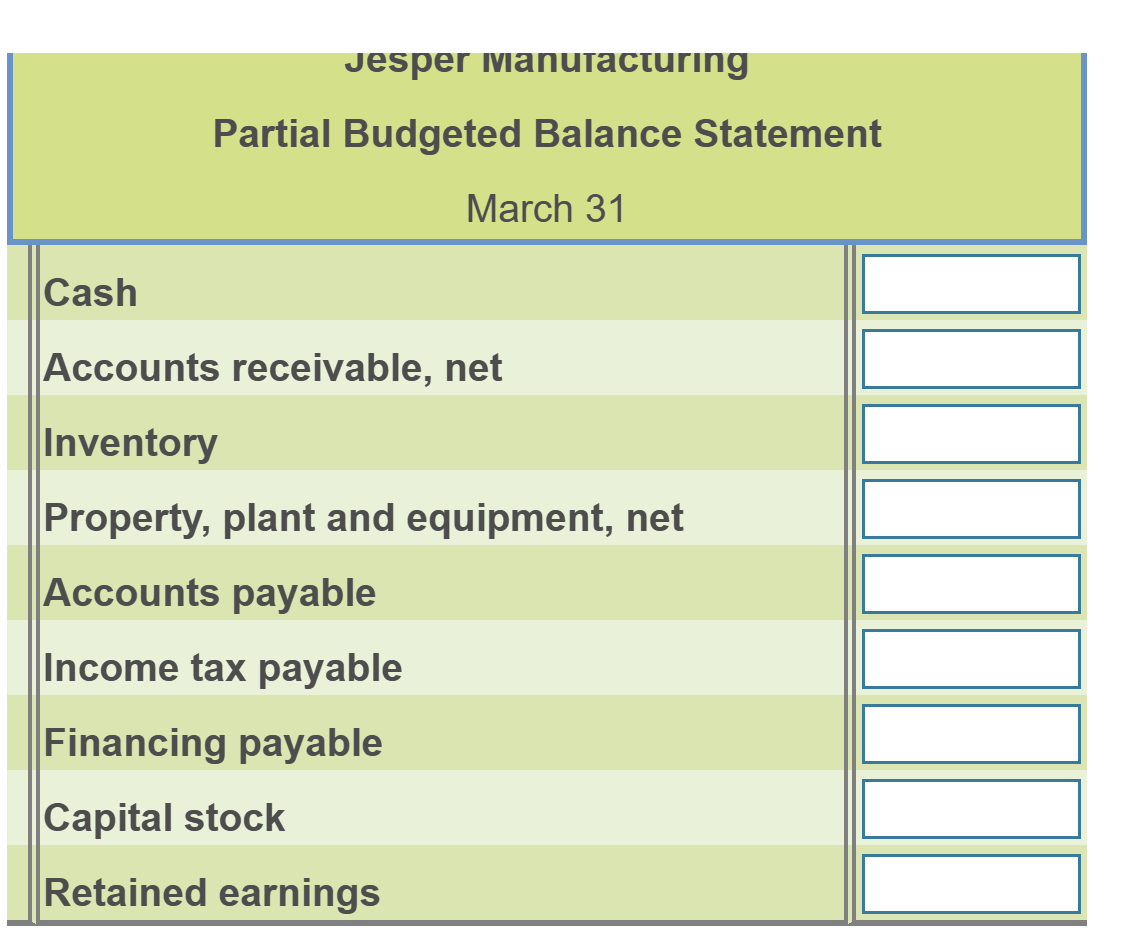

Current Assets as of December 31 (prior year): Cash. . . . . . . . . . . . . . . . .

Current Assets as of December 31 (prior year):

Cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$4,520

Accounts receivable, net. . . . . . . . . . . . .$48,000

Inventory. . . . . . . . . . . . . . . . . . . . . . . . . . .$15,200

Property, plant, and equipment, net. . . . . . . . . .$123,000

Accounts payable. . . . . . . . . . . . . . . . . . . . . . . . .$42,400

Capital stock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $125,000

Retained earnings. . . . . . . . . . . . . . . . . . . . . . . . .$22,700.

.Actual sales in December were

$72,000.

Selling price per unit is projected to remain stable at

$12

per unit throughout the budget period. Sales for the first five months of the upcoming year are budgeted to be as follows:

January. . . . . . . .

$99,600February. . . . . . .$110,400March. . . . . . . . . .$112,800April. . . . . . . . . . .$116,400May. . . . . . . . . . . .$106,800b.Sales are

20%

cash and

80%

credit. All credit sales are collected in the month following the sale.

c.Jesper

Manufacturing has a policy that states that each month's ending inventory of finished goods should be

25%

of the following month's sales (in units).

d.Of each month's direct material purchases,

20%

are paid for in the month of purchase, while the remainder is paid for in the month following purchase.

Three

kilograms of direct material is needed per unit at

$2.00/kg.

