Answered step by step

Verified Expert Solution

Question

1 Approved Answer

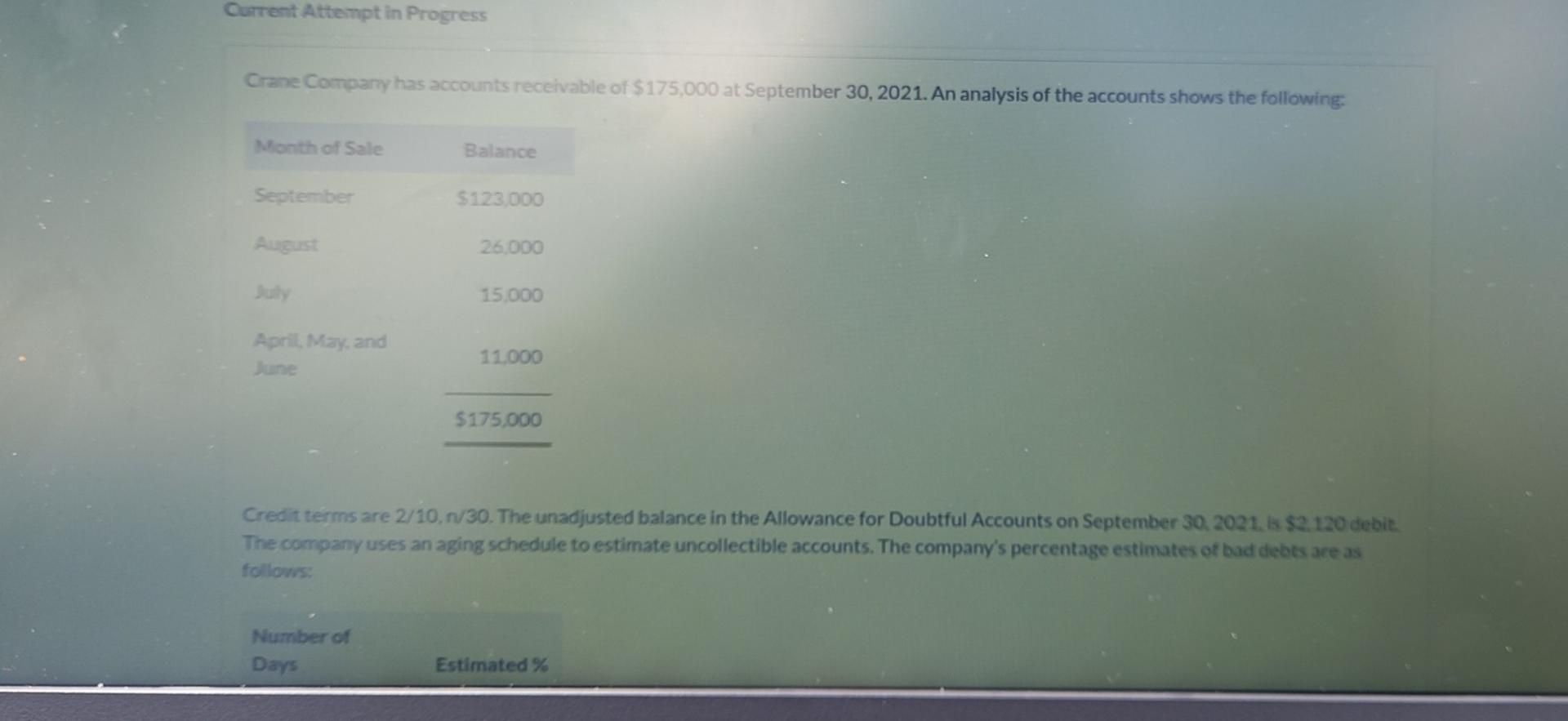

Current Attempt in Progress Crane Company has accounts receivable of $175,000 at September 30, 2021. An analysis of the accounts shows the following: Month of

