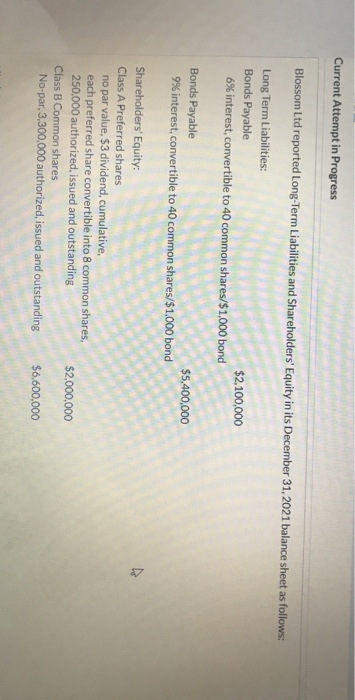

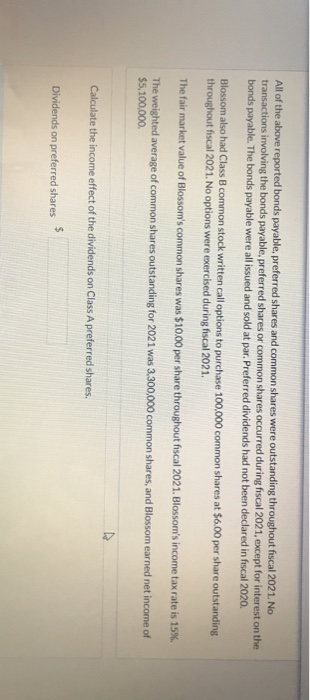

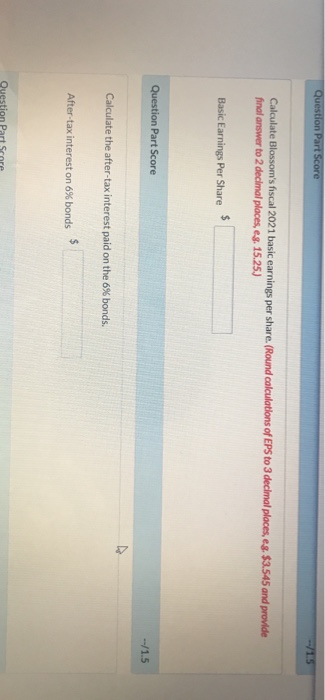

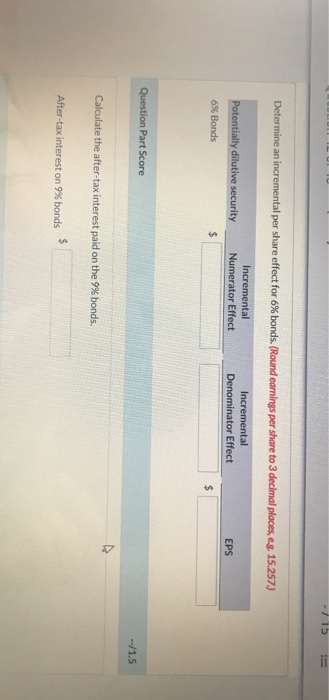

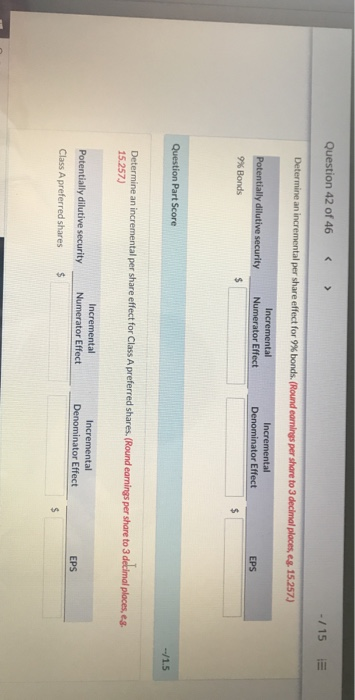

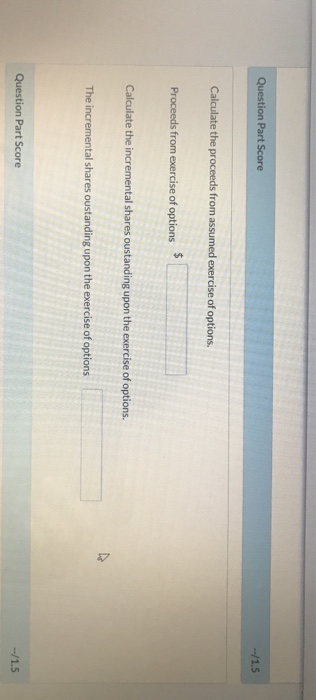

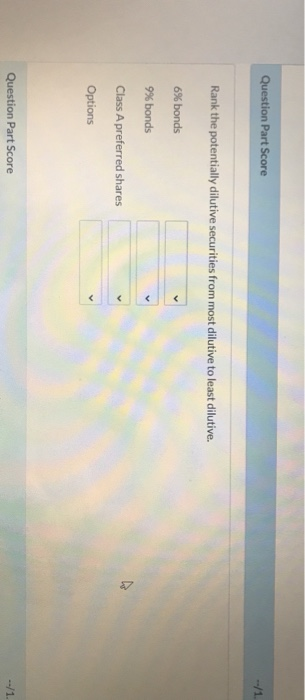

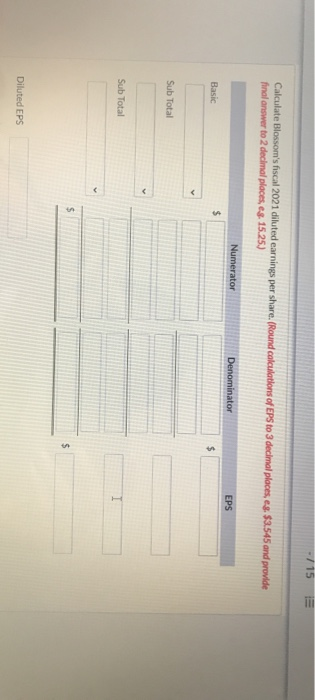

Current Attempt in Progress Blossom Ltd reported Long-Term Liabilities and Shareholders' Equity in its December 31, 2021 balance sheet as follows: Long Term Liabilities: Bonds Payable 6% interest, convertible to 40 common shares/$1,000 bond $2,100,000 Bonds Payable 9% interest, convertible to 40 common shares/$1,000 bond $5,400,000 Shareholders' Equity: Class A Preferred shares no par value, $3 dividend, cumulative, each preferred share convertible into 8 common shares, 250,000 authorized, issued and outstanding Class B Common shares No-par, 3,300,000 authorized, issued and outstanding $2,000,000 $6,600,000 All of the above reported bonds payable, preferred shares and common shares were outstanding throughout fiscal 2021. No transactions involving the bonds payable, preferred shares or common shares occurred during fiscal 2021, except for interest on the bonds payable. The bonds payable were all issued and sold at par. Preferred dividends had not been declared in fiscal 2020. Blossom also had Class B common stock written call options to purchase 100,000 common shares at $6.00 per share outstanding throughout fiscal 2021. No options were exercised during fiscal 2021. The fair market value of Blossom's common shares was $10.00 per share throughout fiscal 2021. Blossom's income tax rate is 15%. The weighted average of common shares outstanding for 2021 was 3,300,000 common shares, and Blossom earned net income of $5,100,000 Calculate the income effect of the dividends on Class A preferred shares. Dividends on preferred shares $ Question Part Score Calculate