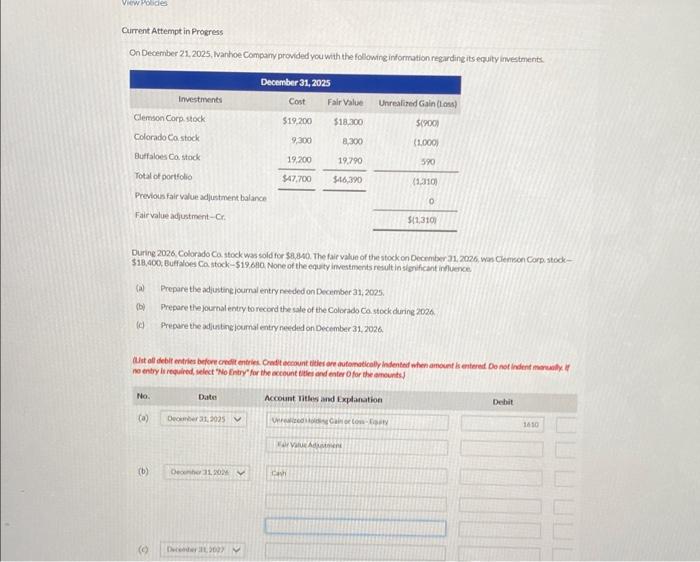

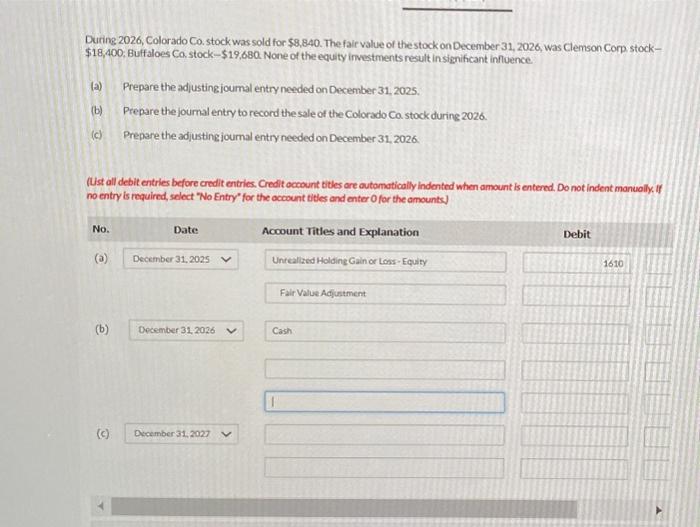

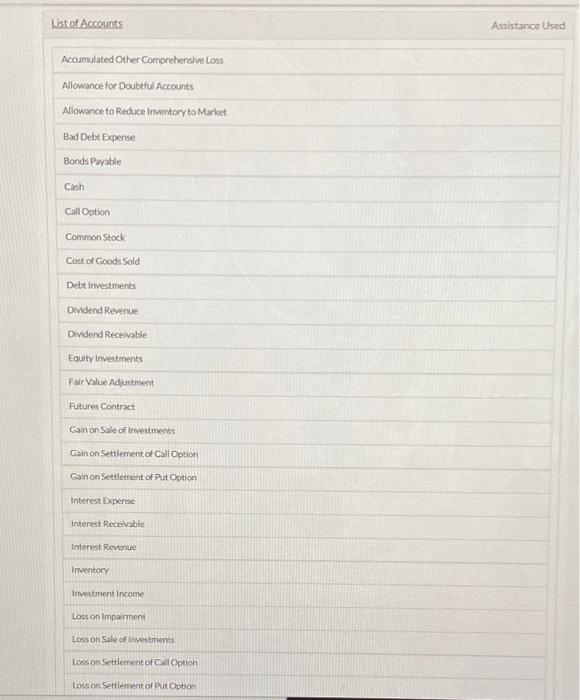

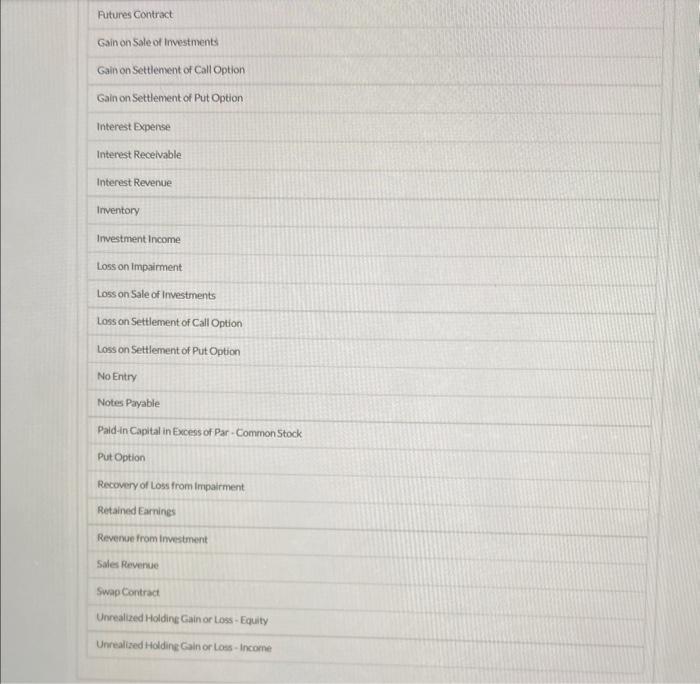

Current Attempt in Progress On December 21, 2025, laantioe Compary prowded you with the folowingindormation regardineits equity investments. During 2026 Colorado Co stock was sold for $8.800. The fair value of the stock on December 31;2006 wen Clemicon Corp. stock318,400, Bufaloes Co stock-519,b80 None of the equity invertments result in signicant influence. (a) Prepare tlye adjustingiournal entry retdedon December 31,2025. (b) Prepare thejournal entry to record the sale of the Colorado Co stock during 2006: (c) Prepare the adjuntingioumal entry feeded on Detember 31,2026 . no entry is required, telect "No fintry" for the account vities and enter O for the amsunts) During 2026, Colorado Co. stock was sold for $8,840. The falr value of the stock on December 31,2026 , was Clemson Corp stock$18,400; Buffaloes Ca. stock $19,680. None of the equity irvestments result in significant influence. (a) Prepare the adjustingjoumal entry needed on December 31, 2025. (b) Prepare the joumal entry to record the sale of the Colorado Ca stock during 2026. (c) Prepare the adjusting journal entry needed on December 31, 2026 . (Ust all debit entries before credit entries. Credit occount tites are