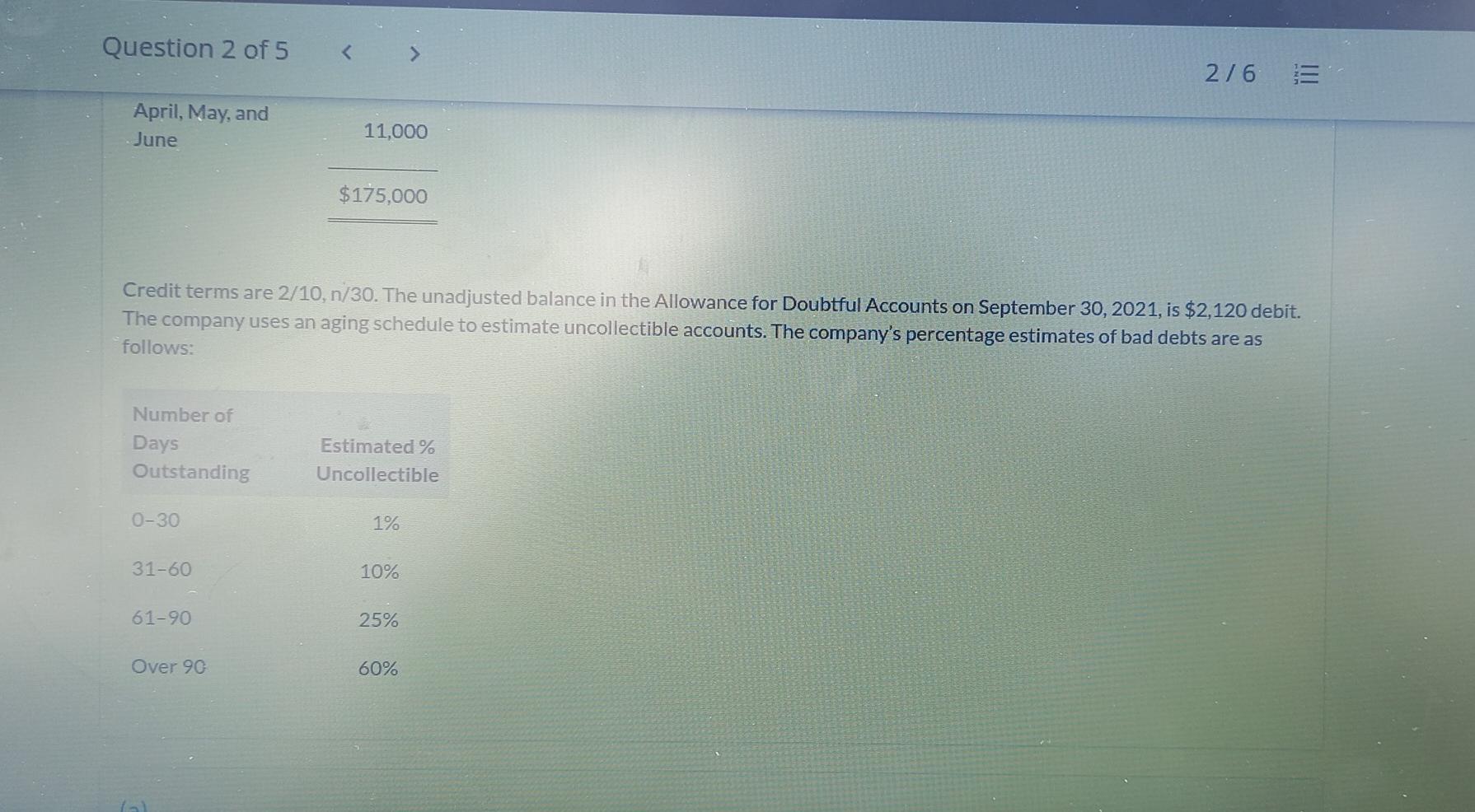

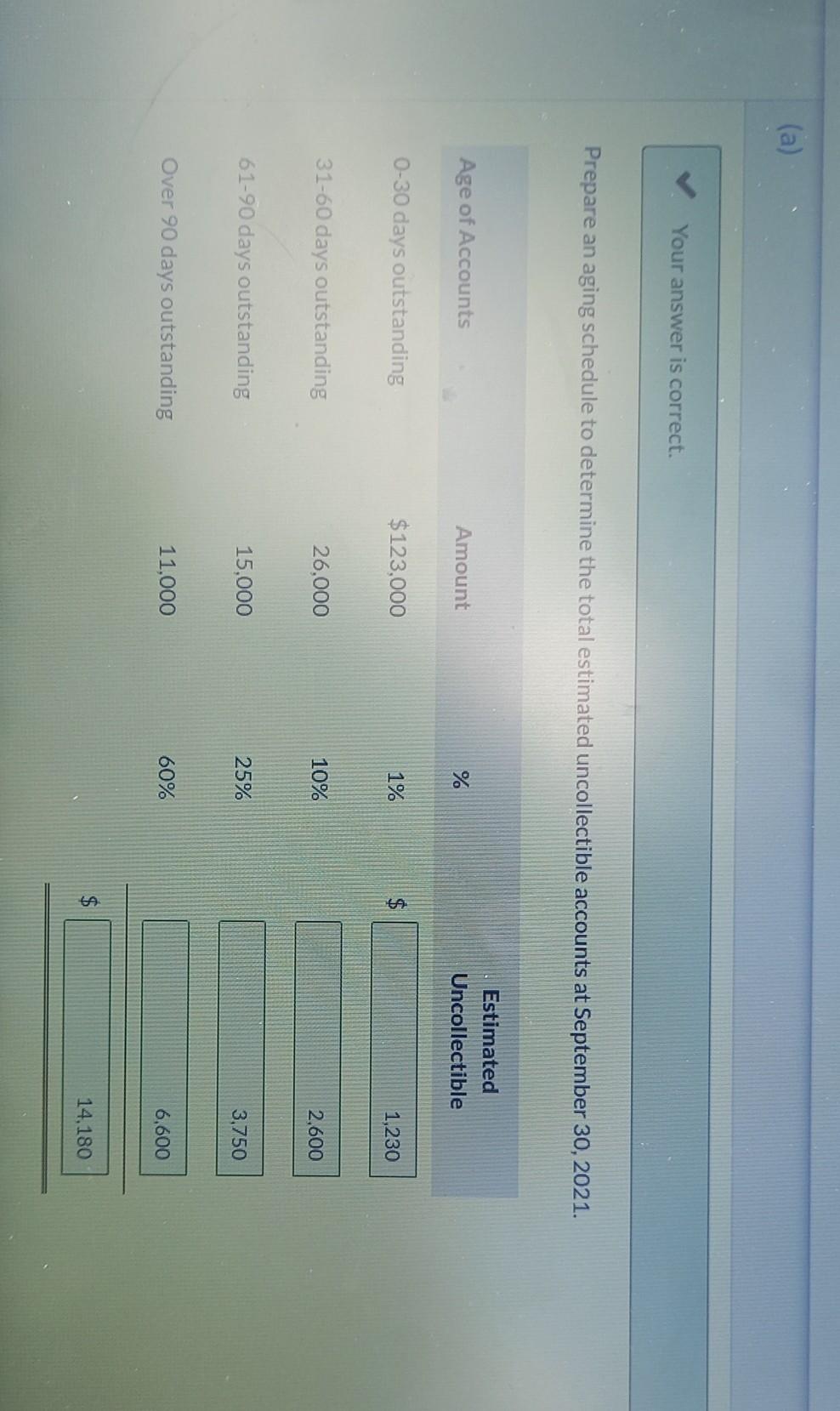

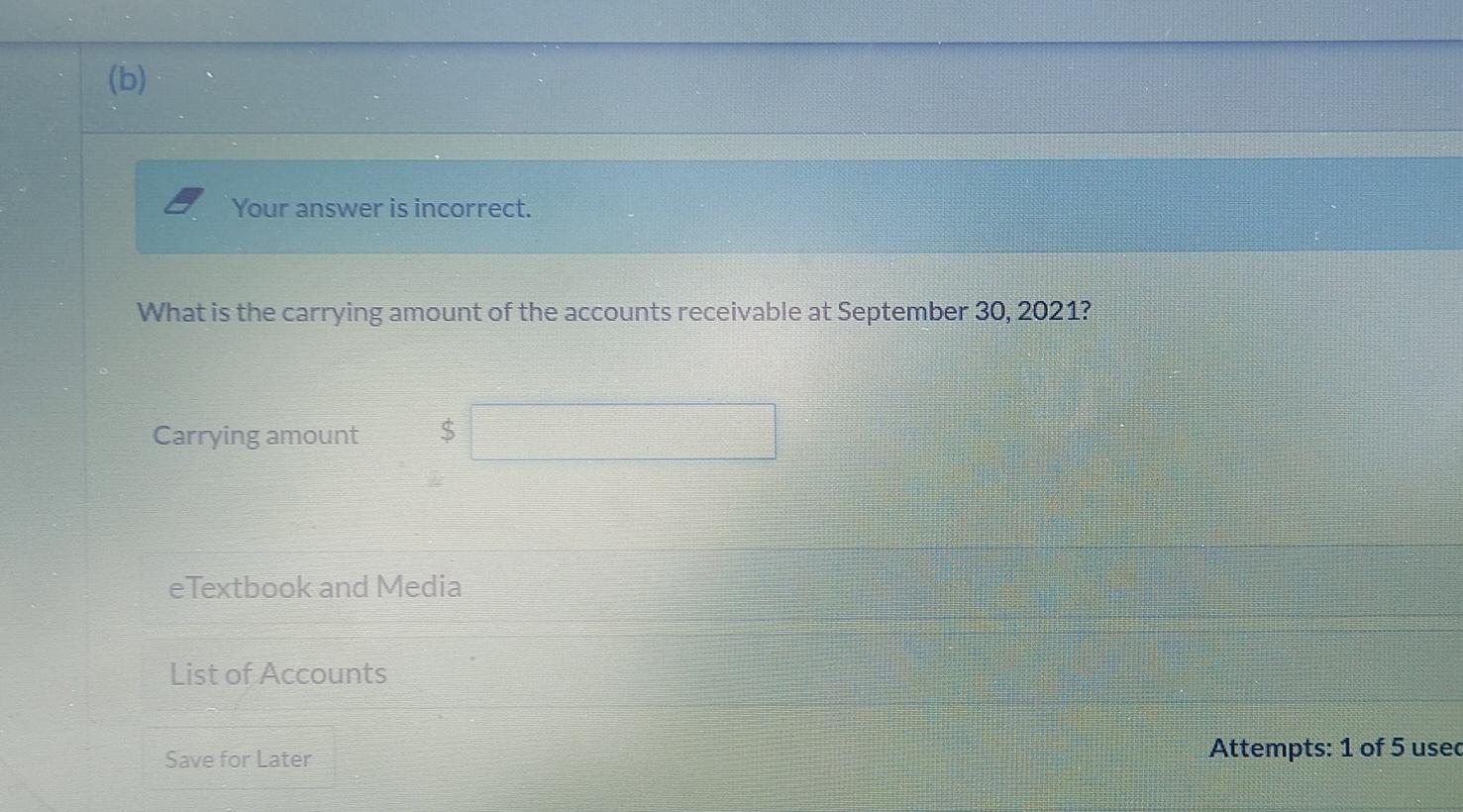

Current Attempt in Progress Crane Company has accounts receivable of $175,000 at September 30, 2021. An analysis of the accounts shows the following: Month of Sale Balance September $123.000 August 26.000 July 15.000 April May, and une 11000 $175.000 Credit terms are 2/10, 1/30. The unadjusted balance in the Allowance for Doubtful Accounts on September 30, 2021. is $2.120 debit. The company uses an aging schedule to estimate uncollectible accounts. The company's percentage estimates of bad debts are as follows Number of Days Estimated % Question 2 of 5 2/6 III April, May, and June 11,000 $175,000 Credit terms are 2/10, n/30. The unadjusted balance in the Allowance for Doubtful Accounts on September 30, 2021, is $2,120 debit. The company uses an aging schedule to estimate uncollectible accounts. The company's percentage estimates of bad debts are as follows: Number of Days Outstanding Estimated % Uncollectible 0-30 1% 31-60 10% 61-90 25% Over 90 60% (a) Your answer is correct. Prepare an aging schedule to determine the total estimated uncollectible accounts at September 30, 2021. Age of Accounts Amount Estimated Uncollectible % 0-30 days outstanding $123,000 1% 1,230 31-60 days outstanding 26.000 10% 2.600 61-90 days outstanding 15,000 25% 3,750 Over 90 days outstanding 11.000 60% 6,600 $ 14,180 (b) Your answer is incorrect. What is the carrying amount of the accounts receivable at September 30, 2021? Carrying amount $ e Textbook and Media List of Accounts Save for Later Attempts: 1 of 5 user

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started