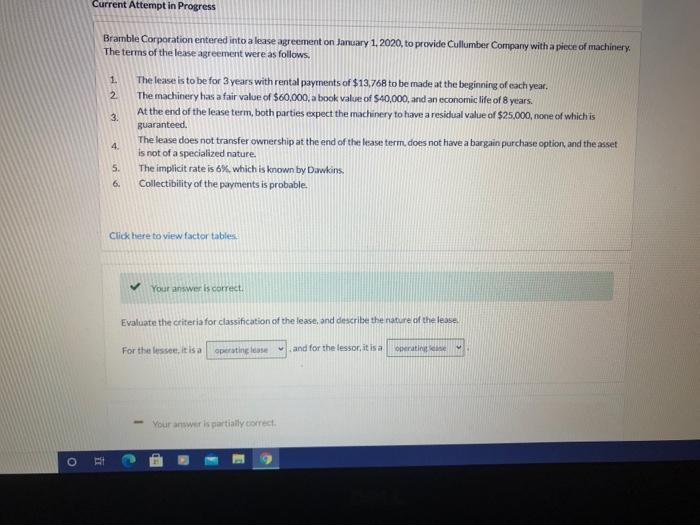

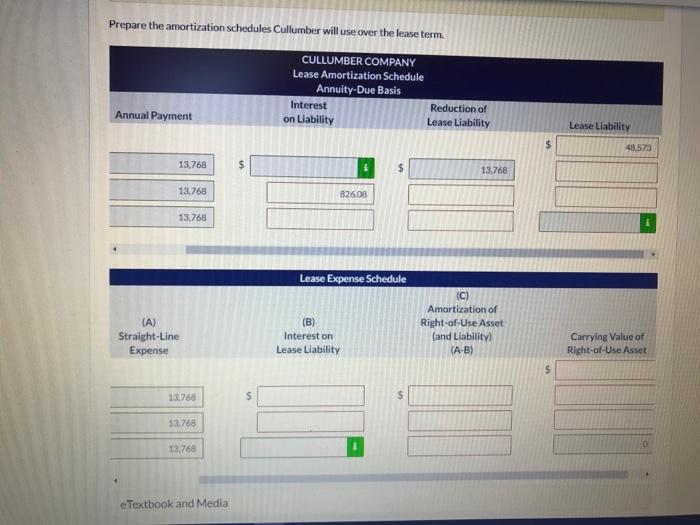

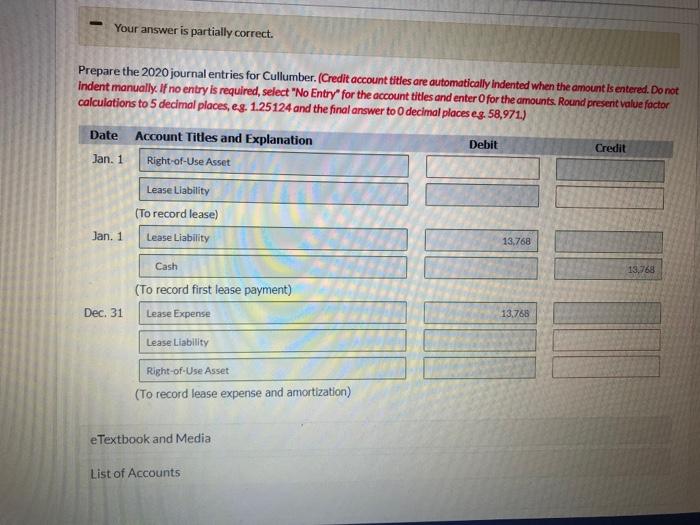

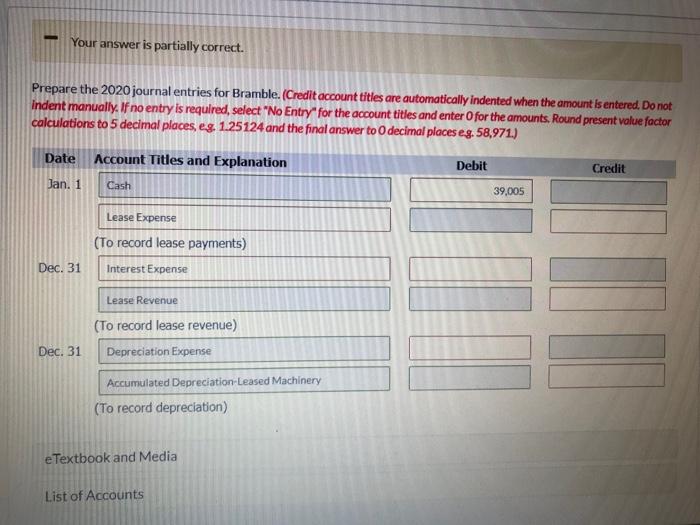

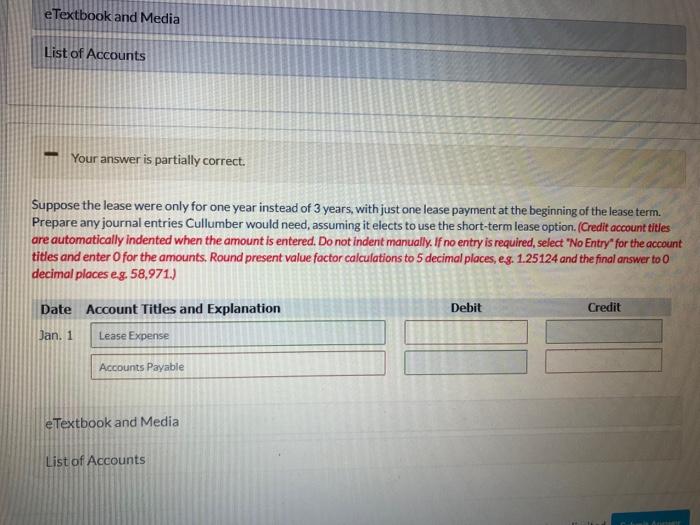

Current Attempt in Progress Bramble Corporation entered into a lease agreement on January 1, 2020, to provide Cullumber Company with a piece of machinery The terms of the lease agreement were as follows. 1 2 3. The lease is to be for 3 years with rental payments of $13,768 to be made at the beginning of each year. The machinery has a fair value of $60,000, a book value of $40,000, and an economic life of 8 years. At the end of the lease term, both parties expect the machinery to have a residual value of $25.000, none of which is guaranteed. The lease does not transfer ownership at the end of the lease term. does not have a bargain purchase option, and the asset is not of a specialized nature. The implicit rate is 6% which is known by Dawkins Collectibility of the payments is probable. 4 5. 6. Click here to view factor tables Your answer is correct Evaluate the criteria for classification of the lease, and describe the nature of the lease For the lessee, it is a operating se and for the lessor, it is a operating Your answer is partially correct O e . Prepare the amortization schedules Cullumber will use over the lease term. CULLUMBER COMPANY Lease Amortization Schedule Annuity-Due Basis Interest Reduction of on Liability Lease Liability Annual Payment Lease Liability 48.573 13.768 13.768 13.768 826.08 13.768 Lease Expense Schedule (A) (C) Amortization of Right-of-Use Asset (and Liability (A-B) (B) Interest on Lease Liability Straight-Line Expense Carrying Value of Right-of-Use Asset $ 13.768 $ $ 13.768 13,768 e Textbook and Media Your answer is partially correct. Prepare the 2020 journal entries for Cullumber. