Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress The following transactions occurred in Wendell Corporation, which has a December 3 1 year end. Wendell has received $ 9 ,

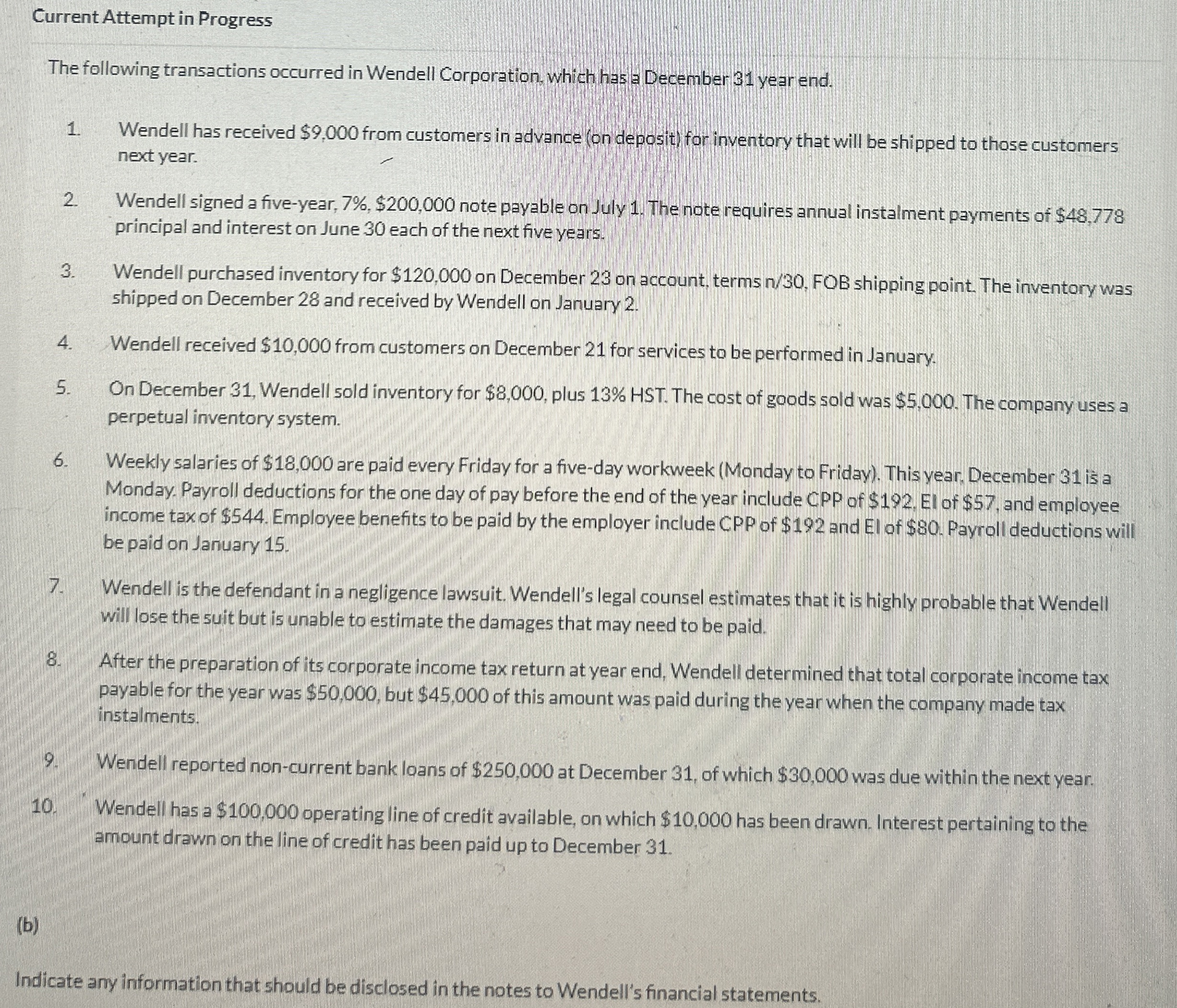

Current Attempt in Progress

The following transactions occurred in Wendell Corporation, which has a December year end.

Wendell has received $ from customers in advance on deposit for inventory that will be shipped to those customers next year.

Wendell signed a fiveyear, $ note payable on July The note requires annual instalment payments of $ principal and interest on June each of the next five years.

Wendell purchased inventory for $ on December on account, terms FOB shipping point. The inventory was shipped on December and received by Wendell on January

Wendell received $ from customers on December for services to be performed in January.

On December Wendell sold inventory for $ plus HST The cost of goods sold was $ The company uses a perpetual inventorysystem.

Weekly salaries of $ are paid every Friday for a fiveday workweek Monday to Friday This year, December is a Monday. Payroll deductions for the one day of pay before the end of the year include CPP of $ El of $ and employee income tax of $ Employee benefits to be paid by the employer include CPP of $ and El of $ Payroll deductions will be paid on January

Wendell is the defendant in a negligence lawsuit. Wendell's legal counsel estimates that it is highly probable that Wendell will lose the suit but is unable to estimate the damages that may need to be paid.

After the preparation of its corporate income tax return at year end, Wendell determined that total corporate income tax payable for the year was $ but $ of this amount was paid during the year when the company made tax instalments.

Wendell reported noncurrent bank loans of $ at December of which $ was due within the next year.

Wendell has a $ operating line of credit available, on which $ has been drawn. Interest pertaining to the amount drawn on the line of credit has been paid up to December

b

Indicate any information that should be disclosed in the notes to Wendell's financial statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started