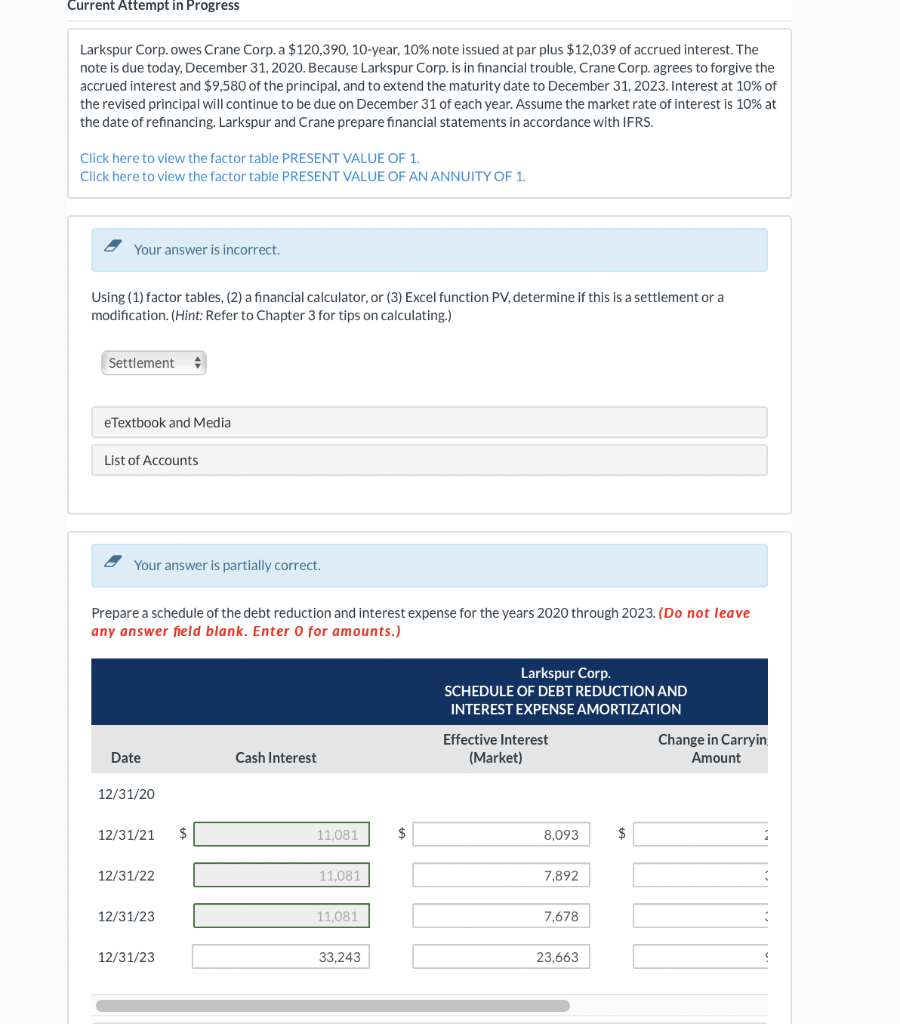

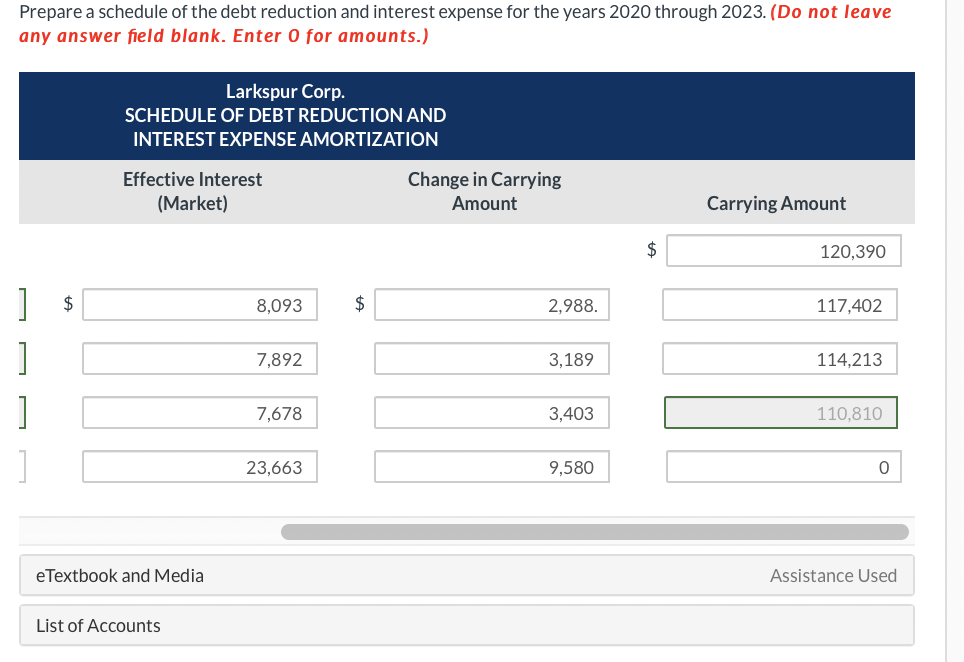

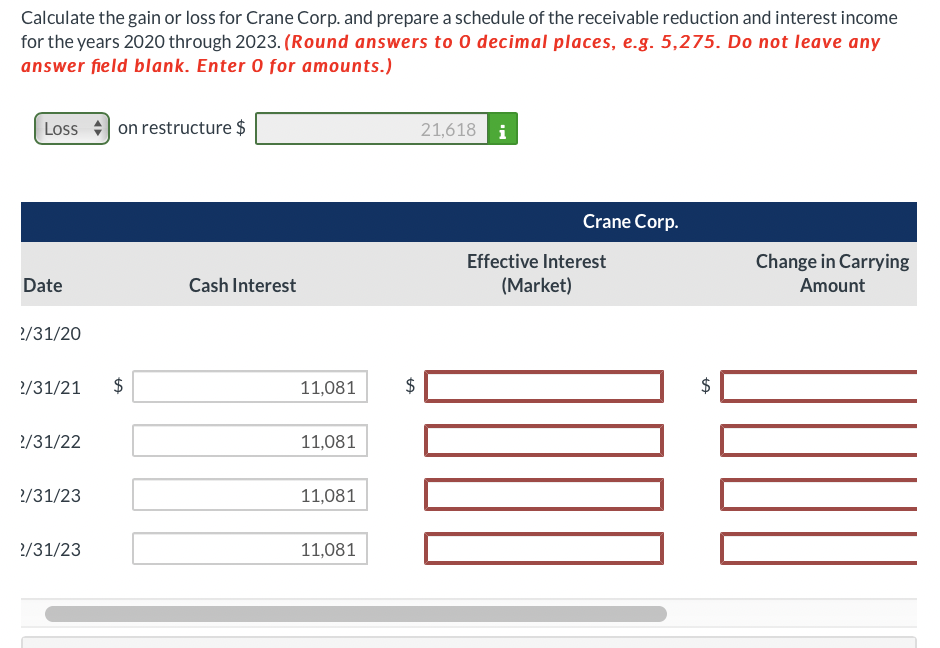

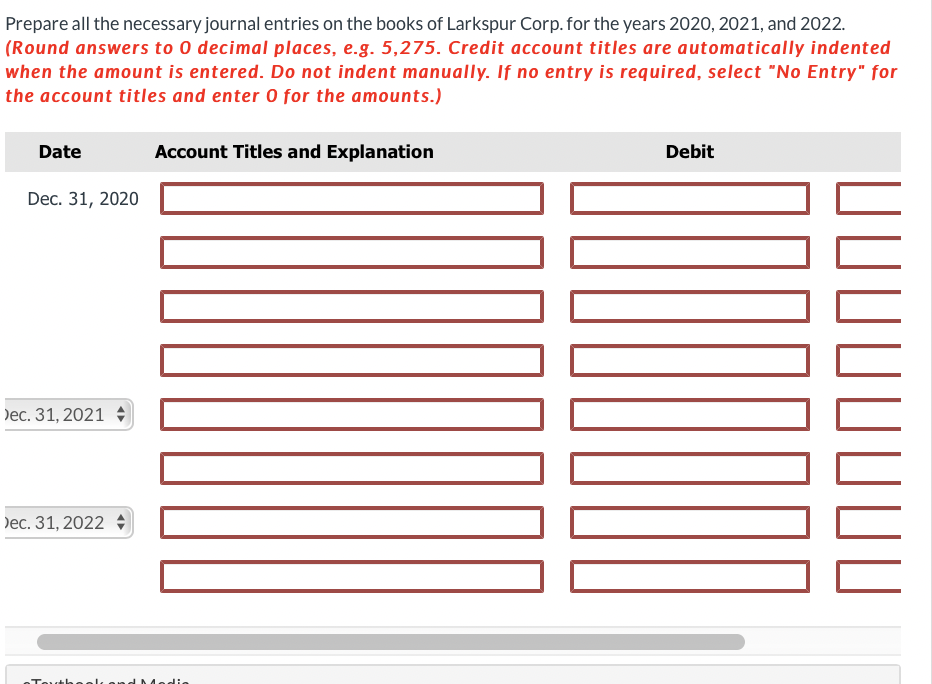

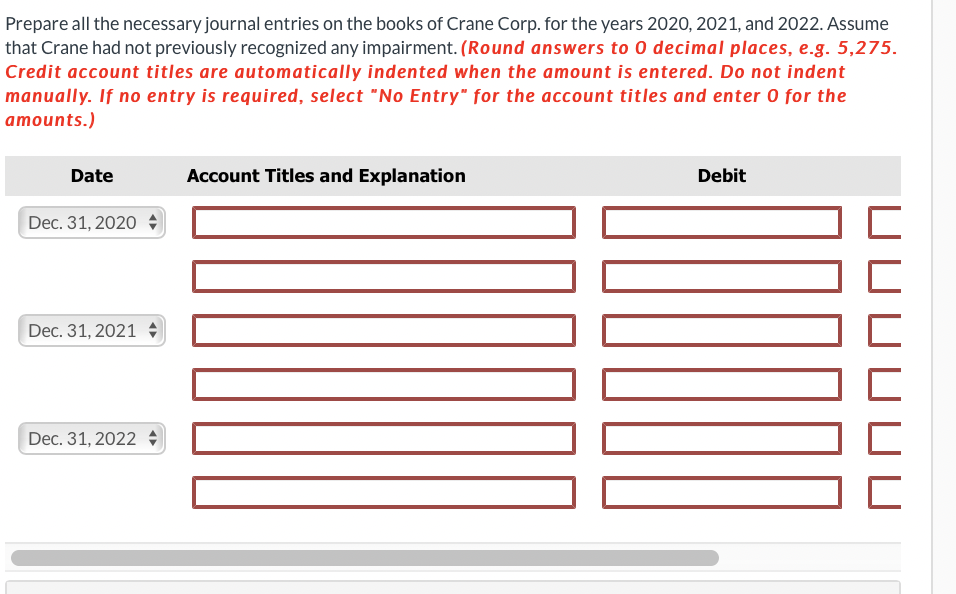

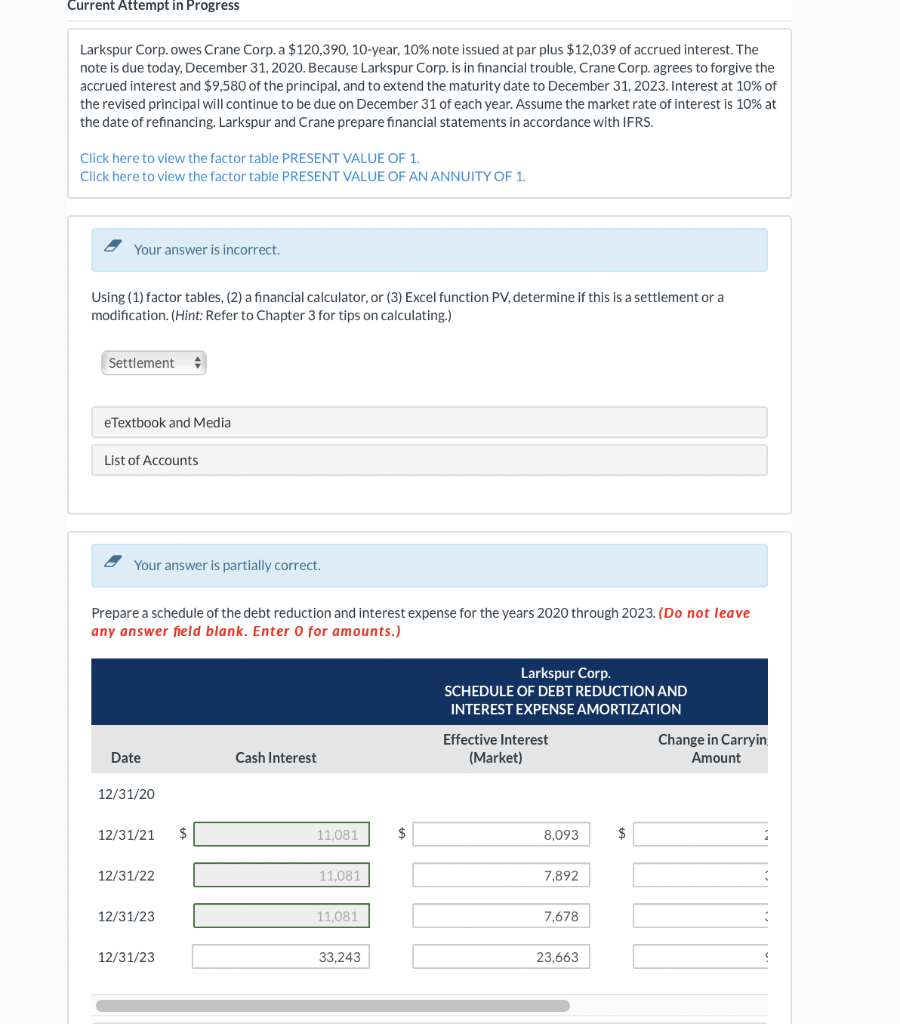

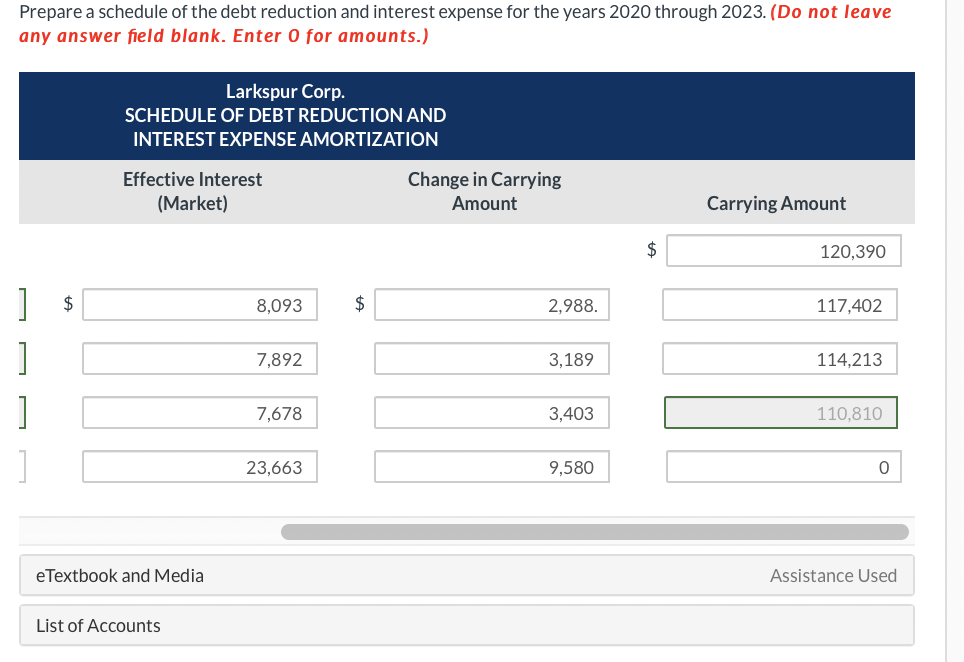

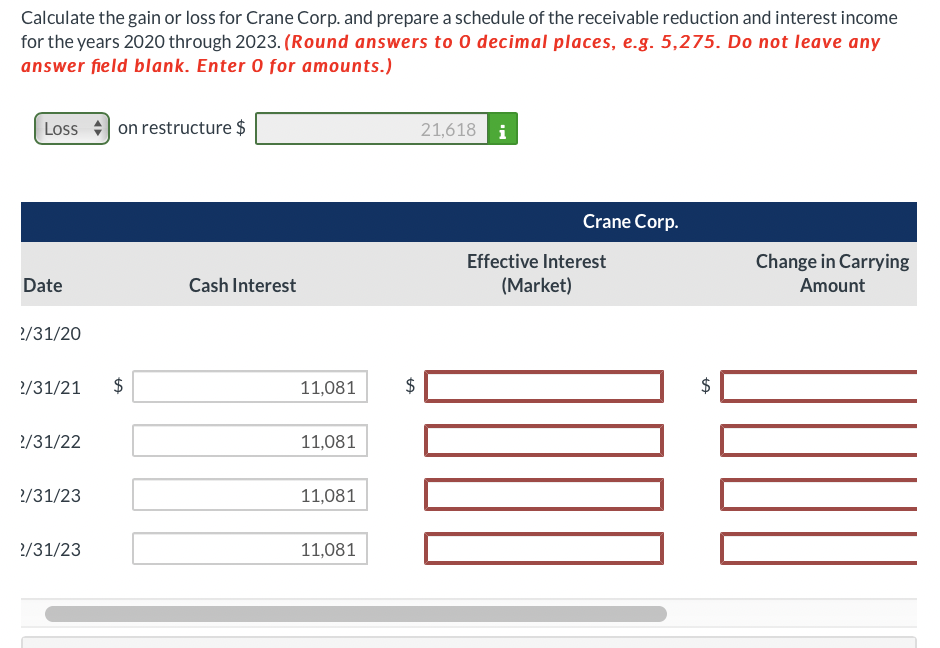

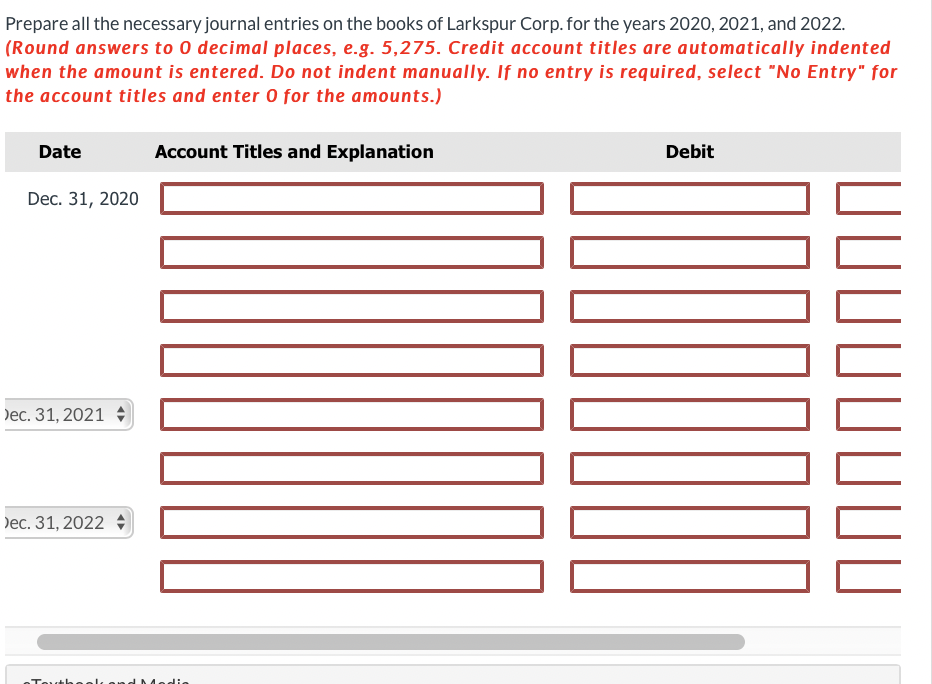

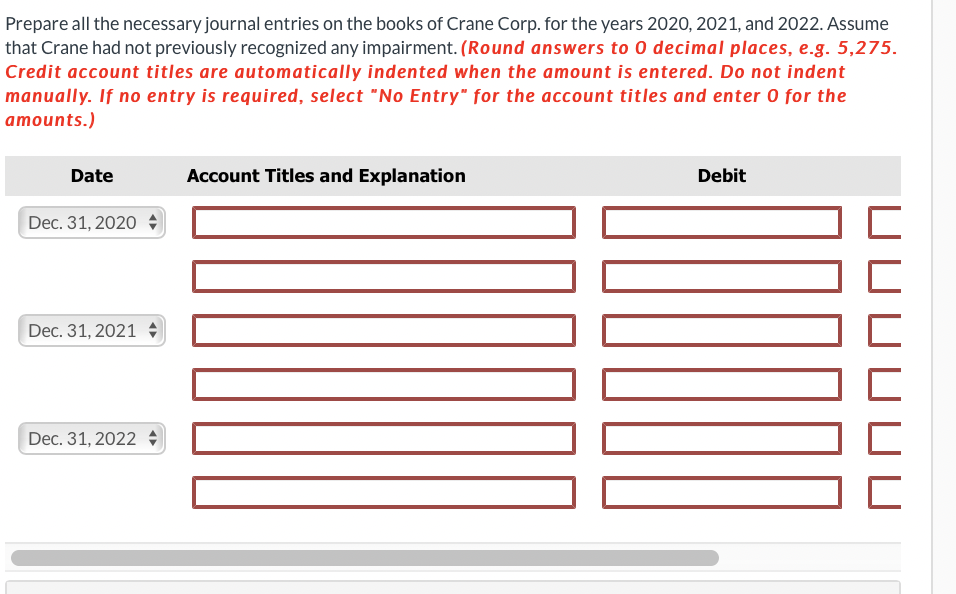

Current Attempt in Progress Larkspur Corp. owes Crane Corp. a $120,390, 10-year, 10% note issued at par plus $12,039 of accrued interest. The note is due today, December 31, 2020. Because Larkspur Corp. is in financial trouble, Crane Corp. agrees to forgive the accrued interest and $9,580 of the principal, and to extend the maturity date to December 31, 2023. Interest at 10% of the revised principal will continue to be