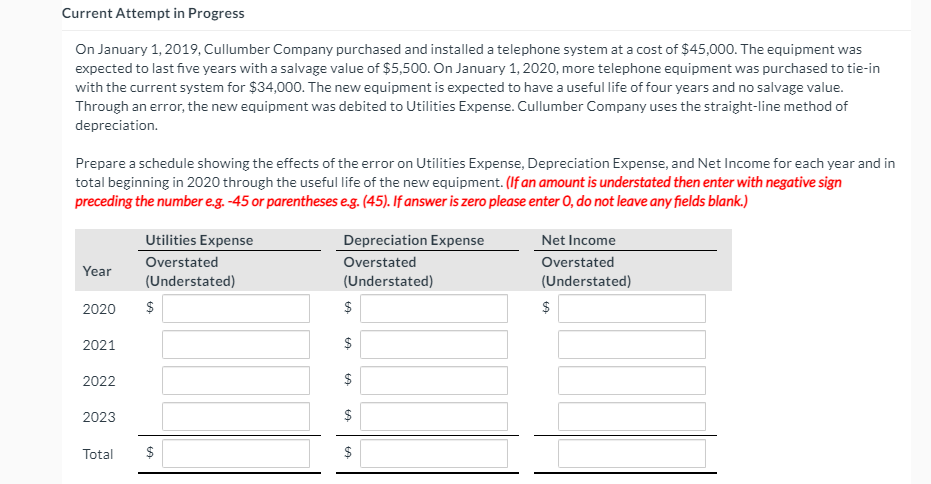

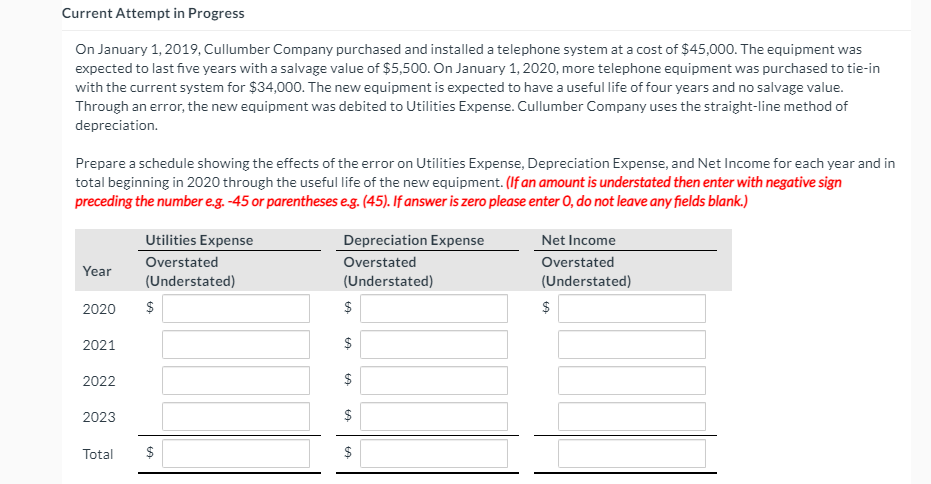

Current Attempt in Progress On January 1, 2019, Cullumber Company purchased and installed a telephone system at a cost of $45,000. The equipment was expected to last five years with a salvage value of $5,500. On January 1, 2020, more telephone equipment was purchased to tie-in with the current system for $34,000. The new equipment is expected to have a useful life of four years and no salvage value. Through an error, the new equipment was debited to Utilities Expense. Cullumber Company uses the straight-line method of depreciation Prepare a schedule showing the effects of the error on Utilities Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2020 through the useful life of the new equipment. (If an amount is understated then enter with negative sign preceding the number eg. -45 or parentheses eg. (45). If answer is zero please enter O, do not leave any fields blank.) Year Utilities Expense Overstated (Understated) $ Depreciation Expense Overstated (Understated) $ Net Income Overstated (Understated) $ 2020 $ 2021 $ 2022 $ 2023 $ Total $ $ Current Attempt in Progress On January 1, 2019, Cullumber Company purchased and installed a telephone system at a cost of $45,000. The equipment was expected to last five years with a salvage value of $5,500. On January 1, 2020, more telephone equipment was purchased to tie-in with the current system for $34,000. The new equipment is expected to have a useful life of four years and no salvage value. Through an error, the new equipment was debited to Utilities Expense. Cullumber Company uses the straight-line method of depreciation Prepare a schedule showing the effects of the error on Utilities Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2020 through the useful life of the new equipment. (If an amount is understated then enter with negative sign preceding the number eg. -45 or parentheses eg. (45). If answer is zero please enter O, do not leave any fields blank.) Year Utilities Expense Overstated (Understated) $ Depreciation Expense Overstated (Understated) $ Net Income Overstated (Understated) $ 2020 $ 2021 $ 2022 $ 2023 $ Total $ $