Ending inventory of direct materials should be

20%

of next month's production needs.

e.Monthly manufacturing conversion costs are

$4,000

for factory rent,

$2,900

for other fixed manufacturing expenses, and

$1.20

per unit for variable manufacturing overhead. No depreciation is included in these figures. All expenses are paid in the month in which they are incurred.

f.Computer equipment for the administrative offices will be purchased in the upcoming quarter. In January,

Jesper

Manufacturing will purchase equipment for

$6,200

(cash), while February's cash expenditure will be

$12,000

and March's cash expenditure will be

$16,800.

g.Operating expenses are budgeted to be

$1.10

per unit sold plus fixed operating expenses of

$1,400

per month. All operating expenses are paid in the month in which they are incurred.

h.Depreciation on the building and equipment for the general and administrative offices is budgeted to be

$5,400

for the entire quarter, which includes depreciation on new acquisitions.

i.Jesper

Manufacturing has a policy that the ending cash balance in each month must be at least

$4,800.

It has a line of credit with a local bank. The company can borrow in increments of

$1,000

at the beginning of each month, up to a total outstanding loan balance of

$140,000.

The interest rate on these loans is

2%

per month simple interest (not compounded).

Jesper

Manufacturing pays down on the line of credit balance if it has excess funds at the end of the quarter. The company also pays the accumulated interest at the end of the quarter on the funds borrowed during the quarter.

j.The company's income tax rate is projected to be 30% of operating income less interest expense. The company pays

$11,000

cash at the end of February in estimated taxes.