due on December 31 of each year. Assume the market rate of interest is 10% at the date of refinancing. Larkspur and Crane prepare financial statements in accordance with IFRS. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Your answer is incorrect. Using (1) factor tables, (2) a financial calculator, or (3) Excel function PV, determine if this is a settlement or a modification. (Hint: Refer to Chapter 3 for tips on calculating.) Settlement eTextbook and Media List of Accounts Your answer is partially correct. Prepare a schedule of the debt reduction and interest expense for the years 2020 through 2023. (Do not leave any answer field blank. Enter O for amounts.) Larkspur Corp. SCHEDULE OF DEBT REDUCTION AND INTEREST EXPENSE AMORTIZATION Effective Interest (Market) Change in Carryin Amount Date Cash Interest 12/31/20 12/31/21 $ 12/31/22 12/31/23 12/31/23 11,081 11,081 11,081 33,243 $ 8,093 7,892 7,678 23,663 $ Prepare a schedule of the debt reduction and interest expense for the years 2020 through 2023. (Do not leave any answer field blank. Enter O for amounts.) Larkspur Corp. SCHEDULE OF DEBT REDUCTION AND INTEREST EXPENSE AMORTIZATION Effective Interest Change in Carrying Amount (Market) Carrying Amount ] $ ] ] eTextbook and Media List of Accounts 8,093 7,892 7,678 23,663 $ 2,988. 3,189 3,403 9,580 $ 120,390 117,402 114,213 110,810 0 Assistance Used Calculate the gain or loss for Crane Corp. and prepare a schedule of the receivable reduction and interest income for the years 2020 through 2023. (Round answers to 0 decimal places, e.g. 5,275. Do not leave any answer field blank. Enter 0 for amounts.) Loss on restructure $ 21,618 i Crane Corp. Change in