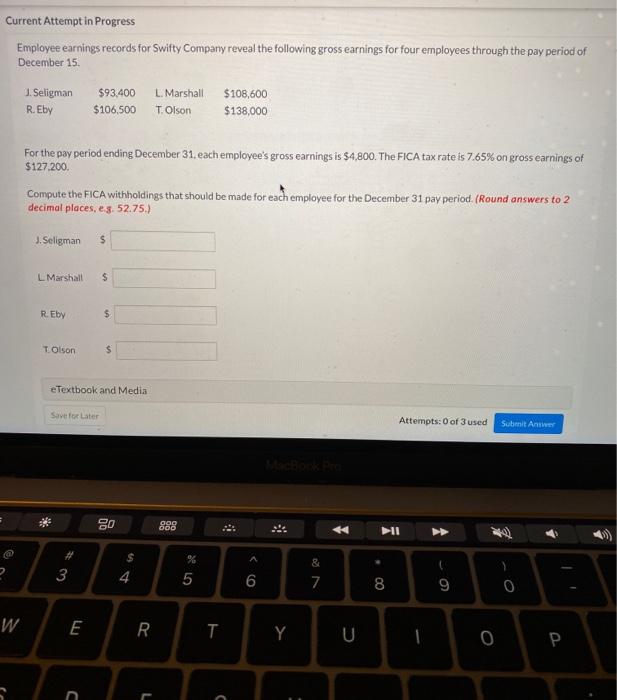

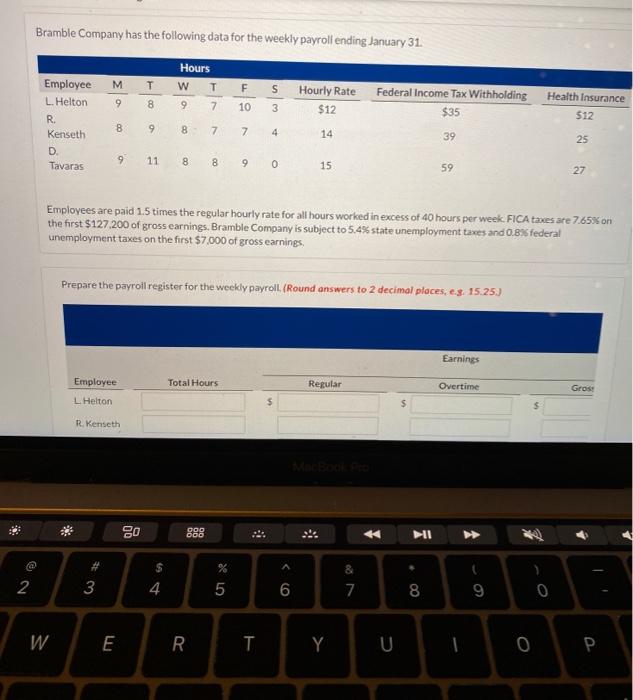

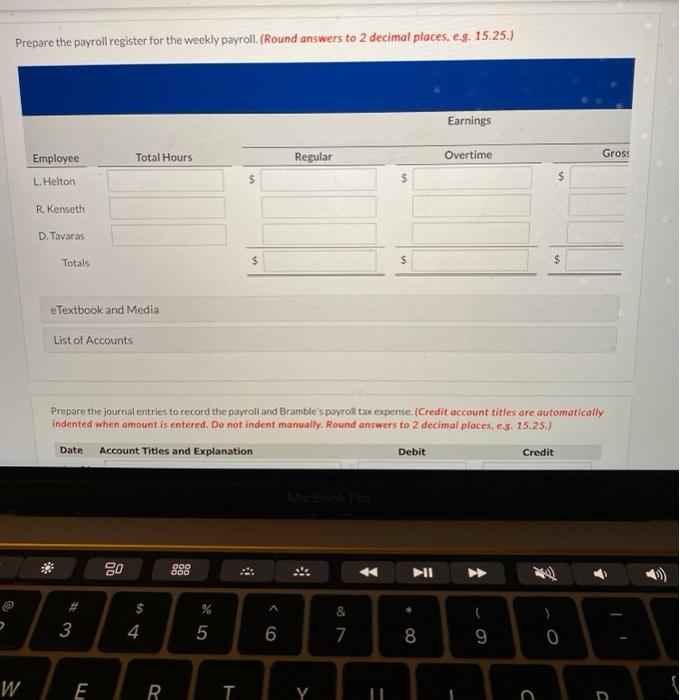

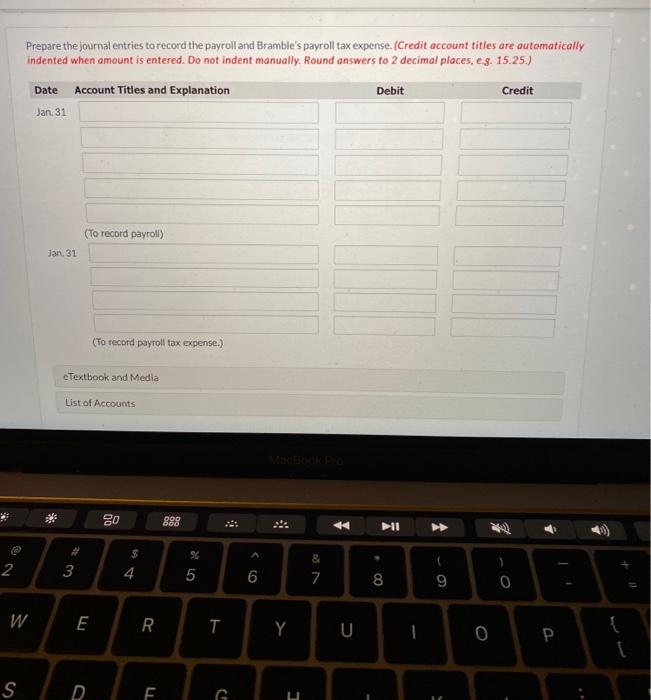

Current Attempt in Progress Employee earnings records for Swifty Company reveal the following gross earnings for four employees through the pay period of December 15. 3. Seligman $93.400 L. Marshall $108,600 R. Eby $106,500 T. Olson $138,000 For the pay period ending December 31, each employee's gross earnings is $4,800. The FICA tax rate is 7.65% on gross earnings of $127.200 Compute the FICA withholdings that should be made for each employee for the December 31 pay period. (Round answers to 2 decimal places, e.g. 52.75.) J. Seligman $ L Marshall $ REby $ TOlson $ e Textbook and Media Savo Later Attempts: 0 of 3 used Submit Antwer go GOD OD . 11 S % & 3 4 5 6 7 8 9 O W E R T Y U 0 a C Bramble Company has the following data for the weekly payroll ending January 31 M 9 Hours w T 9 7 F S Hourly Rate $12 8 Federal Income Tax Withholding $35 10 3 Health Insurance $12 Employee L. Helton R. Kenseth D. Tavaras B 9 8 7 7 14 39 25 9 11 8 8 90 15 59 27 Employees are paid 1.5 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 7.65% on the first $127.200 of gross earnings. Bramble Company is subject to 5.4% state unemployment taxes and 0.89 federal unemployment taxes on the first $7,000 of gross earnings Prepare the payroll register for the weekly payroll. {Round answers to 2 decimal places, e.3. 