Answered step by step

Verified Expert Solution

Question

1 Approved Answer

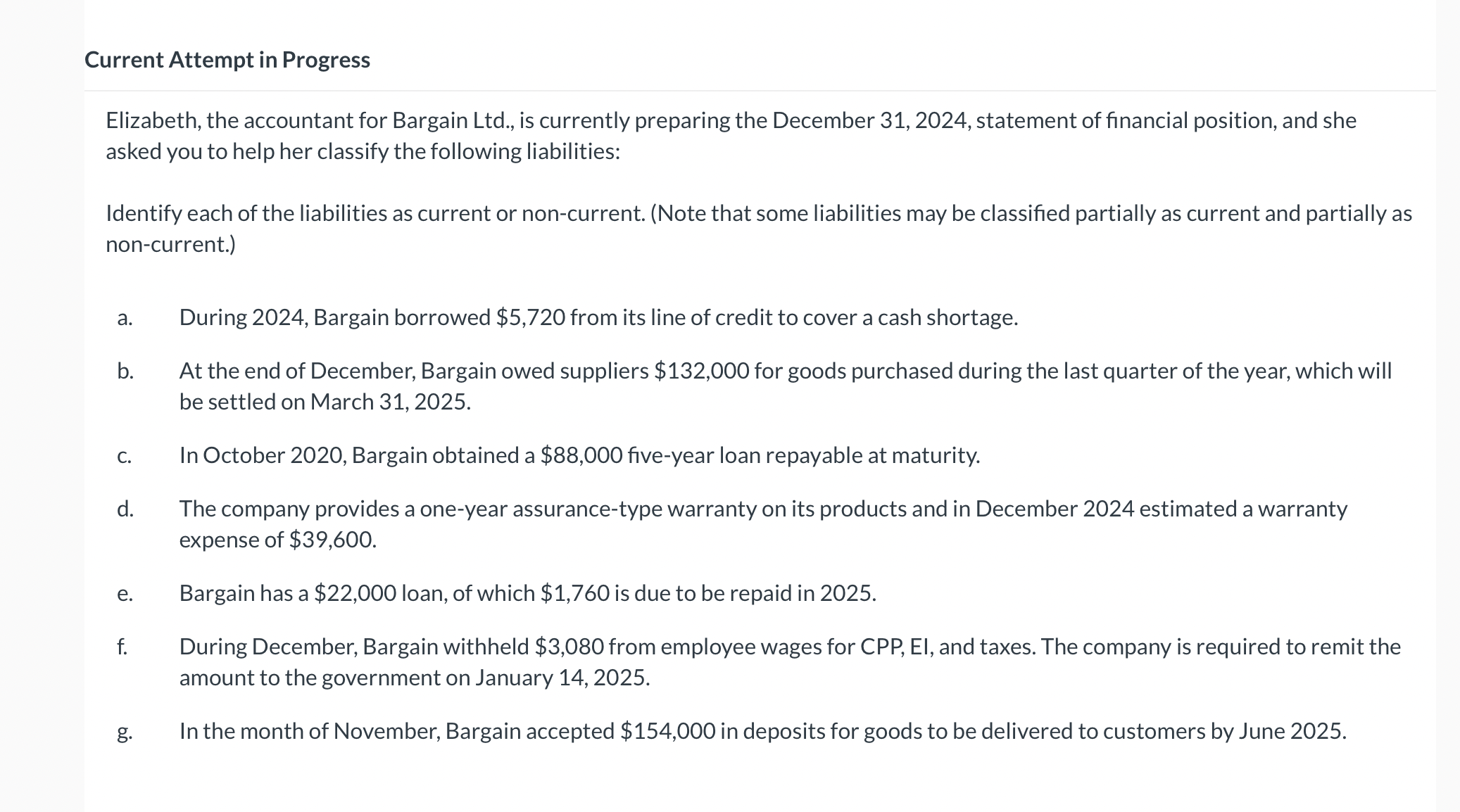

Current Attempt in Progress Elizabeth, the accountant for Bargain Ltd . , is currently preparing the December 3 1 , 2 0 2 4 ,

Current Attempt in Progress

Elizabeth, the accountant for Bargain Ltd is currently preparing the December statement of financial position, and she

asked you to help her classify the following liabilities:

Identify each of the liabilities as current or noncurrent. Note that some liabilities may be classified partially as current and partially as

noncurrent.

a During Bargain borrowed $ from its line of credit to cover a cash shortage.

b At the end of December, Bargain owed suppliers $ for goods purchased during the last quarter of the year, which will

be settled on March

c In October Bargain obtained a $ fiveyear loan repayable at maturity.

d The company provides a oneyear assurancetype warranty on its products and in December estimated a warranty

expense of $

e Bargain has a $ loan, of which $ is due to be repaid in

f During December, Bargain withheld $ from employee wages for CPP El and taxes. The company is required to remit the

amount to the government on January

g In the month of November, Bargain accepted $ in deposits for goods to be delivered to customers by June

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started