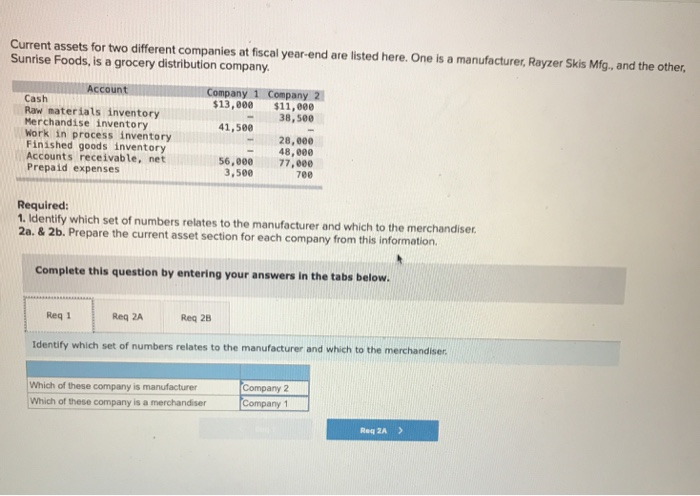

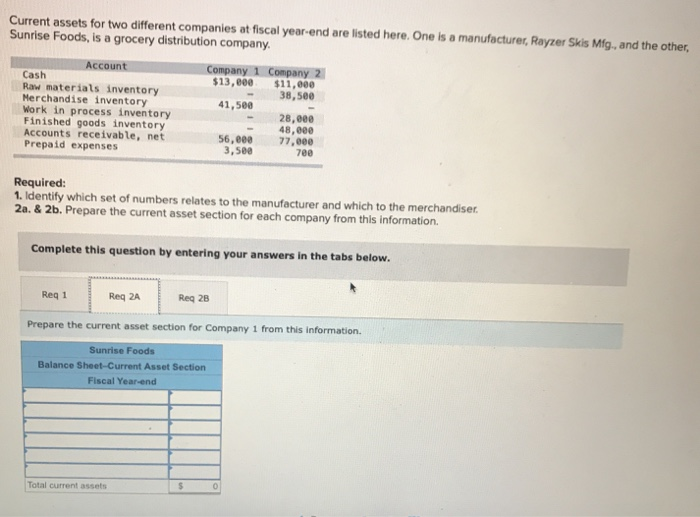

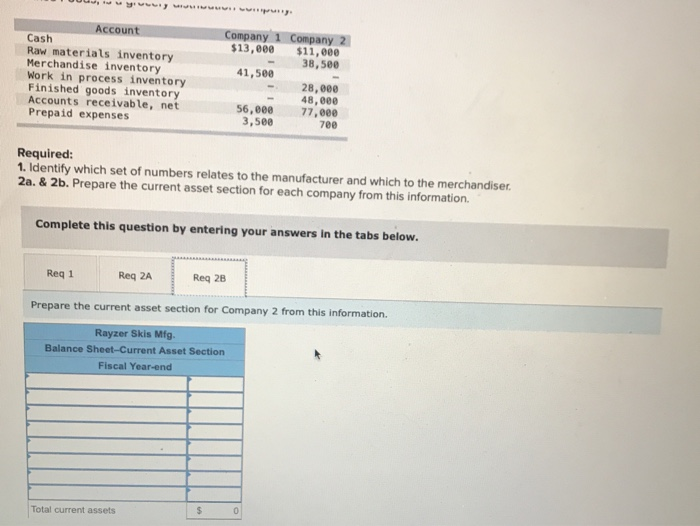

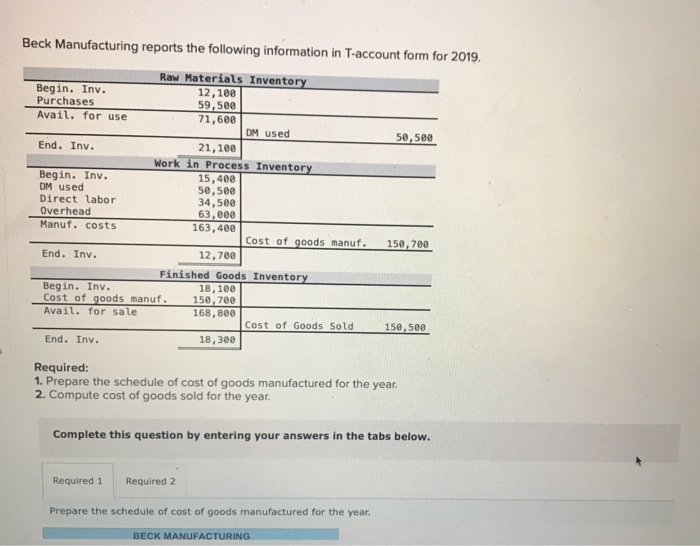

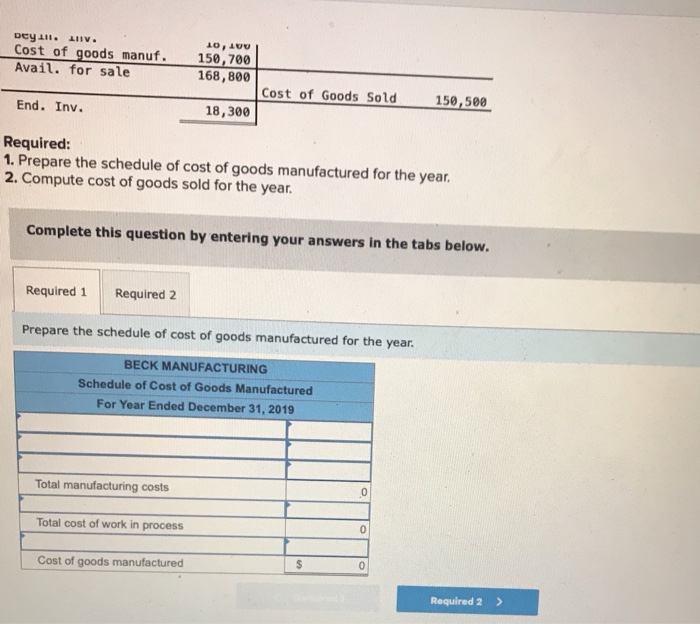

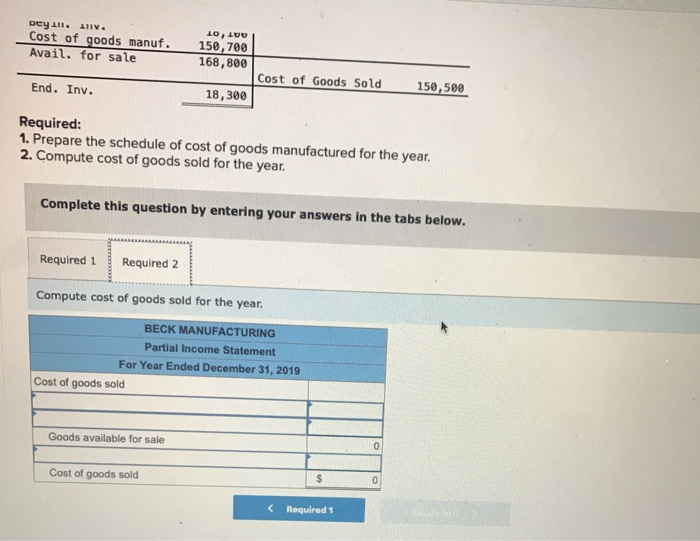

Current assets for two different companies at fiscal year-end are listed here. One is a manufacturer, Rayzer Skis Mfg., and the other. Sunrise Foods, is a grocery distribution company. Account Cash Raw materials inventory Merchandise inventory Work in process inventory Finished goods inventory Accounts receivable, net Prepaid expenses Company 1 Company 2 $13,000 $11,000 38,500 41,500 28,000 48,000 56,000 77,000 3,500 700 Required: 1. Identify which set of numbers relates to the manufacturer and which to the merchandiser 2a. & 2b. Prepare the current asset section for each company from this information Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Identify which set of numbers relates to the manufacturer and which to the merchandiser Which of these company is manufacturer Which of these company is a merchandiser Company 2 Company 1 Req2A > Current assets for two different companies at fiscal year-end are listed here. One is a manufacturer, Rayzer Skis Mfg., and the other, Sunrise Foods, is a grocery distribution company. Account Cash Raw materials inventory Merchandise inventory Work in process inventory Finished goods inventory Accounts receivable, net Prepaid expenses Company 1 Company 2 $13,000 $11,000 38,500 41,500 28. eee 48,000 56,000 77,000 3. See 700 Required: 1. Identify which set of numbers relates to the manufacturer and which to the merchandiser. 2a. & 2b. Prepare the current asset section for each company from this information Complete this question by entering your answers in the tabs below. Req1 Reg 2A Reg 28 Prepare the current asset section for Company 1 from this information Sunrise Foods Balance Sheet-Current Asset Section Fiscal Year-end Total current assets I UUUUUUUU Account Cash Raw materials inventory Merchandise inventory Work in process inventory Finished goods inventory Accounts receivable, net Prepaid expenses Company 1 