Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress Prepare a statement of cash flows, in good form, for Vaughn Corporation, using the direct method. Vaughn Corporation follows ASPE. (

Current Attempt in Progress Prepare a statement of cash flows, in good form, for Vaughn Corporation, using the direct method. Vaughn Corporation follows ASPE.

Show amounts that decrease cash flow with either a negative sign eg or in parenthesis eg

Vaughn Corporation

Statement of Cash Flows

Cash Flows from Operating Activities

Cash Paid for Interest

$

Cash Paid to Suppliers

Cash Paid for Taxes

Cash Paid to Suppliers

Net Cash Provided by Operating Activities

Cash Flows from Investing Activities

Purchase of LongTerm Investment

Purchase of Equipment

Sale of LongTerm Investment

Net Cash Used by Investing Activities

Cash Flows from Financing Activities

Issued Common Shares

Paid Dividends

Net Cash Used by Financing Activities

Decrease in Cash

Cash Balance, Beginning of Year

Cash Balance, End of Year

$

eTextbook and Media

Saved work will be autosubmitted on the due date. Auto

submission can take up to minutes.

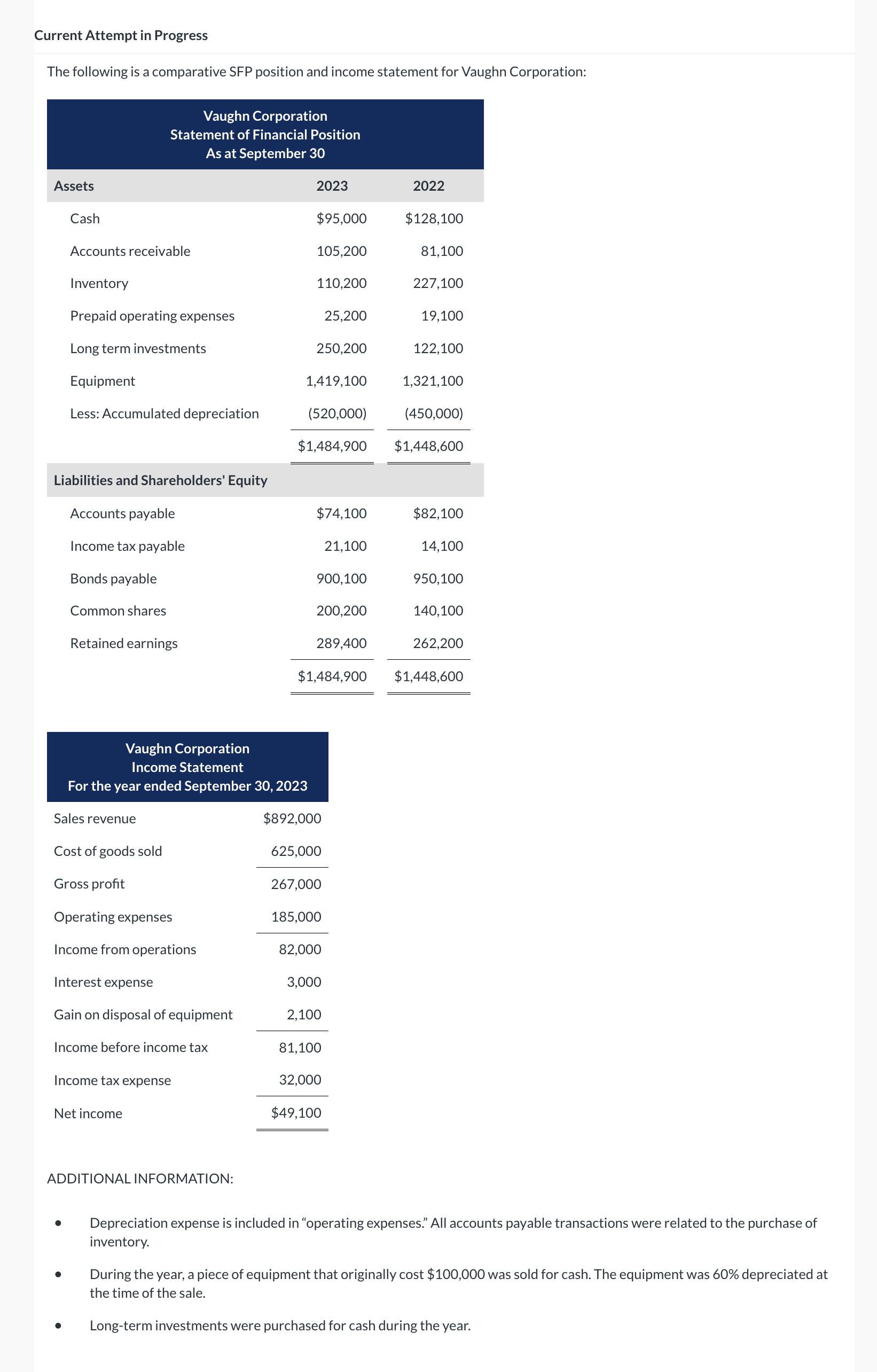

The following is a comparative SFP position and income statement for Vaughn Corporation:

ADDITIONAL INFORMATION:

Depreciation expense is included in "operating expenses." All accounts payable transactions were related to the purchase of

inventory.

During the year, a piece of equipment that originally cost $ was sold for cash. The equipment was depreciated at

the time of the sale.

Longterm investments were purchased for cash during the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started