Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress If a payback period for a project is greater than its expected useful life, the project will always be profitable. entire

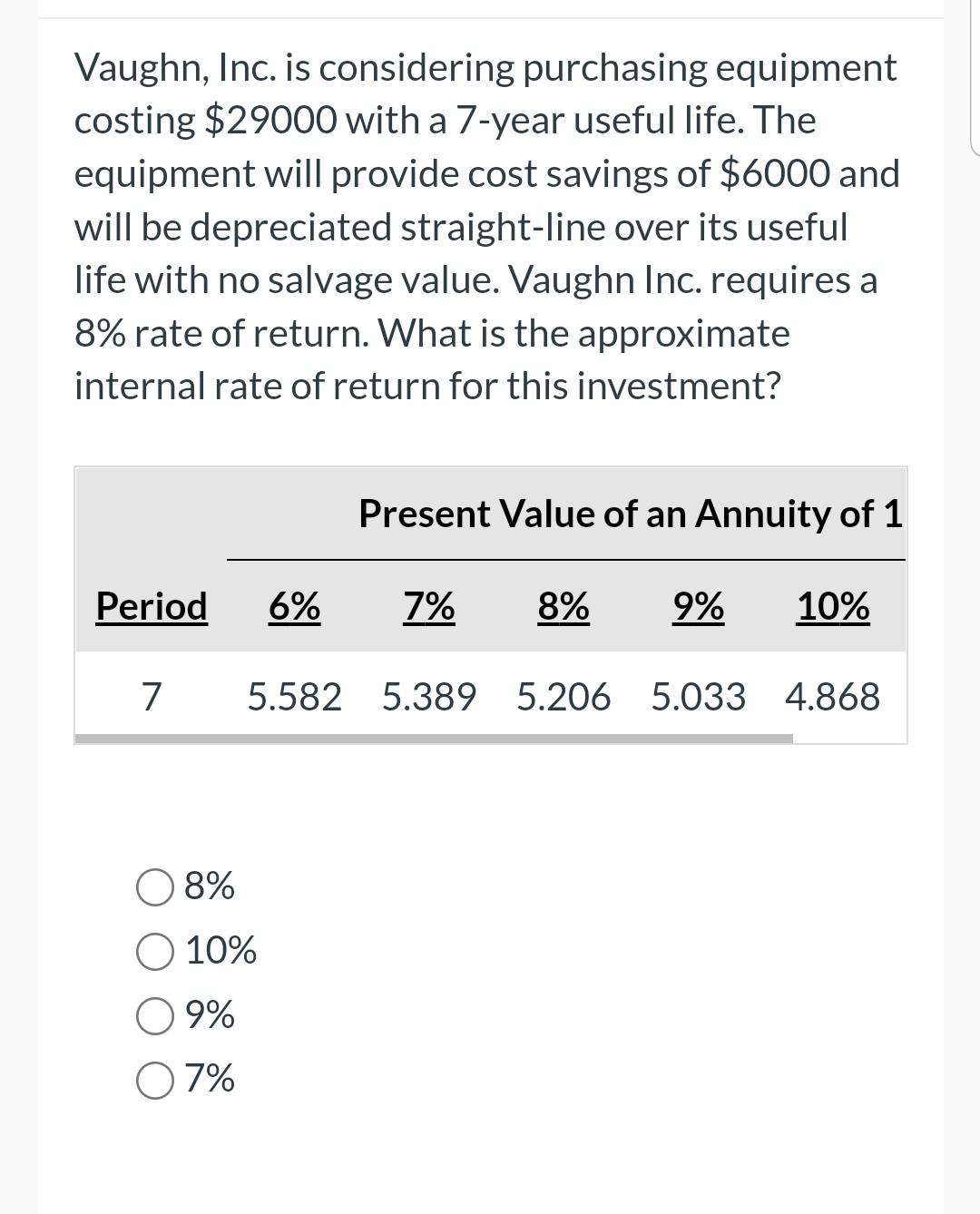

Current Attempt in Progress If a payback period for a project is greater than its expected useful life, the project will always be profitable. entire initial investment will not be recovered. project's return will always exceed the company's cost of capital. project would only be acceptable if the company's cost of capital was low. A disadvantage of the cash payback technique is that it ignores obsolescence factors. is complicated to use. ignores the time value of money. ignores the cost of an investment. If a company uses a 13.2% discount rate with the net present value method, and then does the same analysis, but with a 16.3% discount rate, which of the following is likely to occur? The 13.2% rate will show the project is more profitable than the 16.3% rate. The relative profitability of the two studies depends only on the timing of the cash flows, not on the discount rate. The 16.3% rate will show the project is more profitable than the 13.2% rate. Both rates will produce the same net present value. Using the profitability index method, the present value of cash inflows for Project Flower is $88300 and the present value of cash inflows of Project Plant is \$48100. If Project Flower and Project Plant require initial investments of $90200 and \$40000, respectively, and have the same useful life, the project that should be accepted is Neither project should be accepted. Project Flower. Project Plant. Either project may be accepted. The internal rate of return is the interest rate that results in a positive NPV. zero NPV. negative NPV. positive or negative NPV. If a company's required rate of return is 8%, and in using the profitability index method, a project's index is greater than 1 , this indicates that the project's rate of return is unacceptable for investment purposes. equal to 8%. greater than 8\%. less than 8\%. Vaughn, Inc. is considering purchasing equipment costing $29000 with a 7 -year useful life. The equipment will provide cost savings of $6000 and will be depreciated straight-line over its useful life with no salvage value. Vaughn Inc. requires a 8% rate of return. What is the approximate internal rate of return for this investment? 8%10%9% A company is considering purchasing factory equipment that costs $300000 and is estimated to have no salvage value at the end of its 5-year useful life. If the equipment is purchased, annual revenues are expected to be $147000 and annual operating expenses exclusive of depreciation expense are expected to be $30000. The straightline method of depreciation would be used. If the equipment is purchased, the annual rate of return expected on this equipment is 7.80%39.00%38.00%49.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started