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answer to decimal places eg. 58,971.) Account Titles and Explanation Debit Credit Right-of-Use Asset stos de Date Jan. 1 Lease Liability (To record lease) Jan. 1 Lease Liability 13,768 Cash 13,768 Dec. 31 (To record first lease payment) Lease Expense Lease Liability 13.768 Right-of-Use Asset (To record lease expense and amortization) e Textbook and Media List of Accounts Your answer is partially correct. Prepare the 2020 journal entries for Bramble. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts. Round present value factor calculations to 5 decimal places, eg 1.25124 and the final answer to decimal places eg. 58,971.) Date Account Titles and Explanation Debit Credit Jan. 1 Cash 39,005 Lease Expense (To record lease payments) Interest Expense Dec. 31 Lease Revenue Dec. 31 (To record lease revenue) Depreciation Expense Accumulated Depreciation Leased Machinery (To record depreciation) e Textbook and Media List of Accounts e Textbook and Media List of Accounts Your answer is partially correct. Suppose the lease were only for one year instead of 3 years, with just one lease payment at the beginning of the lease term. Prepare any journal entries Cullumber would need, assuming it elects to use the short-term lease option. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answer too decimal places eg. 58,971.) Date Account Titles and Explanation Debit Credit Jan. 1 Lease Expense Accounts Payable eTextbook and Media List of Accounts