Answered step by step

Verified Expert Solution

Question

1 Approved Answer

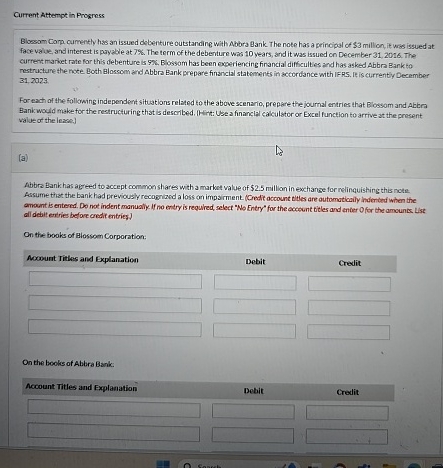

Current Attempt in Progress Blossom Comp cumently has an issued debenture outstanding with Abbra Bank The note has a principal of $ 3 million, it

Current Attempt in Progress

Blossom Comp cumently has an issued debenture outstanding with Abbra Bank The note has a principal of $ million, it was issued at

face value, and interest is payable at The term of the debenture was years, and it was issued on December The

curnent market rate for this debenture is Blossom has been exoeriencing financial diffculties and has asked Abbra Bank to

nestructure the note Both Blossom and Abbra Bank prepare financial statoments in accordance with IFRS. IE is currently December

For each of the following independent situations related to the above scenario, prepare the journal entries that Biossom and Abben

Bank would make for the restructuring that is described. Ilirt: Use a financial calculstor or Excel function to arrive at the prosent

value of the lease

a

Abbrs Eank has agreed to accept common shares with a market value of $ million in exchange for relinquishing this note

Aasume that the bank had previously recognizad a loss an impsirment. Credit account tilles are automaticaily inderibed when the

amount is entered. De not indent manually. If no entry is requhed, select No Entry" for the aceount titles and enter Ofor the amounts. List

all debit erinies before credit entries.

On the books of Blossom Corporation:

Acount Tithes and Explanation

Debit

Credit

On the books of Abbra Bank.

Account Titles and Explanation

Debit

Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started