Answered step by step

Verified Expert Solution

Question

1 Approved Answer

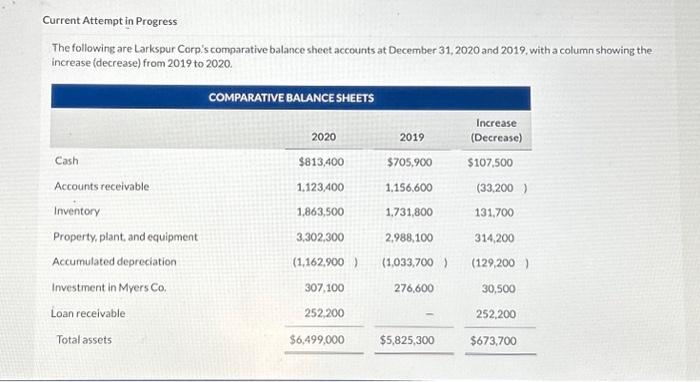

Current Attempt in Progress The following are Larkspur Corp!'s comparative balance sheet accounts at December 31, 2020 and 2019, with a column showing the increase

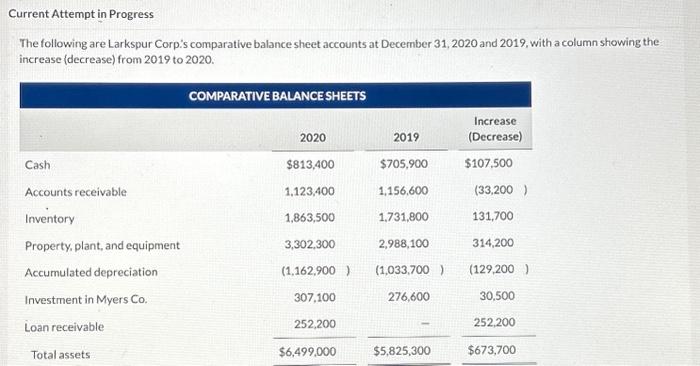

Current Attempt in Progress The following are Larkspur Corp!'s comparative balance sheet accounts at December 31, 2020 and 2019, with a column showing the increase (decrease) from 2019 to 2020. Cash Accounts receivable Inventory Property, plant, and equipment Accumulated depreciation Investment in Myers Co. Loan receivable Total assets COMPARATIVE BALANCE SHEETS 2020 $813,400 1,123,400 1,863,500 3,302,300 307,100 252,200 2019 $6,499,000 $705,900 1,156,600 1,731,800 (1,162,900 ) (1,033,700 ) 2,988,100 276,600 $5,825,300 Increase (Decrease) $107,500 (33,200 ) 131,700 314,200 (129,200 ) 30,500 252,200 $673,700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started