Carrying Amount Date 2/31/20 2/31/21 2/31/22 2/31/23 2/31/23 $ Cash Interest 11,081 11,081 11,081 11,081 tA Effective Interest (Market) tA Prepare all the necessary journal entries on the books of Larkspur Corp. for the years 2020, 2021, and 2022. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Dec. 31, 2020 Dec. 31, 2021 Dec. 31, 2022 Touth Media 1000 Prepare all the necessary journal entries on the books of Crane Corp. for the years 2020, 2021, and 2022. Assume that Crane had not previously recognized any impairment. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Date Dec. 31, 2020 Dec. 31, 2021 Dec. 31, 2022 U Current Attempt in Progress Larkspur Corp. owes Crane Corp. a $120,390, 10-year, 10% note issued at par plus $12,039 of accrued interest. The note is due today, December 31, 2020. Because Larkspur Corp. is in financial trouble, Crane Corp. agrees to forgive the accrued interest and $9,580 of the principal, and to extend the maturity date to December 31, 2023. Interest at 10% of the revised principal will continue to be due on December 31 of each year. Assume the market rate of interest is 10% at the date of refinancing. Larkspur and Crane prepare financial statements in accordance with IFRS. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Your answer is incorrect. Using (1) factor tables, (2) a financial calculator, or (3) Excel function PV, determine if this is a settlement or a modification. (Hint: Refer to Chapter 3 for tips on calculating.) Settlement eTextbook and Media List of Accounts Your answer is partially correct. Prepare a schedule of the debt reduction and interest expense for the years 2020 through 2023. (Do not leave