Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress Presented below is information related to the purchases of common stock by Oriole Company during 2025. Cost (at purchase date)

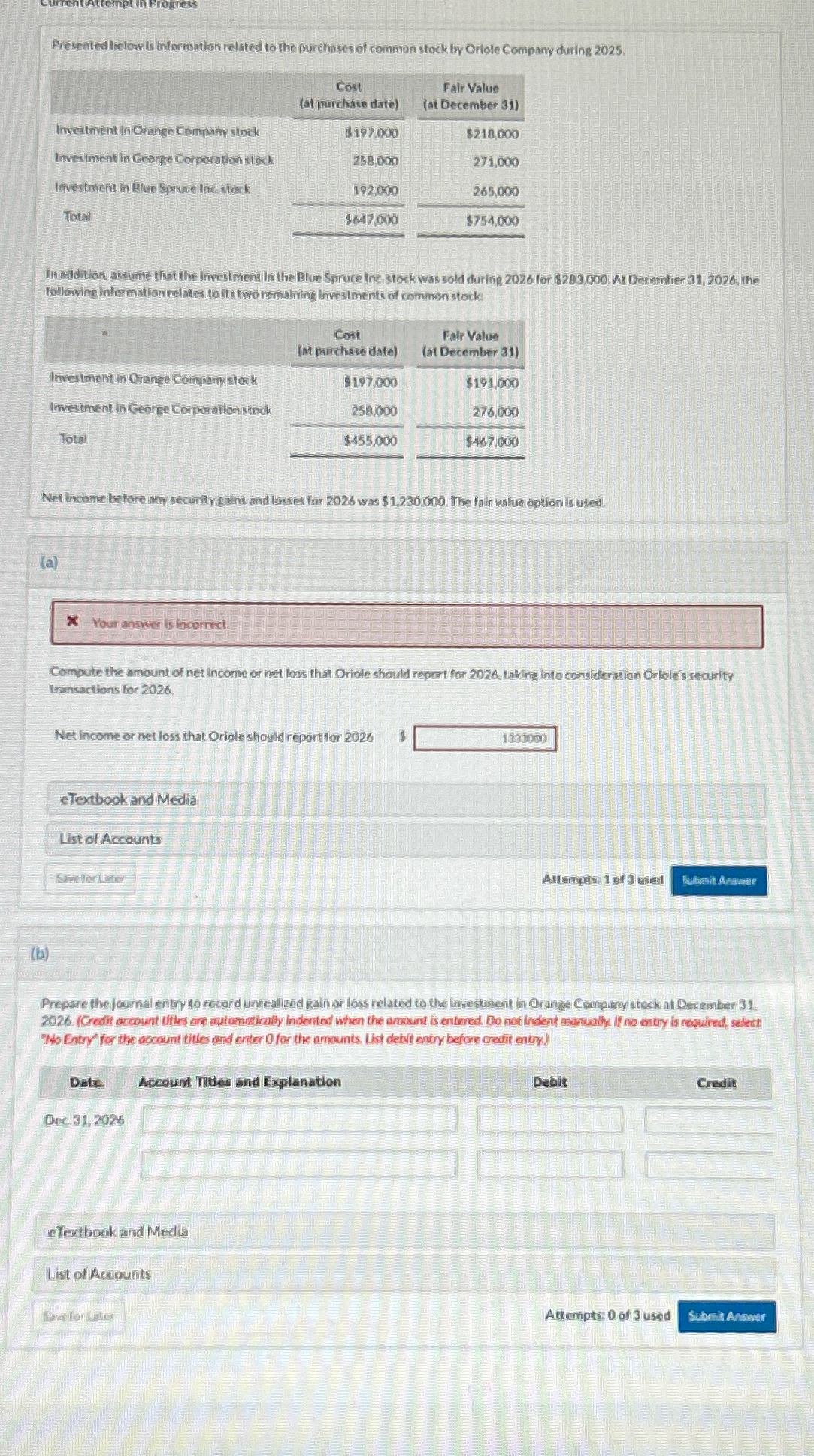

Current Attempt in Progress Presented below is information related to the purchases of common stock by Oriole Company during 2025. Cost (at purchase date) Fair Value (at December 31) Investment in Orange Company stock $197,000 $218,000 Investment in George Corporation stock 258,000 271,000 Investment in Blue Spruce Inc. stock 192,000 265,000 Total $647,000 $754,000 In addition, assume that the Investment in the Blue Spruce Inc. stock was sold during 2026 for $283,000. At December 31, 2026, the following information relates to its two remaining Investments of common stock: Cost (at purchase date) Fair Value (at December 31) Investment in Orange Company stock $197,000 $191,000 Investment in George Corporation stock 258,000 276,000 Total $455,000 $467,000 Net income before any security gains and losses for 2026 was $1,230,000. The fair value option is used. (a) (b) X Your answer is incorrect. Compute the amount of net income or net loss that Oriole should report for 2026, taking into consideration Oriole's security transactions for 2026. Net income or net loss that Oriole should report for 2026 $ 1333000 eTextbook and Media List of Accounts Save for Later Attempts: 1 of Juned Submit Answer Prepare the journal entry to record unrealized gain or loss related to the investment in Orange Company stock at December 31. 2026. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles and Explanation Dec. 31, 2026 eTextbook and Media List of Accounts Save for Later Debit Credit Attempts: 0 of 3 used Submit Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started