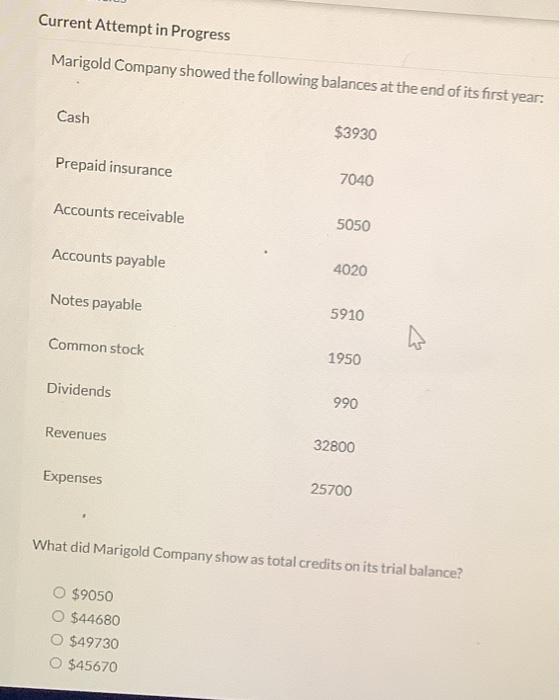

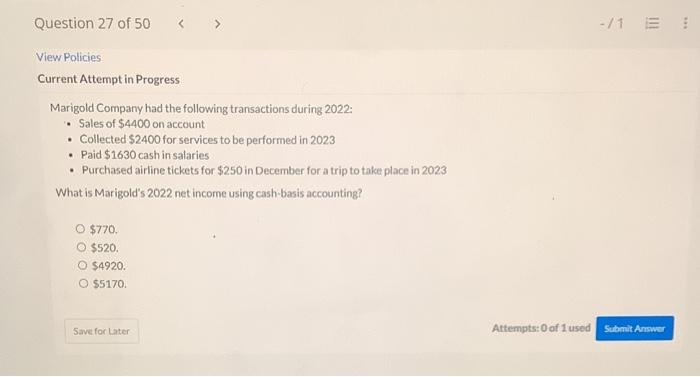

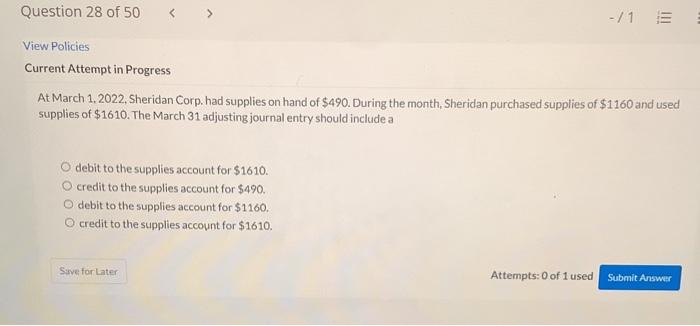

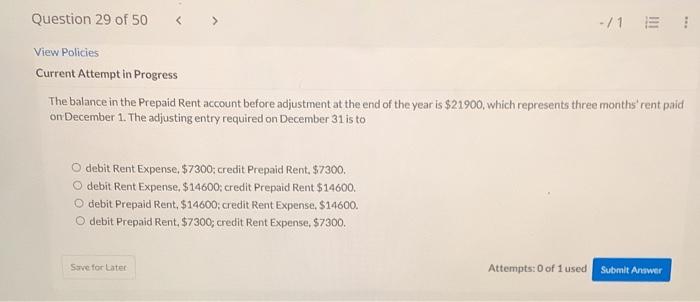

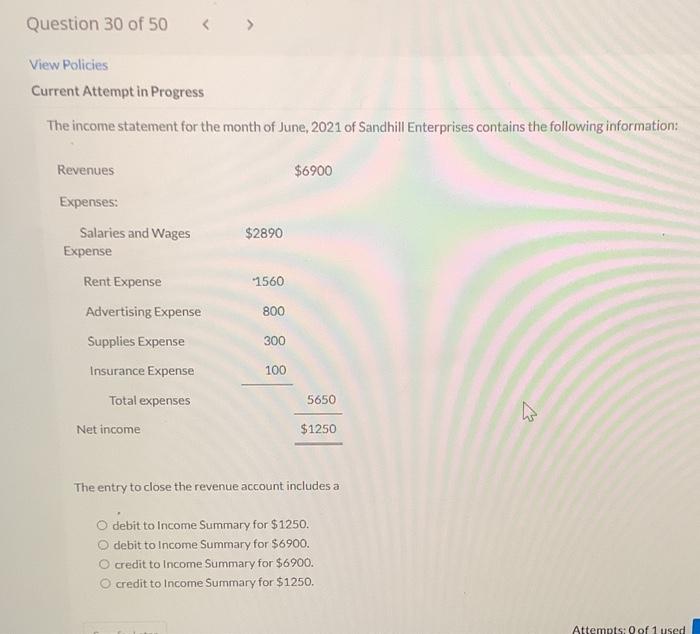

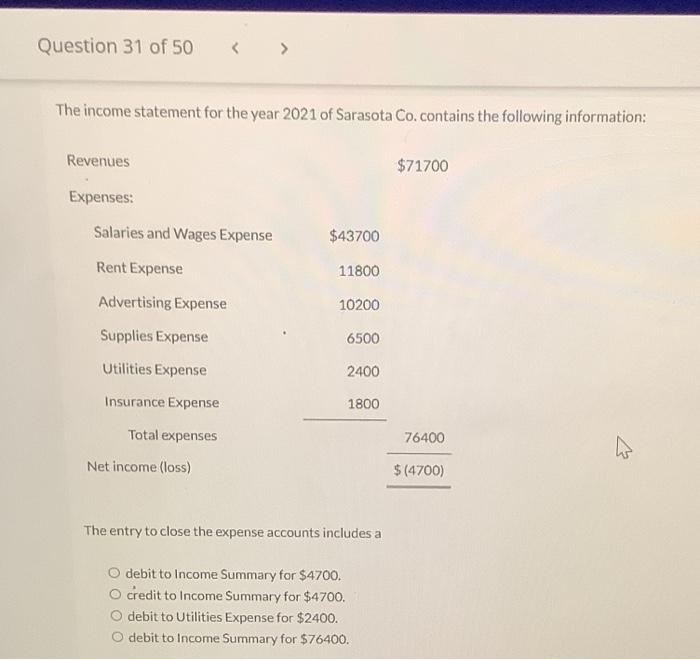

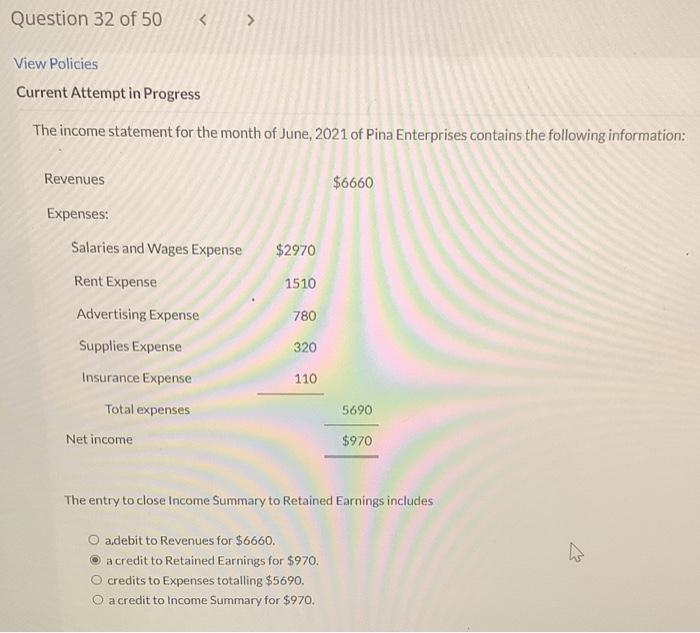

Current Attempt in Progress Marigold Company showed the following balances at the end of its first year: What did Marigold Company show as total credits on its trial balance? $9050 $44680 $49730 $45670 Marigold Company had the following transactions during 2022: - Sales of $4400 on account - Collected $2400 for services to be performed in 2023 - Paid $1630 cash in salaries - Purchased airline tickets for $250 in December for a trip to take place in 2023 What is Marigold's 2022 net income using cash-basis accounting? $770. $520. $4920. $5170. At March 1.2022, Sheridan Corp. had supplies on hand of $490. During the month, Sheridan purchased supplies of $1160 and used supplies of $1610. The March 31 adjusting journal entry should include a debit to the supplies account for $1610. credit to the supplies account for $490. debit to the supplies account for $1160. credit to the supplies account for $1610. The balance in the Prepaid Rent account before adjustment at the end of the year is $21900, which represents three months' rent paid on December 1 . The adjusting entry required on December 31 is to debit Rent Expense, $7300; credit Prepaid Rent, $7300. debit Rent Expense, $14600; credit Prepaid Rent $14600. debit Prepaid Rent, $14600; credit Rent Expense, $14600. debit Prepaid Rent, $7300; credit Rent Expense, $7300. Attempts: 0 of 1 used liew Policies Current Attempt in Progress The income statement for the month of June, 2021 of Sandhill Enterprises contains the following information: The entry to close the revenue account includes a debit to Income Summary for $1250. debit to Income Summary for $6900. credit to Income Summary for $6900. credit to Income Summary for $1250. The income statement for the year 2021 of Sarasota Co. contains the following information: The entry to close the expense accounts includes a debit to Income Summary for $4700. credit to Income Summary for $4700. debit to Utilities Expense for $2400. debit to Income Summary for $76400. Current Attempt in Progress The income statement for the month of June, 2021 of Pina Enterprises contains the following information: The entry to close Income Summary to Retained Earnings includes a,debit to Revenues for $6660. a credit to Retained Earning for $970. credits to Expenses totalling $5690. a credit to Income Summary for $970