Company 2 $13,000 $11,000 38,500 41,500 28,000 48,000 56,000 77,000 3,500 700 Required: 1. Identify which set of numbers relates to the manufacturer and which to the merchandiser 2a. & 2b. Prepare the current asset section for each company from this information Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Reg 28 Prepare the current asset section for Company 2 from this information. Rayzer Skis Mfg. Balance Sheet-Current Asset Section Total current assets Beck Manufacturing reports the following information in T-account form for 2019. 50,500 Raw Materials Inventory Begin. Inv. 12,100 Purchases 59,500 Avail. for use 71,600 DM used End. Inv. 21,100 Work in Process Inventory Begin. Inv. 15,400 DM used 50,500 Direct labor 34,500 Overhead 63,eee Manuf. costs 163,400 Cost of goods manuf. End. Inv. 12,700 Finished Goods Inventory Begin. Inv. 18,100 Cost of goods manuf. 150,700 Avail. for sale 168,800 Cost of Goods Sold End. Inv. 18,300 150,700 150,500 Required: 1. Prepare the schedule of cost of goods manufactured for the year. 2. Compute cost of goods sold for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the schedule of cost of goods manufactured for the year. BECK MANUFACTURING 10, AU Dey 111. 11. Cost of goods manuf. Avail. for sale 150,700 168,800 Cost of Goods Sold 150,500 End. Inv. 18,300 Required: 1. Prepare the schedule of cost of goods manufactured for the year, 2. Compute cost of goods sold for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the schedule of cost of goods manufactured for the year. BECK MANUFACTURING Schedule of Cost of Goods Manufactured For Year Ended December 31, 2019 Total manufacturing costs Total cost of work in process Cost of goods manufactured Required 2 > Dey 11. IV. Cost of goods manuf. 150,700 Cost of Goods Sold 150,500 End. Inv. 18,300 Required: 1. Prepare the schedule of cost of goods manufactured for the year. 2. Compute cost of goods sold for the year. Required 1 Required 2 Compute cost of goods sold for the year. BECK MANUFACTURING Partial Income Statement For Year Ended December 31, 2019 Cost of goods sold Goods available for sale Cost of goods sold