Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress After assessing the credit risk characteristics of its accounts receivable, a company determined that the length of time a receivable was

Current Attempt in Progress

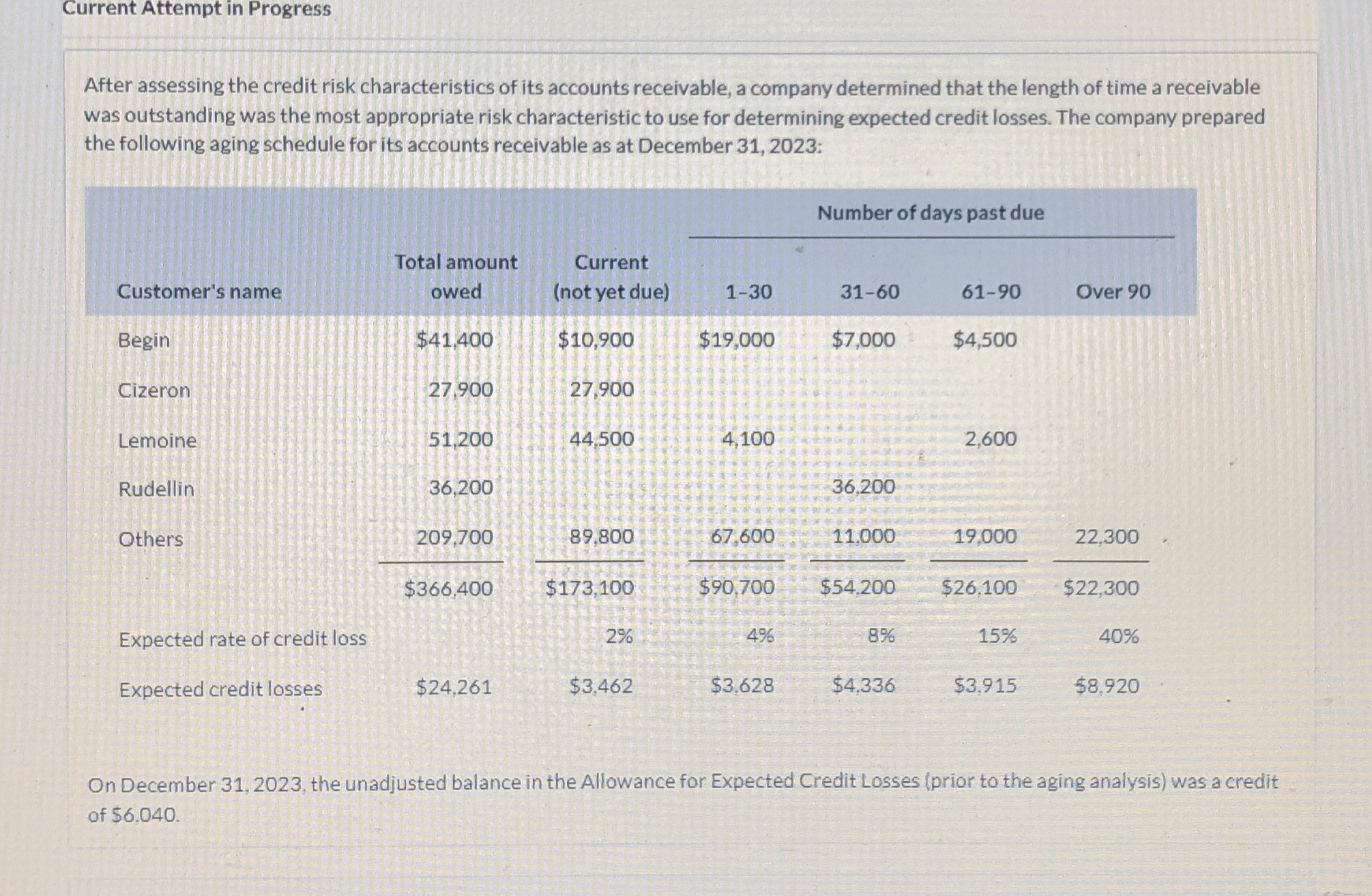

After assessing the credit risk characteristics of its accounts receivable, a company determined that the length of time a receivable was outstanding was the most appropriate risk characteristic to use for determining expected credit losses. The company prepared the following aging schedule for its accounts receivable as at December :

tableCustomers name,tableTotal amountowedtableCurrentnot yet dueNumber of days past dueOver Begin$$$$$CizeronLemoineRudellinOthers$$$$$$

a Journalize the adjusting entry to record the expected credit losses on December

b Journalize the following selected events and trasanctions in

i On April a $ customer account that originated in is judged uncollectible.

ii On September a $ cheque is received from the customer whose account was written oof as uncollectible on April

C Journalize the adjusted entry for credit losses on December Assuming that the undjusted balance in Allowance for Expected Credit Losses at that time is a debit of $ and an aging schedule prepared at the date indicates that the expected credit losses will be $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started