any answer field blank. Enter O for amounts.) Larkspur Corp. SCHEDULE OF DEBT REDUCTION AND INTEREST EXPENSE AMORTIZATION Effective Interest (Market) Change in Carryin Amount Date Cash Interest 12/31/20 12/31/21 $ 12/31/22 12/31/23 12/31/23 11,081 11,081 11,081 33,243 $ 8,093 7,892 7,678 23,663 $ Prepare a schedule of the debt reduction and interest expense for the years 2020 through 2023. (Do not leave any answer field blank. Enter O for amounts.) Larkspur Corp. SCHEDULE OF DEBT REDUCTION AND INTEREST EXPENSE AMORTIZATION Effective Interest Change in Carrying Amount (Market) Carrying Amount ] $ ] ] eTextbook and Media List of Accounts 8,093 7,892 7,678 23,663 $ 2,988. 3,189 3,403 9,580 $ 120,390 117,402 114,213 110,810 0 Assistance Used Calculate the gain or loss for Crane Corp. and prepare a schedule of the receivable reduction and interest income for the years 2020 through 2023. (Round answers to 0 decimal places, e.g. 5,275. Do not leave any answer field blank. Enter 0 for amounts.) Loss on restructure $ 21,618 i Crane Corp. Change in Carrying Amount Date 2/31/20 2/31/21 2/31/22 2/31/23 2/31/23 $ Cash Interest 11,081 11,081 11,081 11,081 tA Effective Interest (Market) tA Prepare all the necessary journal entries on the books of Larkspur Corp. for the years 2020, 2021, and 2022. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Dec. 31, 2020 Dec. 31, 2021 Dec. 31, 2022 Touth Media 1000 Prepare all the necessary journal entries on the books of Crane Corp. for the years 2020, 2021, and 2022. Assume that Crane had not previously recognized any impairment. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Date Dec. 31, 2020 Dec. 31, 2021 Dec. 31, 2022 U