outomatically indented when amount is entered. Do not indent manually, if no entry is required, select "No Entry" for the occount titles and enter O for the amounts) List of Accounts Assistance Used Accumulated Other Comprehensive Loss Allowance for Doubtful Accounts Allowance to Reduce inventory to Market. Bad Debt Expense Bonds Payable Cach Call Option Common Stock Cost of Goods Sold Debt irvestments Dividend Revenue Dividend Receivable Equity Investments Fair Value Adjustment Futures Contract Gain on Sale of Irvesiments Gain on Settlement of Call Option Cain on Setternent of Put Option Interest Expense Interest Reccivable internst Revenue Inventory Ituevtment income Loss on Impaiment Loss on 5 ale of investments: Losson Settlernent of Cal Option Loss on Settlement of Put Option Futures Contract Gain on Sale of invostments Gain on Settlement of Call Option Gain on Settlement of Put Option Interest Expense Interest Receivable Interest Revenue Inventory Irvestment Income Loss on impairment Loss on Sale of Investments Loss on Settlement of Call Option Loss on Settlement of Put Option No Entry Notes Payable Paid-in Capital in Excess of Par - Common Stock Put Option Recovery of Loss from impairment Retained Earnines Revenue from investment Sales Revenue SwapContract Unrealized Holdine Gain or Loss - Equity Unrealised Holdine Gain or Loss - Income