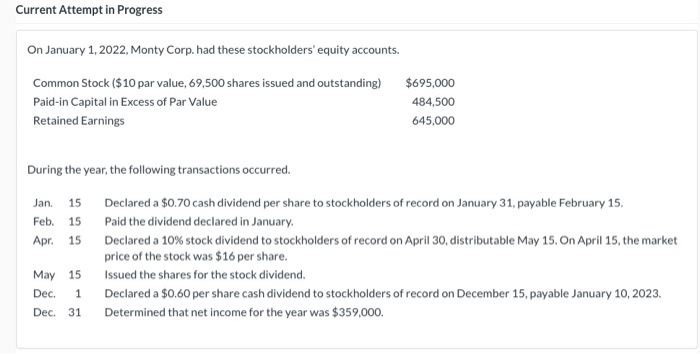

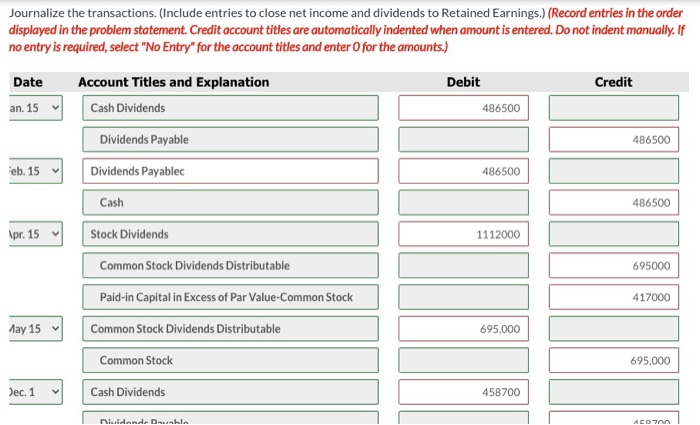

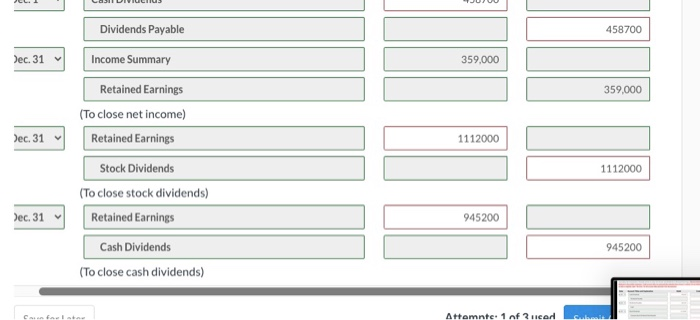

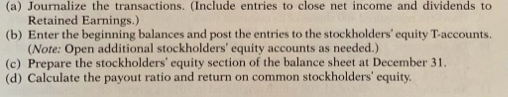

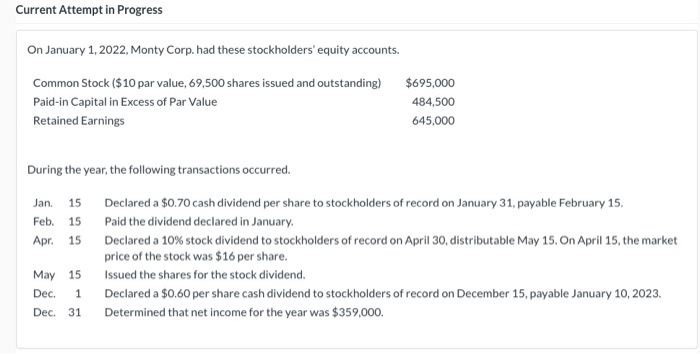

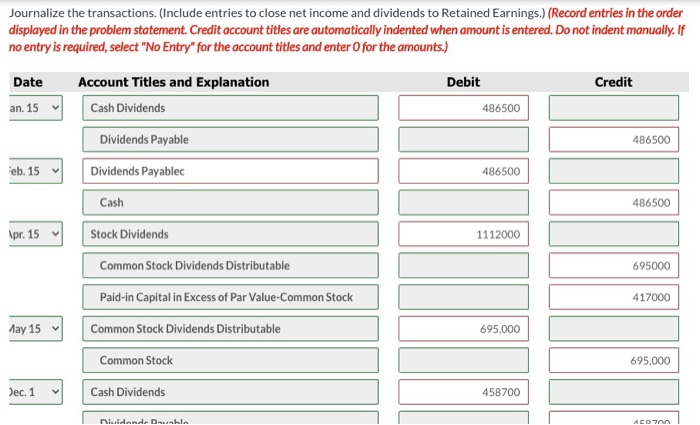

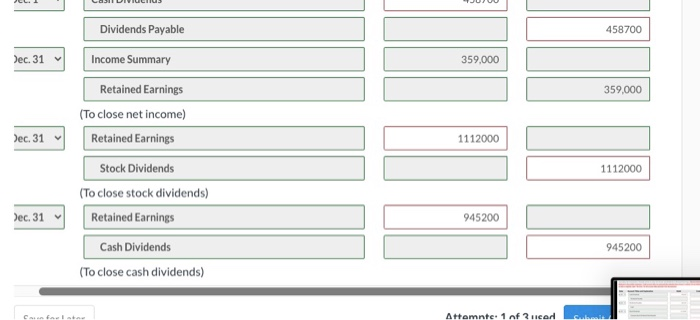

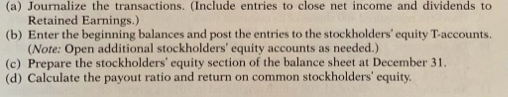

Current Attempt in Progress On January 1, 2022, Monty Corp. had these stockholders' equity accounts. Common Stock ($10 par value, 69,500 shares issued and outstanding) Paid-in Capital in Excess of Par Value Retained Earnings $695,000 484,500 645,000 During the year, the following transactions occurred. Jan. 15 Feb. 15 Apr. 15 Declared a $0.70 cash dividend per share to stockholders of record on January 31, payable February 15. Paid the dividend declared in January Declared a 10% stock dividend to stockholders of record on April 30, distributable May 15. On April 15, the market price of the stock was $16 per share. Issued the shares for the stock dividend. Declared a $0.60 per share cash dividend to stockholders of record on December 15, payable January 10, 2023. Determined that net income for the year was $359,000. May 15 Dec. 1 Dec. 31 Journalize the transactions. (Include entries to close net income and dividends to Retained Earnings.) (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Credit Date an. 15 Debit 486500 Account Titles and Explanation Cash Dividends Dividends Payable Dividends Payablec 486500 eb. 15 486500 Cash 486500 Apr. 15 Stock Dividends 1112000 695000 417000 Common Stock Dividends Distributable Paid-in Capital in Excess of Par Value-Common Stock Common Stock Dividends Distributable Common Stock May 15 695,000 695,000 Dec. 1 Cash Dividends 458700 niidendeDahle ACO Dividends Payable 458700 Dec. 31 359,000 359,000 Dec. 31 Income Summary Retained Earnings (To close net income) Retained Earnings Stock Dividends (To close stock dividends) Retained Earnings 1112000 1112000 Dec. 31 945200 945200 Cash Dividends (To close cash dividends) Channel Attamnte. 1 of uced cu (a) Journalize the transactions. (Include entries to close net income and dividends to Retained Earnings.) (b) Enter the beginning balances and post the entries to the stockholders' equity T-accounts. (Note: Open additional stockholders' equity accounts as needed.) (c) Prepare the stockholders' equity section of the balance sheet at December 31. (d) Calculate the payout ratio and return on common stockholders' equity