Blossom's fiscal 2021 basic earnings per share. (Round calculations of EPS to 3 decimal places, es $3.545 and provide final answer to 2 decimal places, es. 15.25) Basic Earnings Per Share $ Question Part Score --/1.5 Calculate the after-tax interest paid on the 6% bonds. After-tax interest on 6% bonds $ Question Part - 15 11 Determine an incremental per share effect for 6% bonds. (Round earnings per share to 3 decimal places, es. 15.257.) Potentially dilutive security Incremental Numerator Effect Incremental Denominat Effect EPS 6% Bonds $ $ Question Part Score --/1.5 Calculate the after-tax interest paid on the 9% bonds. After-tax interest on 9% bonds $ Question 42 of 46 - / 15 Determine an incremental per share effect for 9% bonds. (Round earnings per share to 3 decimal places, eg. 15.257) Potentially dilutive security 9% Bonds Incremental Numerator Effect Incremental Denominator Effect EPS $ $ Question Part Score --/1.5 Determine an incremental per share effect for Class A preferred shares. (Round earnings per share to 3 decimal places, es 15.257) Incremental Numerator Effect Potentially dilutive security Class A preferred shares Incremental Denominator Effect EPS $ $ Question Part Score --/1.5 Calculate the proceeds from assumed exercise of options. Proceeds from exercise of options $ Calculate the incremental shares oustanding upon the exercise of options. The incremental shares oustanding upon the exercise of options Question Part Score --/1.5 Question Part Score -/1. Rank the potentially dilutive securities from most dilutive to least dilutive. 6% bonds 9% bonds Class A preferred shares Options Question Part Score - / 15 III Calculate Blossom's fiscal 2021 diluted earnings per share. (Round calculations of EPS to 3 decimal places, es $3.545 and provide final answer to 2 decimal places, s. 15.25.) Numerator Denominator EPS Basic $ $ Sub Total Sub Total . $ $ Diluted EPS