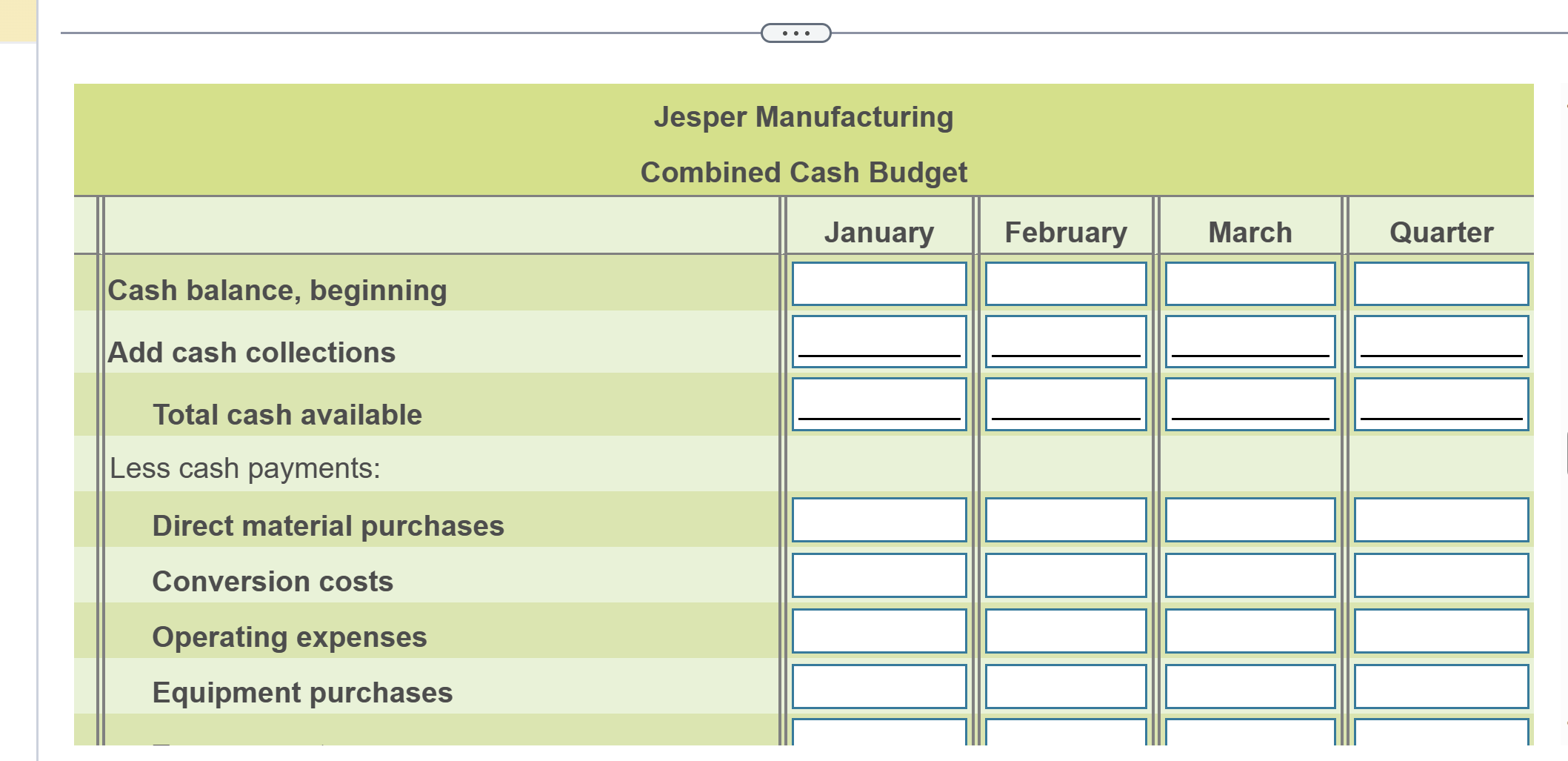

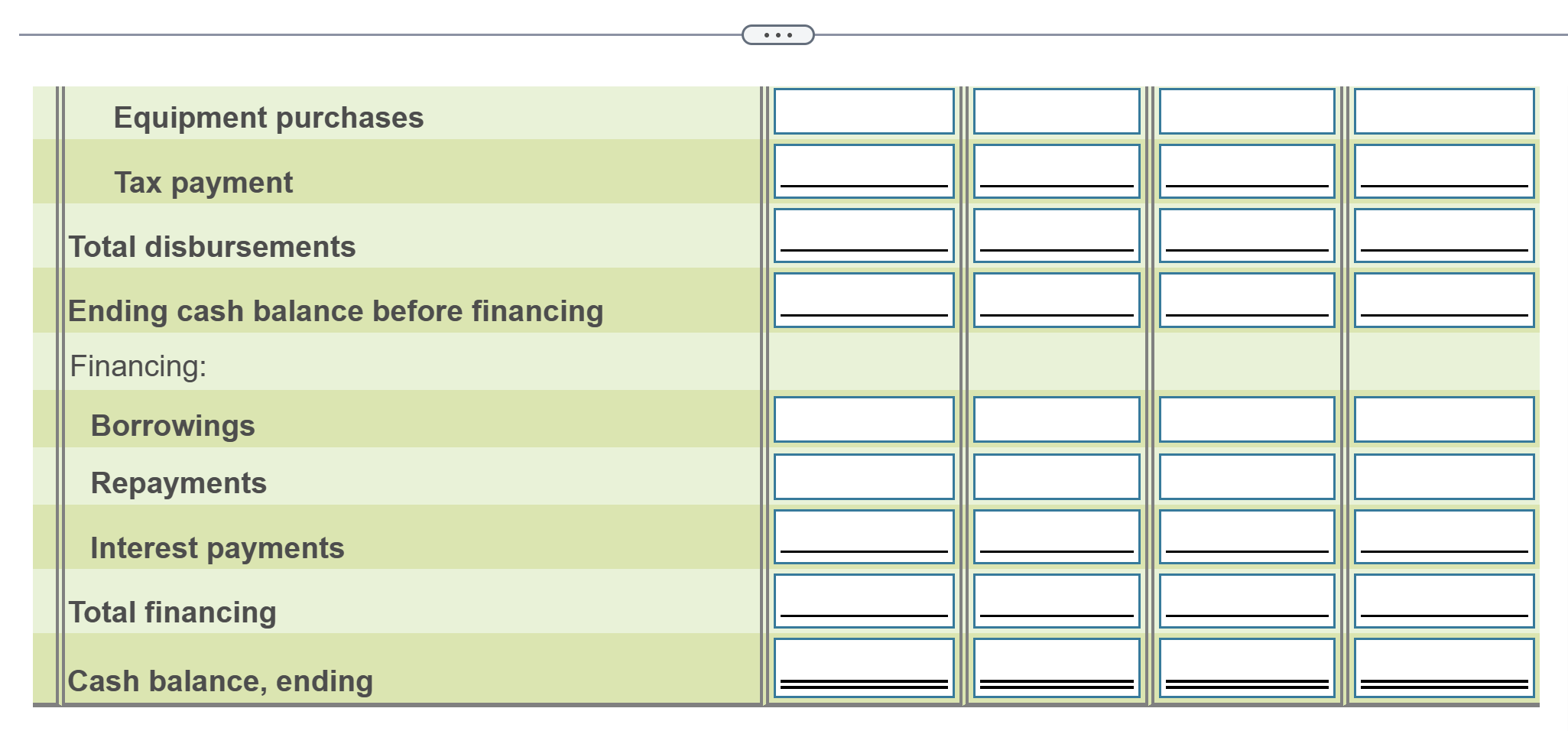

Jesper Manufacturing Combined Cash Budget Total cash available Convect material purchases Cosersion costs Operating expenses Equipment purchases Equipment purchases Tax payment Total disbursements Ending cash balance before financing Financing: Borrowings Repayments Interest payments Total financing Cash balance, ending Jesper Manufacturing Combined Cash Budget Total cash available Convect material purchases Cosersion costs Operating expenses Equipment purchases Equipment purchases Tax payment Total disbursements Ending cash balance before financing Financing: Borrowings Repayments Interest payments Total financing Cash balance, ending

Jesper Manufacturing Combined Cash Budget Total cash available Convect material purchases Cosersion costs Operating expenses Equipment purchases Equipment purchases Tax payment Total disbursements Ending cash balance before financing Financing: Borrowings Repayments Interest payments Total financing Cash balance, ending Jesper Manufacturing Combined Cash Budget Total cash available Convect material purchases Cosersion costs Operating expenses Equipment purchases Equipment purchases Tax payment Total disbursements Ending cash balance before financing Financing: Borrowings Repayments Interest payments Total financing Cash balance, ending Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started