15.25.) Earnings Employee Total Hours Regular Overtime Gross L. Helton $ R Kenseth S: 20 DOO 000 . @ # & 2 3 % 5 4 6 7 8 9 0 W E R T Y 1 0 Prepare the payroll register for the weekly payroll (Round answers to 2 decimal places, e.g. 15.25.) Earnings Total Hours Regular Overtime Gross Employee L. Helton $ $ R Kenseth D. Tavaras Totals $ $ $ eTextbook and Media List of Accounts Prepare the journal entries to record the payroll and Bramble's payroll tax expense. (Credit account titles are automatically Indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e3. 15.25.) Date Account Titles and Explanation Debit Credit DO 000 * 3 4. % 5 6 > 0 7 8 9 E R TY C Prepare the journal entries to record the payroll and Bramble's payroll tax expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 15.25.) Date Account Titles and Explanation Debit Credit Jan. 31 (To record payroll) Jan. 31 (To record payroll tax expense.) eTextbook and Media List of Accounts 20 DOO doo ... * Il % 0 7 8 9 E R TY C Prepare the journal entries to record the payroll and Bramble's payroll tax expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 15.25.) Date Account Titles and Explanation Debit Credit Jan. 31 (To record payroll) Jan. 31 (To record payroll tax expense.) eTextbook and Media List of Accounts 20 DOO doo ... * Il %