Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress Bridgeport Co. recently installed some new computer equipment. To prepare for the installation, Bridgeport had some electrical work done in what

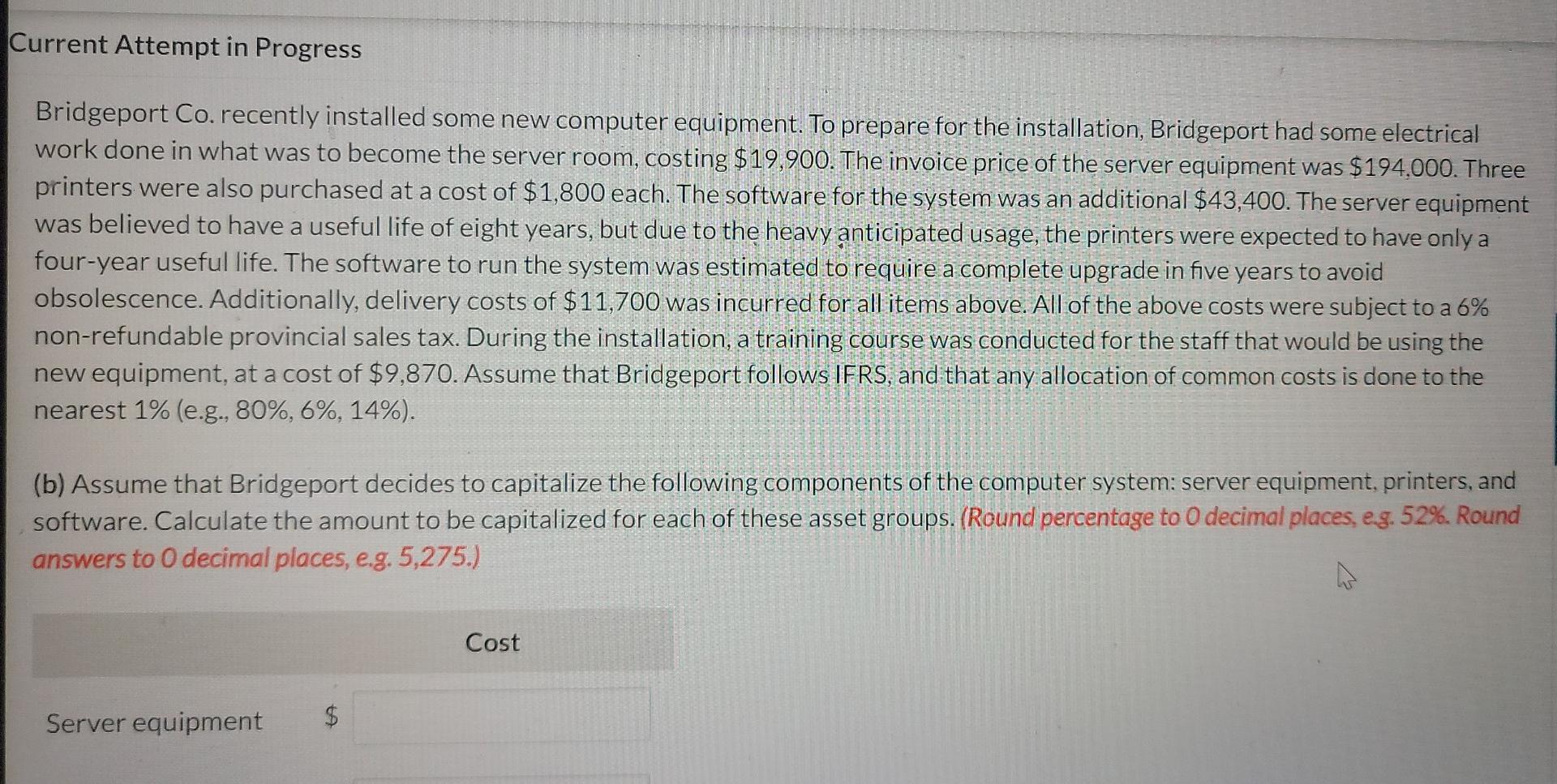

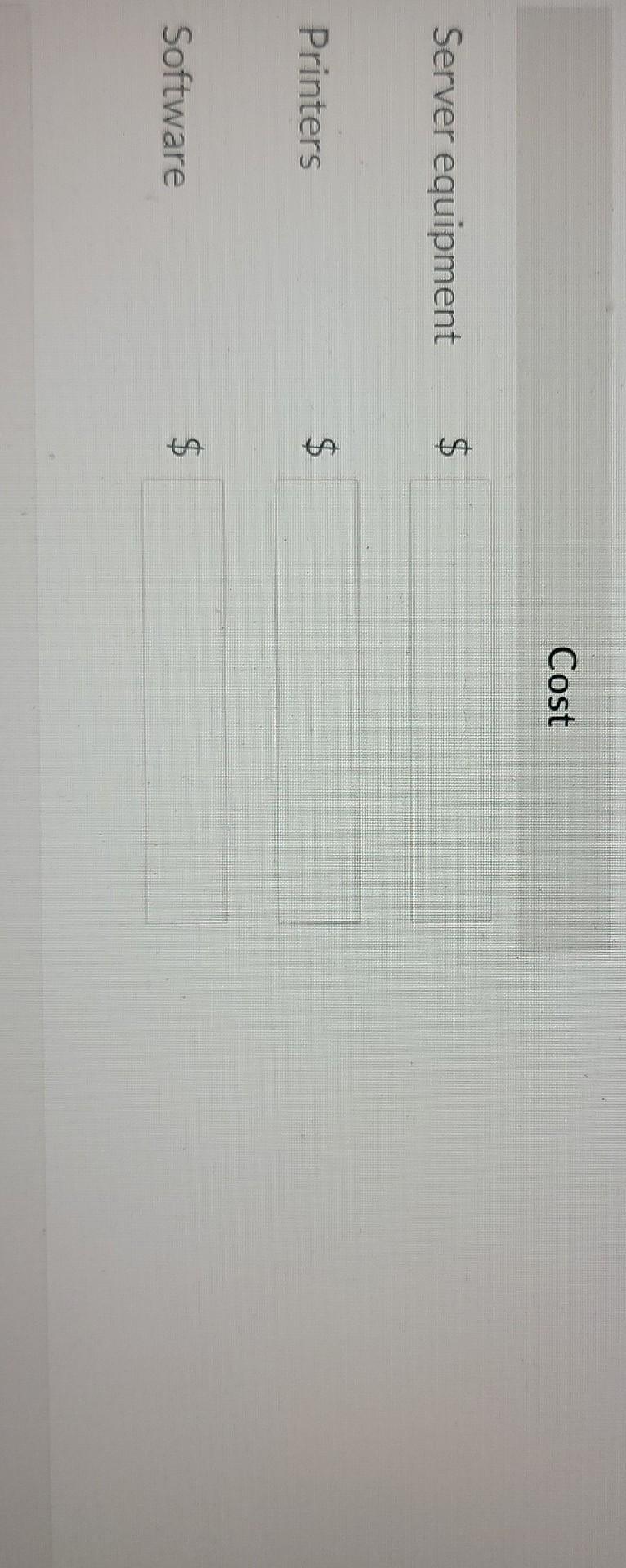

Current Attempt in Progress Bridgeport Co. recently installed some new computer equipment. To prepare for the installation, Bridgeport had some electrical work done in what was to become the server room, costing $19,900. The invoice price of the server equipment was $194,000. Three printers were also purchased at a cost of $1,800 each. The software for the system was an additional $43,400. The server equipment was believed to have a useful life of eight years, but due to the heavy anticipated usage, the printers were expected to have only a a four-year useful life. The software to run the system was estimated to require a complete upgrade in five years to avoid obsolescence. Additionally, delivery costs of $11,700 was incurred for all items above. All of the above costs were subject to a 6% non-refundable provincial sales tax. During the installation, a training course was conducted for the staff that would be using the new equipment, at a cost of $9,870. Assume that Bridgeport follows IFRS, and that any allo ation of common costs is done to the nearest 1% (e.g., 80%, 6%, 14%). (b) Assume that Bridgeport decides to capitalize the following components of the computer system: server equipment, printers, and software. Calculate the amount to be capitalized for each of these asset groups. (Round percentage to O decimal places, eg. 52%. Round answers to O decimal places, e.g. 5,275.) Cost Server equipment $ Cost Server equipment $ Printers $ Software $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started